MoneyMunch.com |  |

| BAJAJ AUTO, AB CAPITAL & DBL Trade Analysis Posted: 19 Jun 2022 08:40 PM PDT Bajaj Auto – BAJAJ AUTO: When Will The Bears Quit?Over the past 25 weeks, Bajaj Auto has formed ascending channels. If we observe the channel’s angle, it appears to be a corrective formation. Recently, the parallel channel’s lower band has broken down. If the price breaks down from a recent low of 3600, traders can sell for the following targets: 3540 – 3476 – 3390. Watch-out support breakout for AB CAPITALAB CAPITAL has taken support from the previous low at 90.05. A breakdown of 90.05will create a new low in AB capital. Traders can trade for the following targets: 89.21 – 88.2 – 85.50. NSE DBL-A Bearish Trade SetupDBL has broken down the previous low at 196, and the price started falling in search of new support. Free subscribers can initiate a short position if the price sustains below 205 for the following targets: 200 – 196 – 190 below. If the price breaks the previous session’s low, it will be extremely bullish. Only premium subscribers have access to entry, exit, and stop-loss at the exact time. Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips Are you looking for NSE paid calls? Want to get premium trading alerts and unlimited access to Moneymunch? Join today and start potentially multiplying your net worth: Premium Stock & Nifty Tips Premium features: daily updates, full access to the Moneymunch #1 Rank List, Equity Research Reports, Focus List portfolio of 50 longer-term stocks, Premium screens, and much more. You will quickly identify which stocks to buy, which to sell and target today΄s hottest industries. Have you any questions/feedback about this article? Please leave your queries in the comment box for answers. The post BAJAJ AUTO, AB CAPITAL & DBL Trade Analysis appeared first on Moneymunch. |

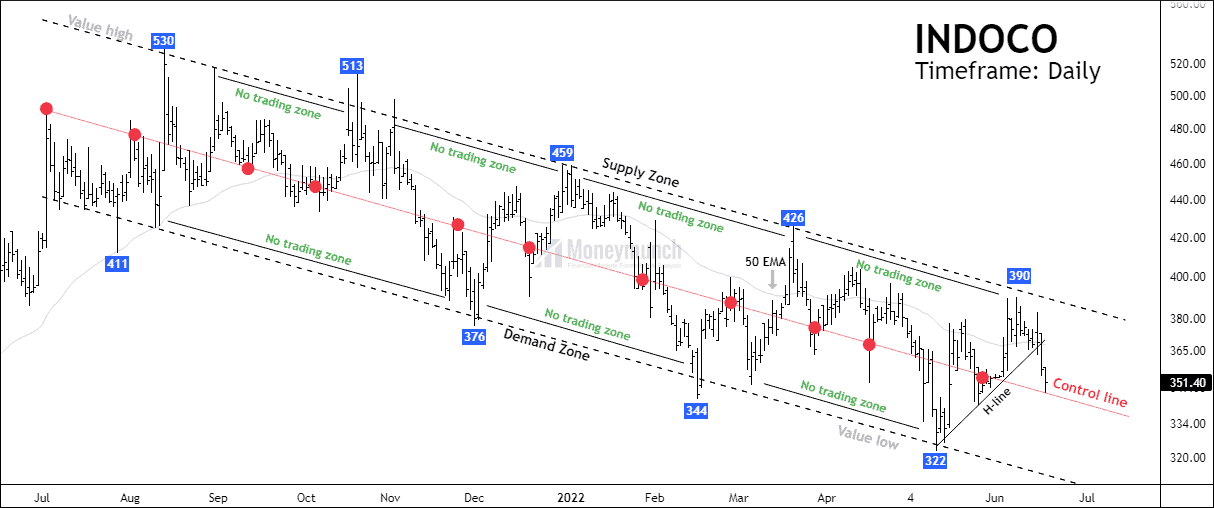

| Is INDOCO Falling To Its Pre-covid Levels? Posted: 19 Jun 2022 04:36 AM PDT INDOCO has been steadily declining for over 11 months. The upper & lower bands are creating a fair value area without price excess. Observe that the upper band shows five reversals and the lower-band shows three reversals. Prices have fallen sharply based on the breakdown of 50 EMA. Currently, the price is on the control line at 350. The control line signals strong support until it breaks down. If the price breaks the control line, traders can trade for the following targets: 343 – 331 – 320 below. Only Premium subscribers will access trade setup in our mobile application. Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips Are you looking for NSE paid calls? Want to get premium trading alerts and unlimited access to Moneymunch? Join today and start potentially multiplying your net worth: Premium Stock & Nifty Tips Premium features: daily updates, full access to the Moneymunch #1 Rank List, Equity Research Reports, Focus List portfolio of 50 longer-term stocks, Premium screens, and much more. You will quickly identify which stocks to buy, which to sell and target today΄s hottest industries. Have you any questions/feedback about this article? Please leave your queries in the comment box for answers. The post Is INDOCO Falling To Its Pre-covid Levels? appeared first on Moneymunch. |

| You are subscribed to email updates from Moneymunch. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |