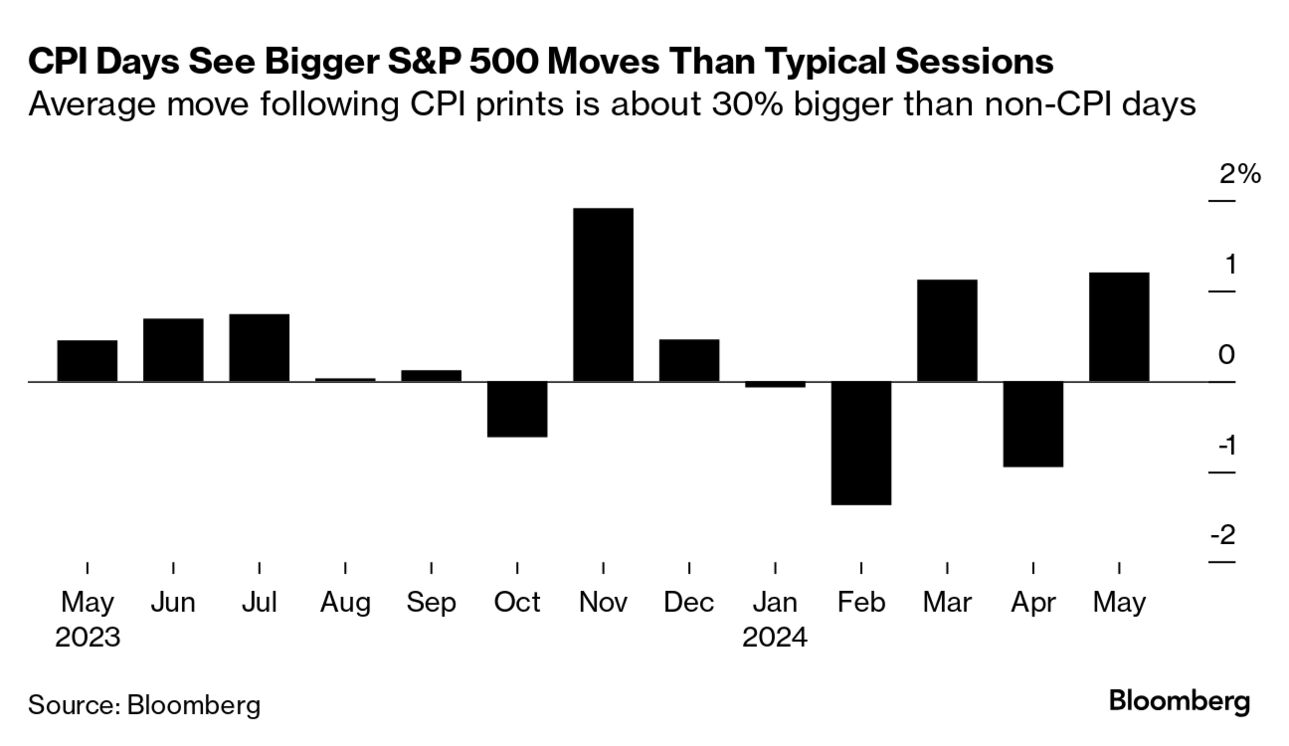

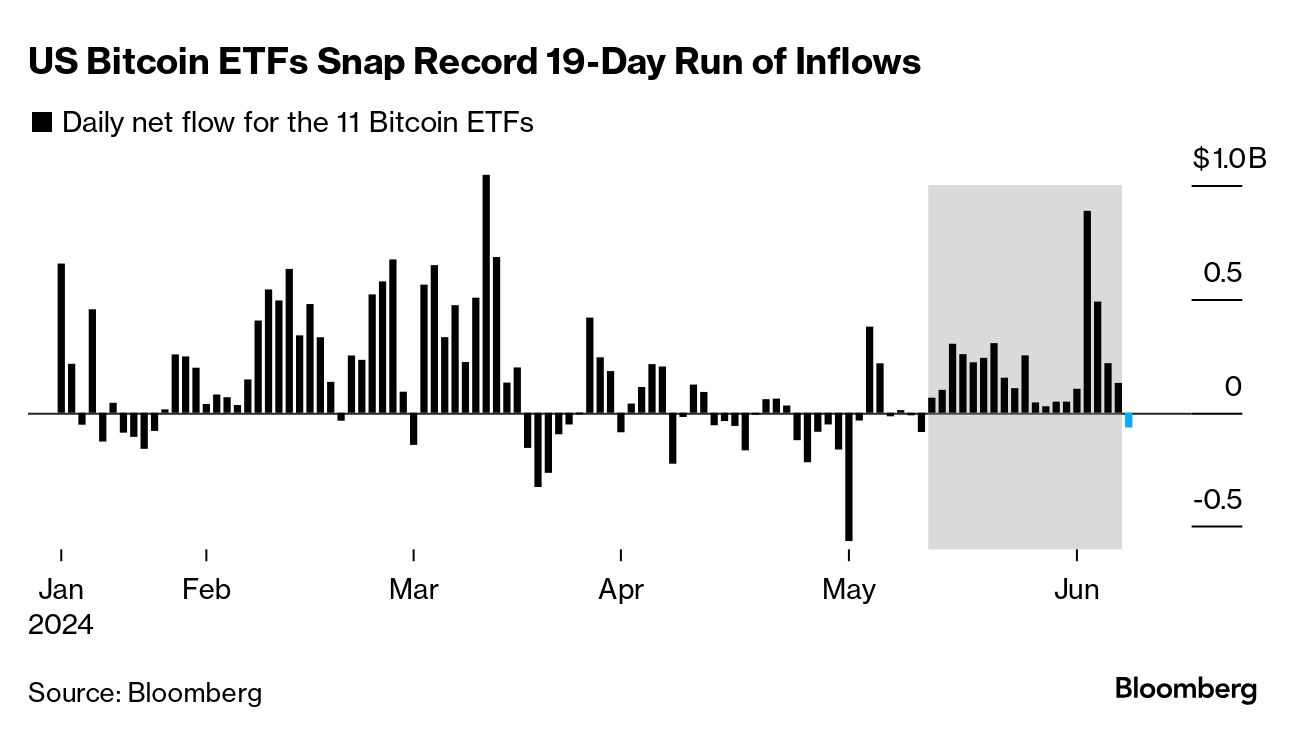

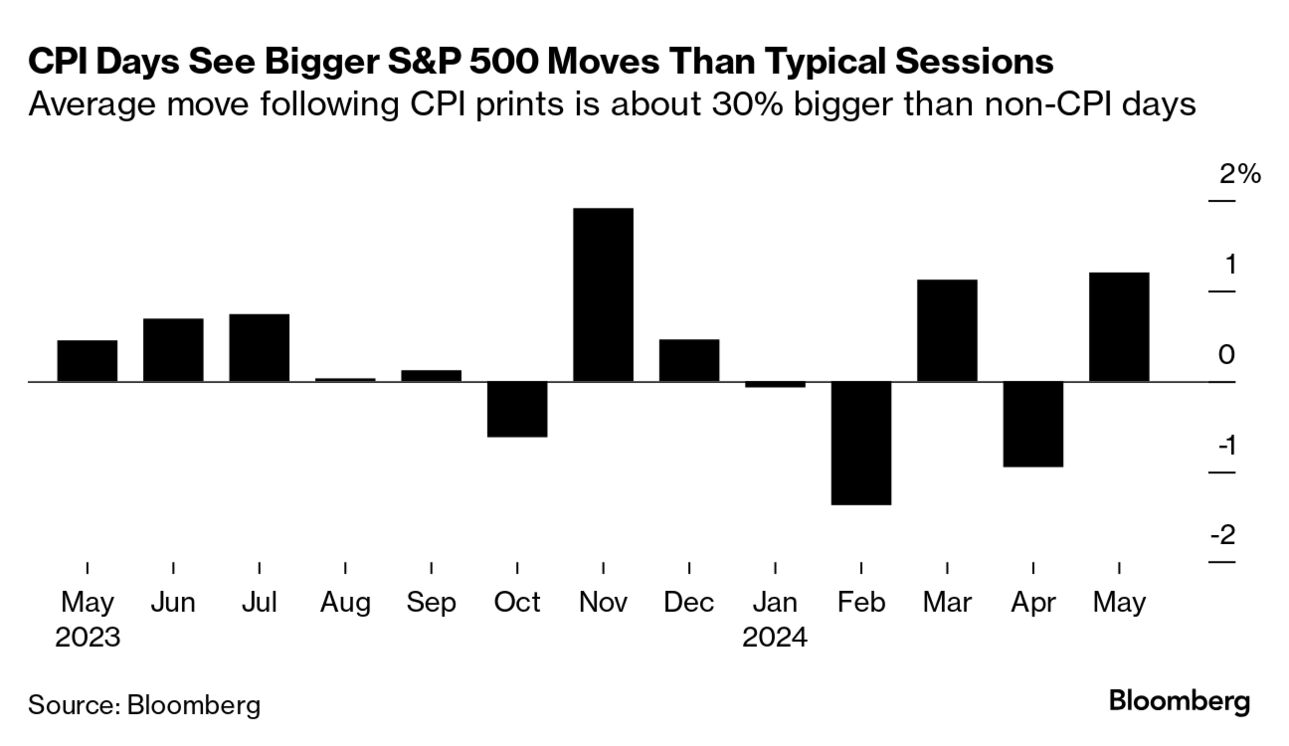

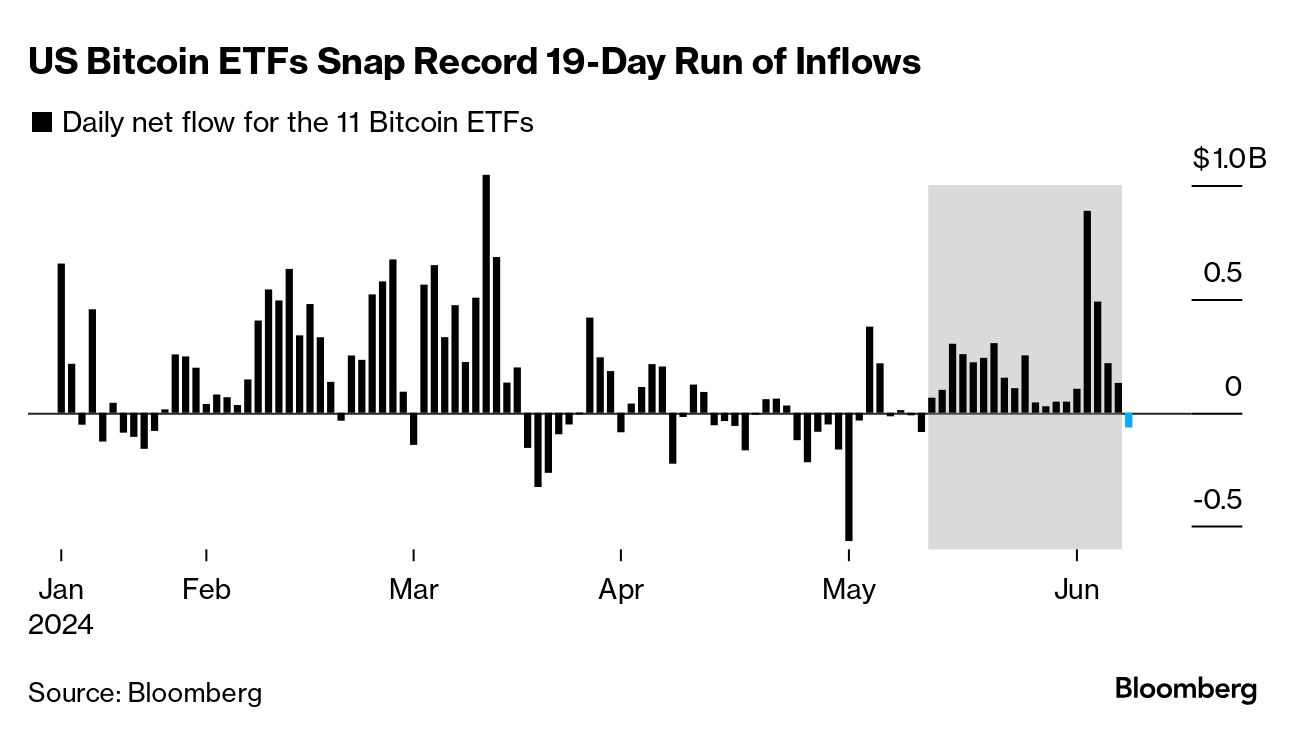

| More US regional bank failures could be on the way thanks to what Pacific Investment Management warns is a “very high” concentration of troubled commercial real estate loans on their books. “The real wave of distress is just starting” for lenders to everything from malls to offices, says Pimco’s John Murray. Recent turmoil has been particularly felt by regional lenders, which boosted commercial real estate exposure that (in many cases) is now worth only a fraction of their value at its peak. Smaller banks have continued to worry investors ever since last year’s mini-collapse. Earlier this year, New York Community Bancorp slashed its dividend and stockpiled more cash for potentially bad loans, sending shares into a tailspin that ended in a capital injection. US Bancorp increased its provisions for credit losses in the first quarter. Shares of Axos Financial slumped last week after a short seller took aim at what it called the bank’s “glaring” property loan problems. Uncertainty over when the US Federal Reserve may cut interest rates has exacerbated challenges faced by commercial real estate, where high borrowing costs have hammered valuations and triggered defaults, leaving lenders stuck with tough-to-sell assets. The landscape looks to be getting grimmer. —David E. Rovella The dollar is rising toward a new high for the year on speculation that tomorrow’s US inflation reading and a Fed policy decision will increase demand. The Bloomberg Dollar Spot Index rose Tuesday for a fourth straight session, climbing