MoneyMunch.com |  |

- NSE 3MINDIA: Elliott wave Projection

- USDINR’s Trade Setup for Premium Subscribers

- Nifty FUT Trade Setup For Premium Subscribers

- Is Nifty Going below 15800?

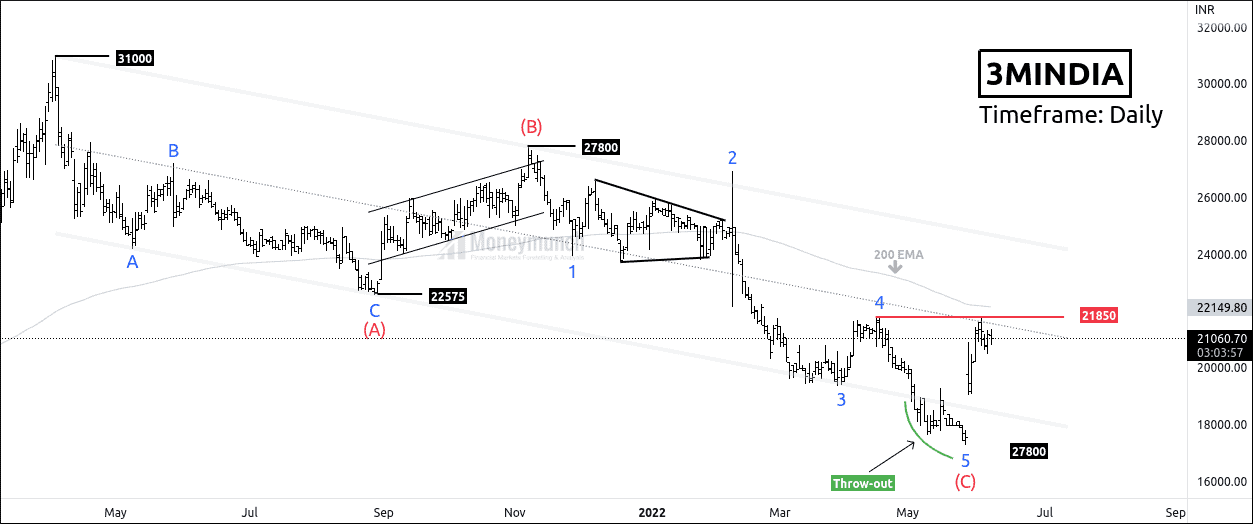

| NSE 3MINDIA: Elliott wave Projection Posted: 08 Jun 2022 03:34 AM PDT Our VIP users received a Nifty Future trade setup yesterday. Timeframe: Daily 3M India has accomplished Wave 5 of wave C. Ending point of correction is the starting point of impulsive structure. Elliott wave principle believes that if prices are bullish, it has to confirm their move by breaking the lower-degree substructure. If the price breaks out the 21580, traders can expect the following targets: 23518 – 25020- 26528. Price is facing the following confluence zones:

If the price fails to break 21580, It can fall to 20242 – 19440 – 18604 below. Bull traders can buy after a pullback to avoid fakeout & maintain the risk-reward ratio. Only Premium subscribers can get a perfect trade setup at the exact time on our mobile application. Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips Are you looking for NSE paid calls? Want to get premium trading alerts and unlimited access to Moneymunch? Join today and start potentially multiplying your net worth: Premium Stock & Nifty Tips Premium features: daily updates, full access to the Moneymunch #1 Rank List, Equity Research Reports, Focus List portfolio of 50 longer-term stocks, Premium screens, and much more. You will quickly identify which stocks to buy, which to sell and target today΄s hottest industries. Have you any questions/feedback about this article? Please leave your queries in the comment box for answers. The post NSE 3MINDIA: Elliott wave Projection appeared first on Moneymunch. |

| USDINR’s Trade Setup for Premium Subscribers Posted: 06 Jun 2022 10:08 PM PDT Only premium subscribers can read the full article. Please log in to read the entire text. If you don’t have a login yet, please subscribe now to get access. Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips Are you looking for NSE paid calls? Want to get premium trading alerts and unlimited access to Moneymunch? Join today and start potentially multiplying your net worth: Premium Stock & Nifty Tips Premium features: daily updates, full access to the Moneymunch #1 Rank List, Equity Research Reports, Focus List portfolio of 50 longer-term stocks, Premium screens, and much more. You will quickly identify which stocks to buy, which to sell and target today΄s hottest industries. Have you any questions/feedback about this article? Please leave your queries in the comment box for answers. The post USDINR’s Trade Setup for Premium Subscribers appeared first on Moneymunch. |

