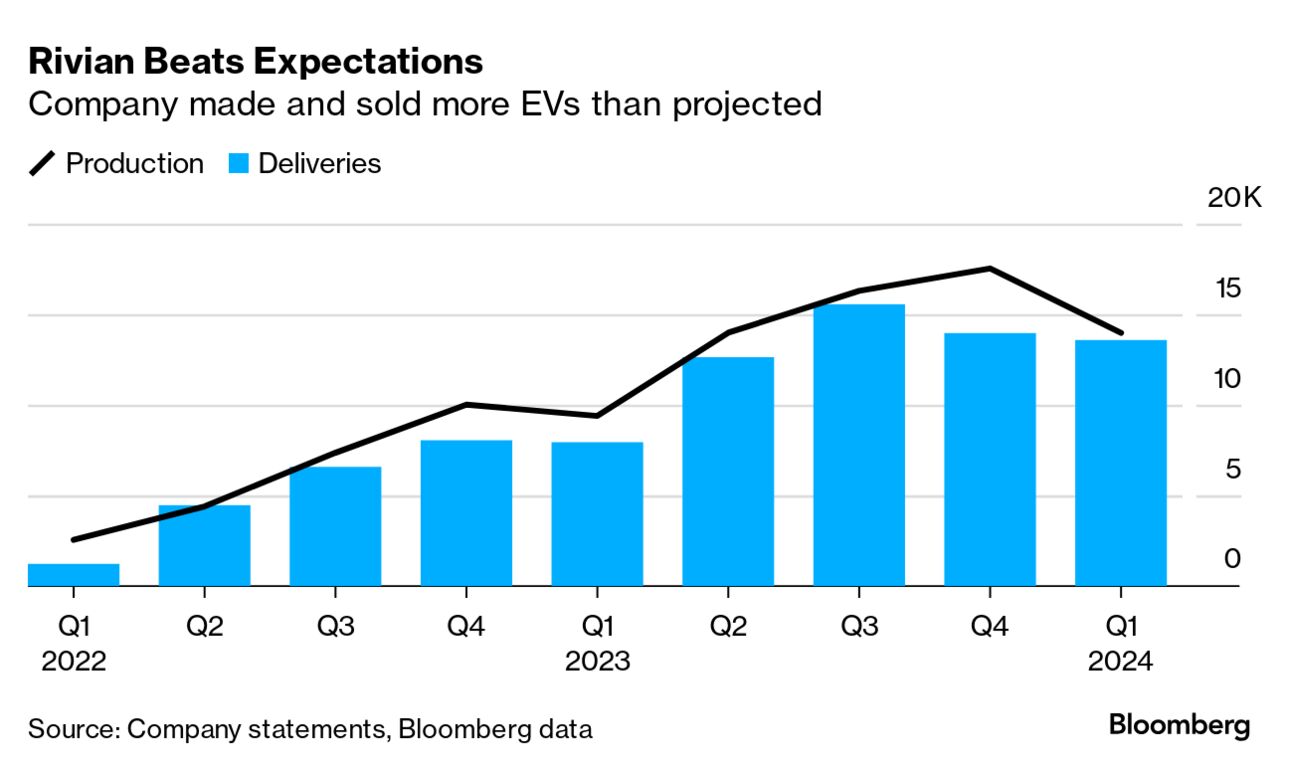

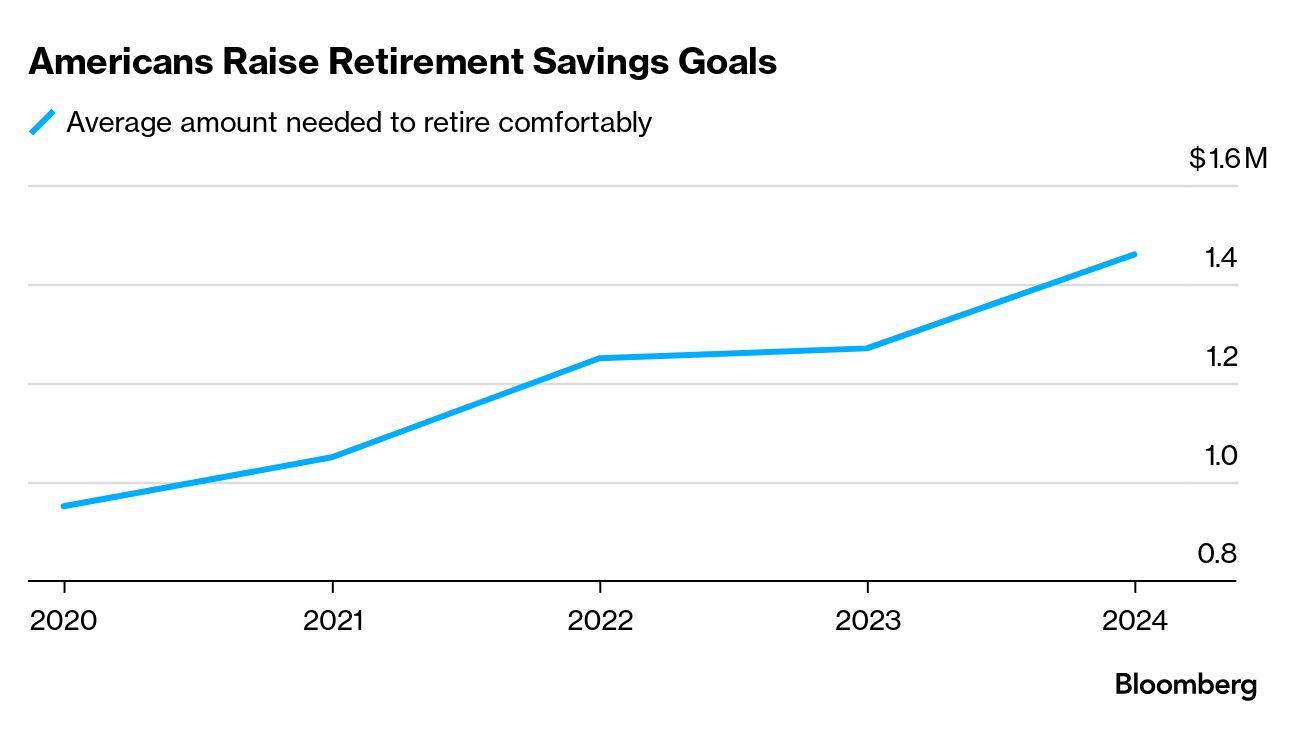

| Wall Street analysts were second-guessing their models just as Tesla’s first quarter came to a close. One after another reduced their estimate for vehicle deliveries. But it turns out they didn’t cut their numbers by nearly enough, because on Tuesday the electric carmaker led by its famously voluble CEO whiffed on Bloomberg’s average sales estimate by the most ever. Tesla’s shares fell 4.9%, extending their 2024 slide to a tremendous 33%, the second-worst showing in the S&P 500 Index. It wasn’t a total surprise, though, as red flags were flying for some time. Tesla had warned its rate of growth would be “notably lower” and the company did face multiple disruptions at its plant outside Berlin. But still, there’s Elon Musk. His inflammatory posting of far-right conspiracy theories (among other things) has turned off prospective buyers for whom a Tesla was once an aspirational purchase. “Is Elon’s brand damaging Tesla sales in the US?” asked Gene Munster, managing partner of Deepwater Asset Management. “It’s directionally a negative.” —David E. Rovella While Tesla suffers, others appear to be picking up some of the slack (though EVs as a general proposition are having a tough time of it recently). Rivian Automotive built and delivered more electric vehicles last quarter than Wall Street expected, though it stood by its 2024 output target of about 57,000 units. Still, even cheery results like these and the unchanged full-year outlook failed to mollify investor concerns about the sector. Rivian shares fell 58 cents to $10.51 in New York. After decades of empty threats, much of the world tunes out when North Korea vows to unleash destruction. But in the past few months, some prominent analysts began warning that Kim Jong Un may be serious about preparing for war. Backed by rapid progress in his nation’s nuclear capabilities and missile program, he began 2024 by removing the goal of peaceful unification from North Korea’s constitution and declaring he had the right to “annihilate” South Korea. The yen could slide to hit 160 per dollar unless the US Federal Reserve cuts interest rates this year, according to Bank of America. Any intervention from the Bank of Japan to try to prop the currency up will be ineffective until the US starts easing monetary policy, says BofA’s global head of Group-of-10 currency strategy. The yen has already hit three-decade lows and is flirting with the 152 per dollar level that many say would force Japanese authorities to act. Zimbabwe’s currency plunged to yet another record low as citizens rushed to the safety of the US dollar amid speculation an announcement from the central bank on the fate of the local unit is imminent. The Zimbabwe dollar traded at 22,476 against the greenback, taking its losses this year to 73%, the world’s second-worst performance only after