a total of 1.1% amid help from last week’s report of US jobs growth and political turbulence in Europe. The gauge now trades about 0.4% below this year’s peak reached on April 19. Meanwhile the S&P hit a new record and bonds were higher after a solid $39 billion Treasury sale triggered—you guessed it—even more speculation that Wednesday’s consumer price index data will help make the case for Fed cuts this year. Hope springs eternal—here’s your markets wrap.  Source: Bloomberg Wall Street’s half-trillion-dollar business cloning quant trades has some surprising new customers: the very firms whose strategies it mimics. Once hostile to the copycat products being churned out by big banks, hedge funds are becoming a major driver of the boom in what are known as quantitative investment strategies, or QIS. These tools take popular systematic trades and typically turn them into swaps or structured notes, creating a quick and cheap way to gain exposure. They’ve long drawn fire from asset managers for being pale imitations. Yet money managers are increasingly giving in to their sheer convenience. Bitcoin investors have reason to be particularly alert for volatility ahead of the Fed’s decision on whether to deviate from the status quo. A 30-day correlation between Bitcoin and the US 10-year Treasury yield is at minus 53, one of the most negative readings in data compiled by Bloomberg since 2010. The metric suggests the digital asset is moving in the opposite direction to the benchmark bond yield to an unusual degree. Bonds may be buffeted by the inflation data and Fed policy outlook, which are both due in the space of a few hours on Wednesday. The correlation study hints at the risk of Bitcoin being kicked around in the Treasury market’s wake.  