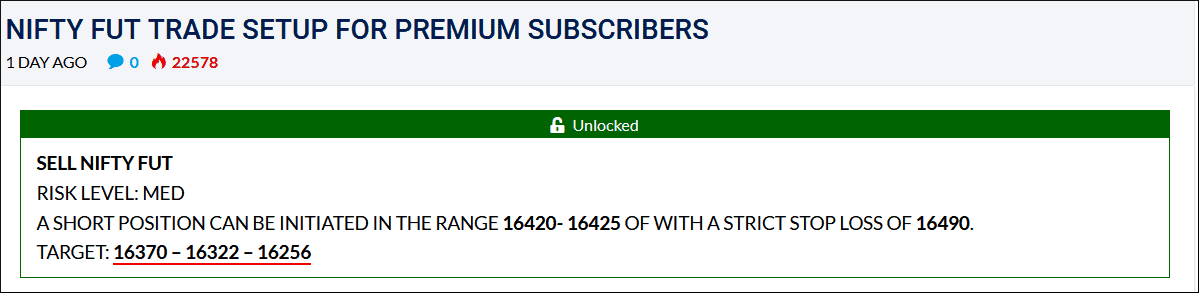

| Nifty FUT Trade Setup For Premium Subscribers Posted: 06 Jun 2022 09:38 PM PDT Only premium subscribers can read the full article. Please log in to read the entire text. If you don’t have a login yet, please subscribe now to get access. Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips Are you looking for NSE paid calls? Want to get premium trading alerts and unlimited access to Moneymunch? Join today and start potentially multiplying your net worth: Premium Stock & Nifty Tips Premium features: daily updates, full access to the Moneymunch #1 Rank List, Equity Research Reports, Focus List portfolio of 50 longer-term stocks, Premium screens, and much more. You will quickly identify which stocks to buy, which to sell and target today΄s hottest industries. Have you any questions/feedback about this article? Please leave your queries in the comment box for answers. The post Nifty FUT Trade Setup For Premium Subscribers appeared first on Moneymunch. |

