| Bloomberg Evening Briefing Americas |

| |

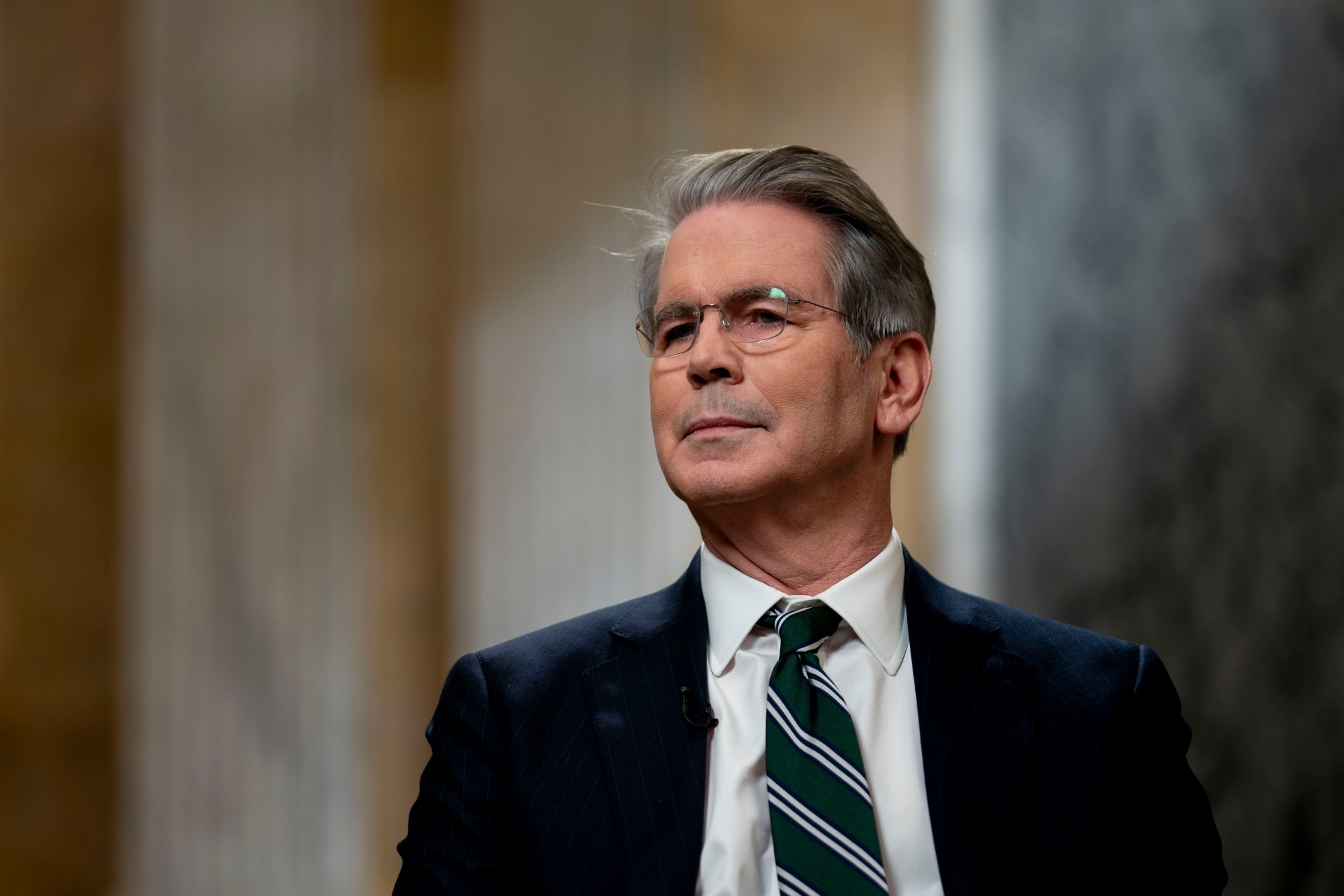

| Moving fast and breaking things has long been the mantra of Silicon Valley, with results that haven’t always been appreciated. Elon Musk and his young adjutants have been racing through government agencies in similar fashion, with little outside supervision and in ways deemed illegal by a growing chorus of alarmed critics. Now, a much slower-moving institution known as the federal judiciary is beginning to weigh in. The multibillionaire’s most controversial effort on behalf of President Donald Trump, involving the heart of the US Treasury, has now been stopped by a federal judge. The court paused Musk’s access to the agency’s payments system after a group of unions accused the agency, under former hedge fund manager Scott Bessent, of illegally sharing their members’ information with Musk’s group. US District Judge Colleen Kollar-Kotelly on Thursday allowed “read only” access to two “special government employees” tied to Musk’s group. The specific constraints of the order, although in place only temporarily, marked the first time a judge has placed limits on the Tesla CEO’s actions on behalf of Trump.  Scott Bessent Photographer: Stefani Reynolds/Bloomberg Still, trillions of dollars of federal payments flow through Treasury every year, and Musk’s access has already given the entrepreneur visibility into sensitive information about taxpayers, beneficiaries, contractors and employees—all of which he could make use of in the private sector. Members of Congress, federal employee unions and privacy advocates have exploded in anger at the access given him, citing unprecedented conflicts of interest. For his part, Bessent contends there’s been no “tinkering” with the department’s payment systems. And while he is more on board with Musk’s mission than has been widely understood, the world’s richest man and his brazen cost-cutting tactics are nevertheless starting to irk Republican lawmakers. —Jordan Parker Erb |

|

What You Need to Know Today |

|

| The courts also are awakening to the rest of Trump’s busy first few weeks, including Musk’s attempts to drive out government employees. Federal workers’ “buyouts” are on pause, too. US District Judge George O’Toole temporarily delayed the deadline—which was today—for millions of federal workers to decide whether to accept the Trump administration’s deferred resignation offer. O’Toole will hold a hearing on Feb. 10 regarding a longer-term halt to the Trump strategy, also widely seen as illegal, and unfunded, given Congress would have to pay for any buyouts. Ahead of today’s deadline, about 50,000 employees had signed up for the resignation offer. Meanwhile, Trump is trying to find other ways to fire people, asking agencies to draw up lists of their poorest performing employees. And over at USAID, it may be too late for most.  Demonstrators on Capitol Hill Wednesday during a protest for the US Agency for International Development, which the Trump administration has been targeting. Photographer: Stefani Reynolds/Bloomberg |

|

|

