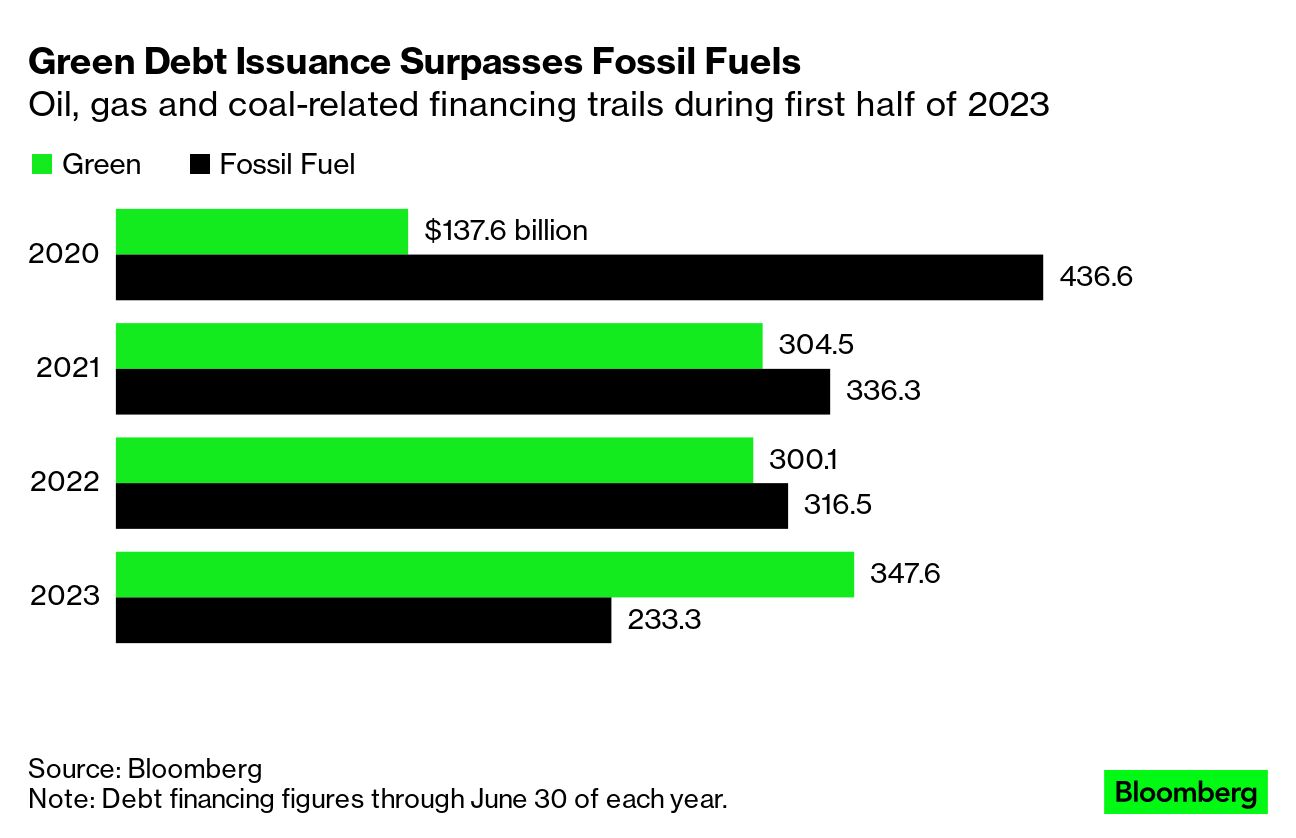

| It seems that US Federal Reserve officials struck a weak agreement to pause interest-rate increases in June, and in doing so all but committed to hike them again later this month to keep fighting stubborn inflation. The minutes from the Fed’s June 13-14 meeting show that while almost all officials deemed it “appropriate or acceptable” to keep rates unchanged last month, some would have supported a quarter-point increase instead. “It was a little surprising given that the decision was sold as unanimous from Fed officials,” said Lindsey Piegza, chief economist at Stifel Nicolaus & Co. “There was a divergence of opinions, with some officials pretty clearly giving some reluctance for a one-month pause.” Officials supporting a hike in June cited tight labor markets and relatively few signs that inflation was slowing toward their 2% goal, according to the minutes. Some policymakers have expressed concern that core inflation, in particular, hasn’t budged much in the last six months. Whatever the disagreement among Fed officials, it’s fair to say the key takeaway is that more hikes coming. Here’s your markets wrap. —David E. Rovella Ukrainian authorities are warning that Russia may be preparing for a false-flag operation, where Kremlin forces perpetrate an attack or similar provocation and then try to blame Kyiv. Like when, as Ukraine claims, Russia allegedly blew up a massive dam and then blamed Kyiv’s forces. In this case, the false-flag would involve blowing up Europe’s largest nuclear power plant.  A Russian soldier outside of the occupied Zaporizhzhia Nuclear Power Station in Energodar, Ukraine. Kyiv has warned that Vladimir Putin may be planning to blow it up. Photographer: Andrey Borodulin/AFP It turns out Russia’s short-lived mercenary mutiny has consequences beyond Vladimir Putin’s ability to stay in power. The ruble crashed through what a top Kremlin official calls Russia’s “comfort” zone. Just as a recovery in imports drives up demand for hard currency at home, Russian households and businesses are seeking out safety by shifting money outside the country. The stock of retail deposits held abroad increased by $43.5 billion from early 2022 until May 2023, according to Bloomberg Economics. The failed mutiny by Wagner mercenaries provided the latest spark for the ruble’s weakness. South Korea says it has salvaged a failed North Korean spy satellite from the sea, giving it a rare direct look at Pyongyang’s capabilities even as it concluded that the technology had little military value. Officials on Wednesday said they concluded a 36-day salvage operation that deployed ships, aircraft and deep-sea divers to search for a rocket that was launched on May 31 but failed a few minutes into flight.  South Koreans watch a televised launch of a North Korean satellite on May 31. The rocket failed and fell into the Yellow Sea, the South Korean military said at the time. Now, South Korea says it has recovered the craft. Photographer: Chung Sung-Jun/Getty Images AsiaPac King Street Capital Management has jumped on some of the most high-profile distressed debt events of the past two decades. We’re talking everything from WeWork to Lehman Brothers. Now, the $23 billion hedge fund is gearing up for another potential financial squeeze. Some see the combination of rising interest rates and what they consider to be a weakening economy as a vise, catching companies laden with debt they took on when borrowing costs were lower. The firm is said to be seeking roughly $3 billion of fresh capital across various funds to capitalize on the coming crunch—and it’s not the only one.