To the greatest investor of all time: a small suggestion…

They’ve bashed you on this one. “What’s he thinking buying another tech company?” “After his IBM disaster, he’s buying into tech again?”

The company I’m referring to is Apple Inc. (AAPL).

Just a few short years ago, pundits called AAPL the next Blackberry—a faddish phone company doomed to fail.

Well, they were wrong. And Warren Buffett, through Berkshire Hathaway (BRK-A), crushed it by buying Apple stock.

Since first buying Apple in 2016 to today, he’s up over 700%, and he’s generated many billions of dollars in unrealized gains for Berkshire shareholders.

It’s been a huge win for him, to say the least. But with the stock trading at a premium multiple—over 30X earnings—I think it’s time to take some chips off the table.

Let Coca-Cola Serve as a Lesson

For the 92-year-old Warren Buffett, this isn’t the first time he’s been in this situation.

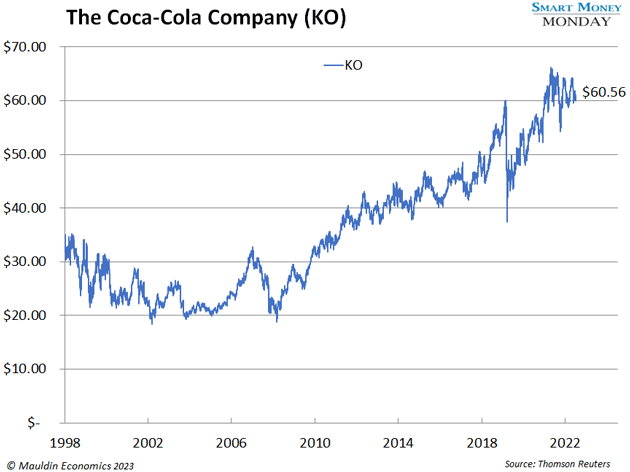

Just look back to the late 1990s. At the time, the Coca-Cola Co. (KO) was one of the largest stock positions in the Berkshire Hathaway stock portfolio.

Buffett got in cheap in the late 1980s. He bought it right. However, sometimes a great company gets too pricey. As I’ve written about time and again, a great company does not always make for a great investment.

Coca-Cola, from the late 1980s up until around 1997, traded at a reasonable multiple of earnings. In 1998, however, the market bid Coca-Cola up to nosebleed levels of valuation.

Looking at the Coca-Cola 1998 annual report, you can see the stock traded well north of 45X trailing earnings per share. You must adjust for some stock splits to get there, but it’s true.

Super investor Bill Ackman, of all people, brought this to Buffett’s attention at the 1998 shareholder meeting:

Coca-Cola at 40 P/E. Is that a smart place for Coke to deploy capital?

A little context here…

He’s referring to Coca-Cola’s decision to repurchase shares at these lofty valuation multiples.

Buffett’s response was a bit generic. Basically, he said it’s a great company, so you should own it forever. Unfortunately, selling then would have been the right call.

On a split-adjusted basis, at the end of 1998, KO was $34 per share. Today, it’s $60.

That’s a poor 2.4% compounded annual return over 25 years. Sure, you got some dividends along the way. But it’s fair to say that from 1998 to today, owning Coca-Cola wasn’t a great investment.

The Apple Compromise

Warren Buffett is the greatest investor of all time. Hands down, no question.

But even the greats can make mistakes. Not selling Coca-Cola was probably a mistake. With Apple, hopefully he doesn’t make the same mistake twice.

Yes, Apple is an amazing company with an incredible brand and products. Will it be around another 100 years? Maybe. Will it be a great investment from here?

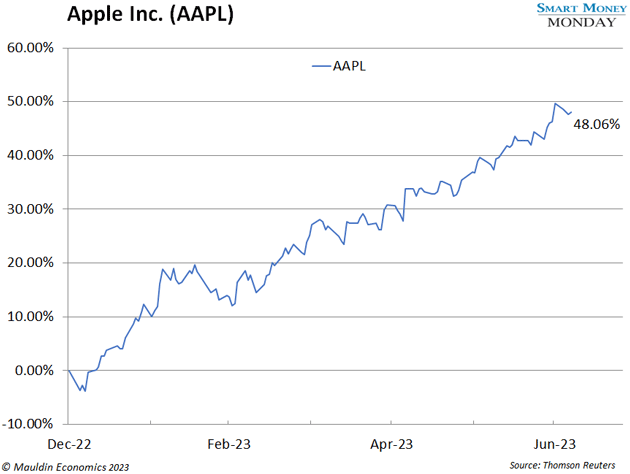

The stock has been on a tear just this year—up nearly 50% in a little more than six months.

After this monster run, Apple currently has a $3 trillion market cap. At Berkshire, it makes up a whopping 50% of the $300+ billion common stock portfolio.

And again, at something like 30X earnings, even a fancy new virtual reality headset won’t change the fact that it’s hard to see this being a worthwhile investment from here.

So again, my advice to Mr. Buffett: Take some chips off the table. The tax bill will be well worth paying. There are plenty of other fish in the sea—that is, plenty of other great investments.

Here’s a compromise: Just sell half!

But who am I to question the master? My guess is that he probably hangs on. That’s just his style.

Thanks for reading,

—Thompson Clark

Editor, Smart Money Monday

Suggested Reading...