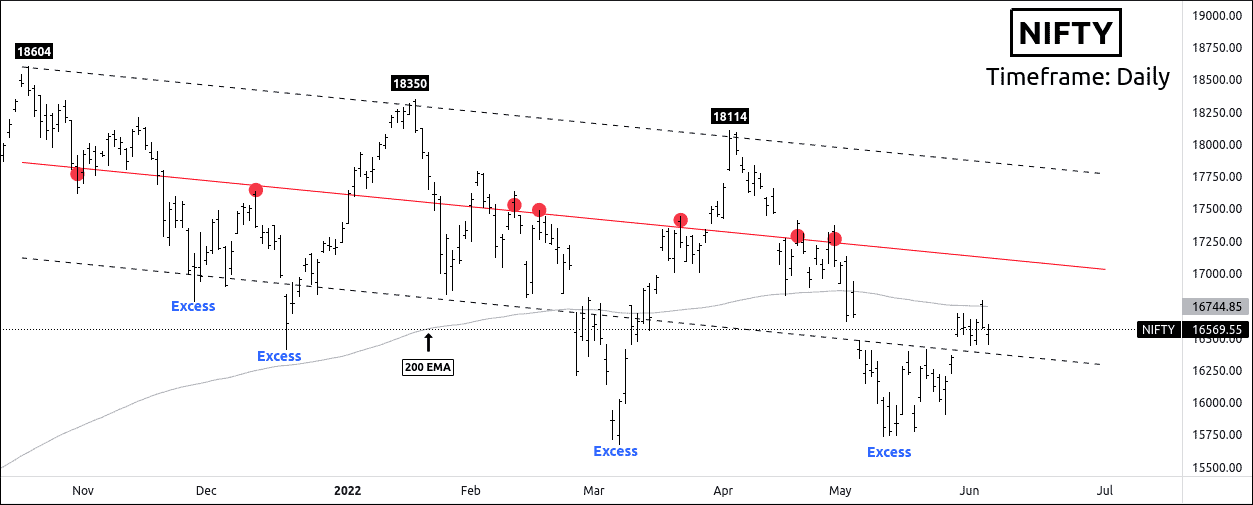

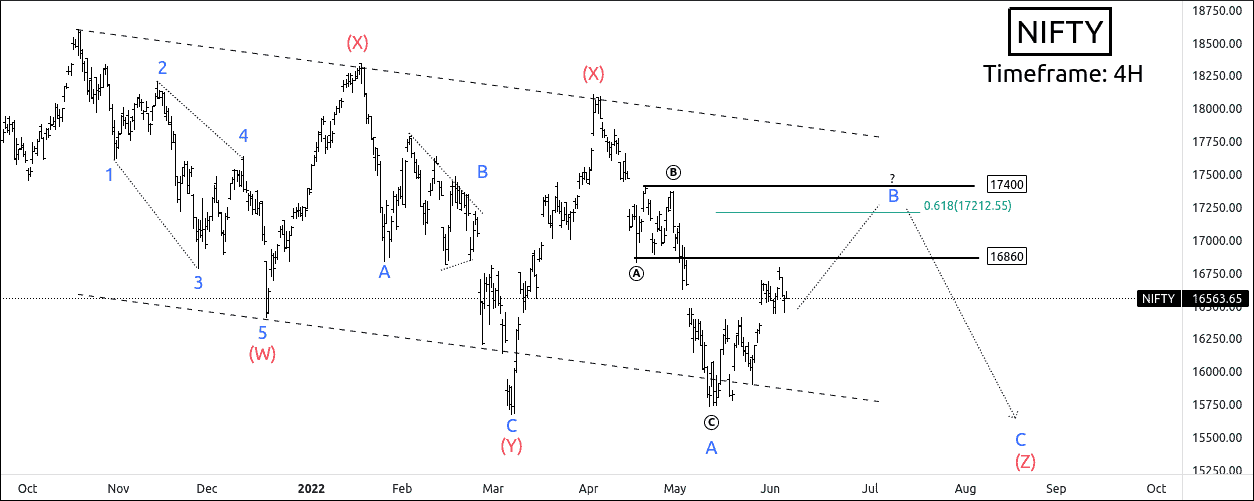

| Posted: 06 Jun 2022 08:30 PM PDT Timeframe: Daily 16860 is the key level for bull traders. If the price breaks this level, it can go up to the control line at 17100 and above. Timeframe: 4H However, 17400 is a strong resistance.If bulls fail to break 16860, they will not even reach 17200 If bulls have to change the trend, they must break wave b at 17400. Bullish move is only possible above 17400. I will upload futher information soon. Only premium subscribers can read the full article. Please log in to read the entire text. If you don’t have a login yet, please subscribe now to get access. Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips Are you looking for NSE paid calls? Want to get premium trading alerts and unlimited access to Moneymunch? Join today and start potentially multiplying your net worth: Premium Stock & Nifty Tips Premium features: daily updates, full access to the Moneymunch #1 Rank List, Equity Research Reports, Focus List portfolio of 50 longer-term stocks, Premium screens, and much more. You will quickly identify which stocks to buy, which to sell and target today΄s hottest industries. Have you any questions/feedback about this article? Please leave your queries in the comment box for answers. The post Is Nifty Going below 15800? appeared first on Moneymunch. |

| You are subscribed to email updates from Moneymunch. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Inbox too full? | |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Lock

Lock