| US unemployment applications picked up last week with new claims increased by 11,000 to 219,000. But private employment data from ADP Research showed a healthy pace of hiring in January. Together, that’s consistent with a labor market that Federal Reserve Chair Jerome Powell described last week as “pretty stable.” Another labor indicator, productivity, ticked upward last week, a good sign for central bank officials looking to curb labor costs. |

|

|

| Canadians support using oil as a weapon against America if Trump follows through on his trade war against the US’s northern neighbor. According to a new poll, there is strong nationwide support for putting export taxes on oil shipments if needed to retaliate against Trump’s tariffs. Overall, 82% of Canadians would be in favor of raising the price on oil exports to the US if Trump tries to put levies on Canadian goods but exempts oil. While export taxes on energy have been considered politically divisive in Canada, the robust backing shows the level of anger among the Canadian public over the 78-year-old Republican’s repeated threats. |

|

|

| Trump’s trade war on China is already doing damage in some unexpected ways. Lewis Black, chief executive of tungsten miner Almonty, says his clients are in shock following China’s decision to impose export controls on the niche metal, a super-dense material used in armor-piercing munitions, engine parts and—you guessed it—chipmaking. Beijing’s move, made Tuesday, was one of several in response to tariffs placed on Chinese goods by the Trump administration. “It’s the warning shot, because we cannot exist without it,” Black said. |

|

|

| Bankers descended upon Capitol Hill Thursday to defend an existential part of the municipal bond market: keeping state and local debt tax free. The potential loss of tax exemption would disrupt not only Wall Street’s bankers and lawyers, but also raise costs to build most of the nation’s infrastructure, from schools to roads to airport terminals. The threat comes as state and local governments are still reeling from the Trump administration’s since-rescinded, arguably unconstitutional and now judicially blocked push to halt all federal loans and grants authorized by Congress, leaving officials grappling with how to plan their budgets. |

|

|

| Ecuador’s president, Daniel Noboa, engineered a turnaround within 14 months for the South American country in debt markets. By pushing through a fiscal reform, he’s lifted the serial defaulter’s bonds out of distressed territory for the first time since 2022, drummed up demand for a debt-for-nature transaction and handed investors 100% returns along the way. Already facing reelection on Feb. 9, the market expects Noboa to win a second term. The question is whether Noboa has the support to win outright in the first round. |

|

|

| |

What You’ll Need to Know Tomorrow |

|

| |

| |

| |

| Enjoying Evening Briefing Americas? Get more news and analysis with our regional editions for Asia and Europe. Check out these newsletters, too: Explore all newsletters at Bloomberg.com. |

|

| |

Like getting this newsletter? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and subscriber-only insights. Before it’s here, it’s on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can’t find anywhere else. Learn more. Want to sponsor this newsletter? Get in touch here. |

|

| You received this message because you are subscribed to Bloomberg's Evening Briefing: Americas newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. |

|

|