Source: Bloomberg Over in the world of meme stocks, it’s amazing what a YouTube video can accomplish. GameStop managed to raise roughly $2.14 billion from a share sale program as it capitalized on a stock rally. Why the spike? Because Keith Gill (also known as “Roaring Kitty”) talked up the company’s shares while returning to the social media platform made famous by another kind of cat. The video-game retailer has now raised more than $3 billion over the past month through share sales as retail investors powered the stock higher. National Bank of Canada is buying Canadian Western Bank for about C$5 billion ($3.6 billion) in a tie-up of two of the country’s regional lenders. Montreal-based National will pay the equivalent of C$52.24 a share for CWB, a premium of 110% over its closing price on Tuesday. The deal requires the approval of two-thirds of CWB’s shareholders and the Canadian government. Hunter Biden was found guilty of gun charges by a federal court jury in Delaware. The son of US President Joe Biden was convicted of three counts of violating federal gun laws when he checked a box on a form stating he wasn’t an active drug user at the time he bought a firearm. President Biden, who previously ruled out any pardon, praised his son for having recovered from drug addiction. Though a first-time offender, Hunter Biden could face prison time at sentencing. Germany will deliver several thousand strike drones and 100 additional Patriot guided-missiles to Ukraine as part of the latest military aid package for the war-battered country. Defense Minister Boris Pistorius unveiled the support during a joint visit with Ukrainian President Volodymyr Zelenskiy at a military site in Sanitz, northern Germany, where Ukrainian soldiers are being trained to operate the Patriot air-defense system.  