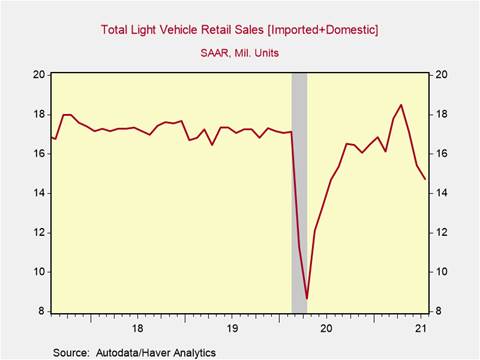

Motor vehicle sales drop again in July as U.S. car manufacturers face production constraints

*Motor vehicle sales fell in July to 14.7 million units on a seasonally adjusted pace, their third consecutive monthly decline (Chart 1). Amid ongoing economic recovery and strong demand, the decline in sales reflects work stoppages of U.S. auto manufacturers that is pushing up prices.

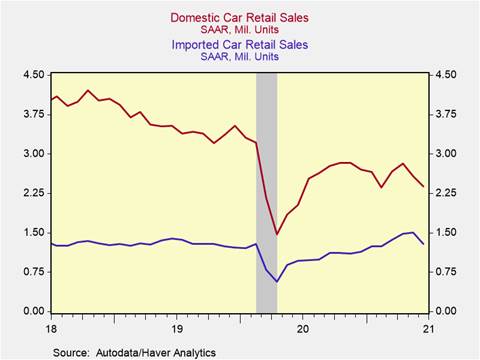

*Although auto sales have experienced a healthy rebound from pandemic lows, current volumes remain below those of recent years. The shortfall in supply has been attributable largely to domestic production. In July, sales of domestically produced motor vehicles fell 4.3% and remain well below pre-pandemic levels, whereas imported auto sales fell less than 0.1% (Chart 2) and have recovered more quickly.

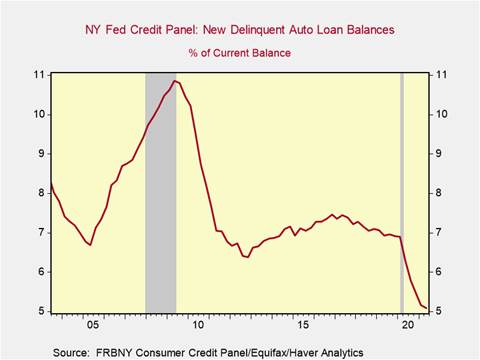

*Cyclical factors that traditionally drive consumption and motor vehicle sales are positive and suggest a strong rebound from current levels in auto sales. The ongoing recovery in employment and rising wages are supporting disposable income, and auto loans are readily available at low rates. New delinquent 30-day auto loan balances are at their lowest point in decades (Chart 3).

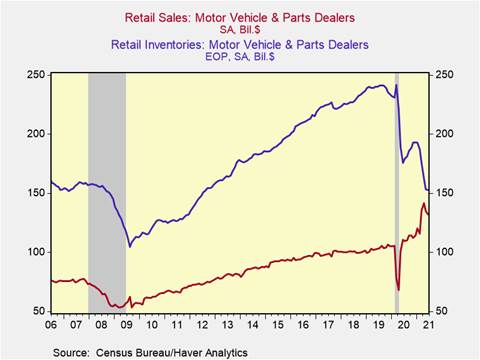

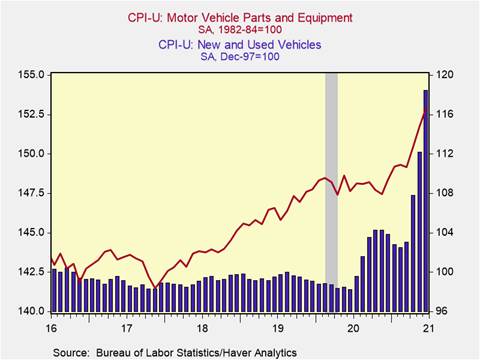

*Motor vehicle inventories have fallen significantly, close to the lows seen toward the end of the 2008-2009 financial crisis, and the gap between inventories and sales is at its narrowest ever (Chart 4). This has resulted in sharply higher prices for both new and used motor vehicles, as well as auto parts and equipment (Chart 5). Particularly striking, new vehicle prices have risen 5.3% in the year ending in June, but significantly trail used vehicle prices that have climbed 45.2%.

*Auto manufacturers face higher costs of production, including materials and labor. The higher prices eventually will weigh on demand. U.S. auto manufacturers are adjusting their expected production schedules to reflect the realities of ongoing shortages of microchips. This suggests that in coming months, the supply-demand imbalance for motor vehicles will persist, keeping prices elevated and delaying the eventual return of inventories to desired levels.

Chart 1: Total Light Vehicle retail sales

Chart 2: Trade of Retail Car sales

Chart 3: 30-day Auto loan delinquency rate

Chart 4: Motor Vehicle sales and inventories

Chart 5: CPI– Motor Vehicles & parts and equipment

Mickey Levy, mickey.levy@berenberg-us.com

© 2021 Berenberg Capital Markets, LLC, Member FINRA and SPIC

Remarks regarding foreign investors. The preparation of this document is subject to regulation by US law. The distribution of this document in other jurisdictions may be restricted by law, and persons, into whose possession this document comes, should inform themselves about, and observe, any such restrictions. United Kingdom This document is meant exclusively for institutional investors and market professionals, but not for private customers. It is not for distribution to or the use of private investors or private customers. Copyright BCM is a wholly owned subsidiary of Joh. Berenberg, Gossler & Co. KG (“Berenberg Bank”). BCM reserves all the rights in this document. No part of the document or its content may be rewritten, copied, photocopied or duplicated in any form by any means or redistributed without the BCM’s prior written consent. Berenberg Bank may distribute this commentary on a third party basis to its customers.