the Lebanese pound. The southern African nation’s unstable currency risks sending the nation back into hyperinflation 15 years after its old local dollar had to be abandoned. Retirement is becoming an even more distant goal for Americans. A typical person now believes they need $1.5 million to retire comfortably, which is nearly 17 times more than the $88,400 savers have set aside on average. The gap, up 16% from last year, highlights the challenges coming into focus as the over-65 population in the US increases and they face the prospect of financing longer life spans and potential cuts to Social Security benefits. Patients struggling to get their hands on the hard-to-find weight-loss shot Zepbound have a solution for drugmaker Eli Lilly: Release the vials. Zepbound isn’t in short supply because there’s a lack of medicine—but rather the pre-filled pens that patients use to inject the right dose of the drug. Making that device requires “some of the most complex” production systems “on the planet,” according to Lilly Chief Executive Officer David Ricks. But there’s another way to administer the drug: Lilly could ditch the pen and sell Zepbound in vials. Endeavor Group Holdings, the talent agency and controlling investor in professional wrestling’s WWE and the Ultimate Fighting Championship, agreed to be acquired in a $13 billion buyout by the private equity group Silver Lake Management. Silver Lake, which already owns a 71% voting stake in Endeavor, offered minority investors $27.50 a share for their holdings. Endeavor, led by superagent Ari Emanuel, has a market value of about $12 billion.  Ari Emanuel Photographer: Kyle Grillot/Bloomberg Texas Governor Greg Abbott started busing migrants from his state’s dusty southern reaches to cold northern cities as a way of publicizing the rise in apprehensions at the US southern border. Eventually the issue, a staple of election year politics normally, reached Washington again. Only this time, President Joe Biden and the US Senate gave Republicans like Abbott much of what they wanted in the form of a bipartisan immigration bill. In the Bloomberg Originals mini-documentary How Texas Unleashed a Political Firestorm, we explain the reasons why the bill was killed and how the chance for reform may not come again—at least not anytime soon.  Watch How Texas Unleashed a Political Firestorm Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive Bloomberg’s flagship briefing in your mailbox daily—along with our Weekend Reading edition on Saturdays. Bloomberg Technology Summit: Led by Bloomberg Businessweek Editor Brad Stone and Bloomberg TV Host and Executive Producer Emily Chang, this full-day experience in downtown San Francisco on May 9 will bring together leading CEOs, tech visionaries and industry icons to focus on what's next in artificial intelligence, the chip wars, antitrust outcomes and life after the smartphone. Learn more. |