“This market is a slow-motion car crash,”King Street co-founder Brian Higgins said. “There are opportunities in terms of new lending, a bit of a walk-don’t-run.” For the first time, companies and governments are raising considerably more money in the debt markets for environmentally friendly projects than they are for fossil fuels. Almost $350 billion was raised from green bond sales and loan arrangements in the first half of this year, compared with less than $235 billion of oil, gas and coal-related financing. But what may on its face looks like good news for climate finance is, when you dig down, not so great after all. Following the ruling by the US Supreme Court’s 6-3 supermajority to throw out his student loan forgiveness program, President Joe Biden says he has a new strategy to provide widespread debt relief to borrowers, many of whom were made even worse off by the three-year pandemic. But Biden’s new plan may also face legal headwinds. Ever wonder about all that money Amazon spends on making those super-high production value series for its streaming platform? Well you’re not alone: Amazon Chief Executive Officer Andy Jassy is equally curious, and is now scrutinizing the studio’s ballooning costs and mixed track record with audiences.  Morfydd Clark stars in Amazon’s The Lord of the Rings: The Rings of Power. Amazon’s most expensive series, it was initially estimated to cost close to half a billion dollars. Source: Amazon It’s not your imagination. In addition to the unprecedented wildfires, tropical storms and flooding, it is indeed much hotter than you remember as a child. And yes, it’s because of global warming. Global temperatures have smashed through records this week, underscoring the dangers of ever-increasing greenhouse gas emissions generated from the burning of fossil fuels. The average worldwide temperature reached 17C (63F) on Monday, just above the previous record of 16.9C in August 2016, according to data from the National Centers for Environmental Prediction. “It’s a death sentence for people and ecosystems,” said Friederike Otto, a senior lecturer at the Grantham Institute for Climate Change and the Environment. And it’s about to get worse.  Photographer: Gary Hershorn/Getty Images Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive it in your mailbox daily along with our Weekend Reading edition on Saturdays. The Bloomberg Sustainable Business Summit returns to Singapore July 26 for a day of community building and solutions-driven discussions on innovations and best practices in sustainable business and finance. Speakers include Singapore Minister for Sustainability and the Environment Grace Fu, and top leaders from AIA, Nissan and many more. Register here for a virtual pass or to request to join us in Singapore. |