A reservist member of the German armed forces stands next to a launcher of a Patriot missile system. Photographer: Sean Gallup/Getty Images While Chinese leader Xi Jinping’s decision to crush civil liberties in the former British colony fueled the predictable retreat by international companies, Hong Kong’s real estate picture has been getting progressively more bleak in the years since. The home-price downturn in this packed metropolis will soon reach its five-year mark, the longest retreat since the depths of the SARS crisis. Sure, many cities are suffering from a mix of rising interest rates, financial-sector job losses and changing work habits. But in Hong Kong, the property slump is now a $270 billion wipeout—arguably one of the clearest market proxies for its steadily dissipating status as Asia’s premier financial hub.  Demonstrators in 2019 during a protest in Hong Kong commemorating the 30th anniversary of the 1989 Tiananmen Square crackdown. Photographer: Paul Yeung/Bloomberg Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive Bloomberg’s flagship briefing in your mailbox daily—along with our Weekend Reading edition on Saturdays. Bloomberg Green Festival: Join changemakers including former White House Climate Advisor Gina McCarthy, former Georgia lawmaker and voting rights activist Stacey Abrams and Nikolaj Coster-Waldau of An Optimist’s Guide to the Planet on July 10-13 in Seattle at a groundbreaking new event celebrating climate optimism and action. Learn more here. |