New home sales moderate, supply shortages constrain construction

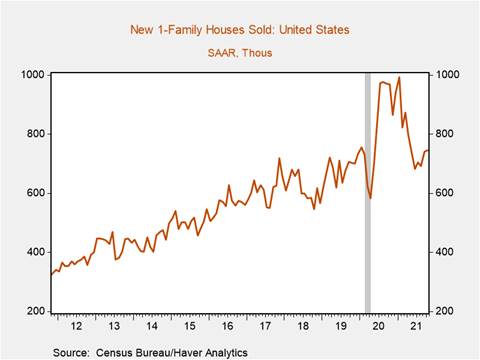

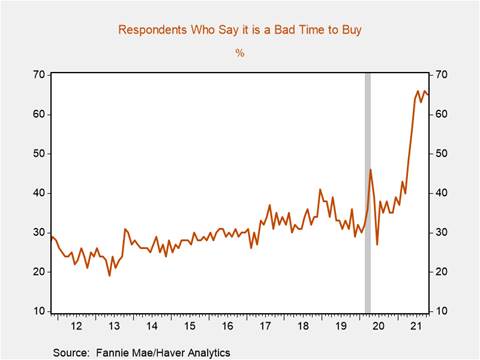

*New home sales were flat at 740k annualized following a significant downward revision to last month’s data (-58k) and remain almost 250k below their January 2021 peak (Chart 1). The median sales price ticked up 0.7% to $407,000, a 17.5% yr/yr increase. Supply disruptions and materials shortages have prevented home builders from taking full advantage of zooming new home prices by constraining building. Amid strong demand and limited supply, home builders continue to maintain the flexibility to pass mounting costs on to consumers who continue to pile into the housing market despite a marked increase in the proportion of households who think it is a bad time to purchase a home (Chart 2).

*The increase in construction costs is striking. Construction costs have risen by more than 0.8% m/m for eleven consecutive months and are 13.3% higher than in October 2020.

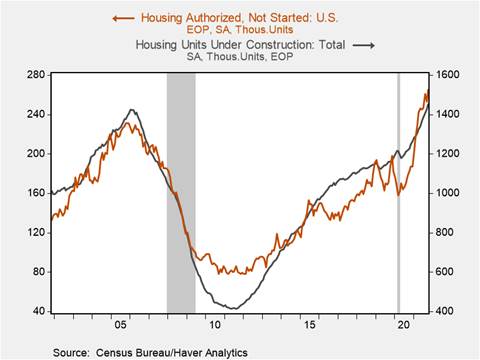

*Material and labor shortages continue to constrain home building. The number of housing completions has plummeted from a peak of 1500k annualized in March to 1240k in October. There has been a commensurate increase in the number of homes under construction, which rose from 1300k to 1450k over the same time span, while the number of homes that have been authorized but not started has risen to 265k, a 60% increase relative to February 2020 (Chart 3).

*As supply chain disruptions resolve, employment in the construction industry – which remains 150k below its pre-pandemic level – should rebound as home-building accelerates. An expansion in the supply of new homes on the market should also lift demand for household furnishings and durable household equipment.

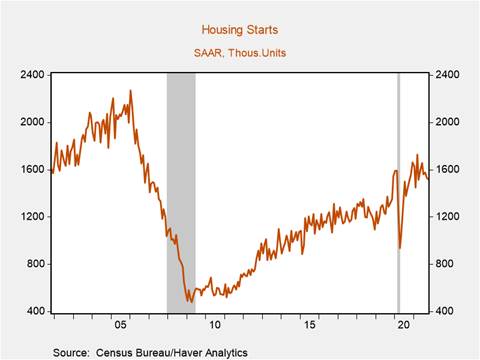

* Housing starts ticked down to 1520k (-10k) annualized following a slight downward revision to September’s data and remain 70k short of their pre-pandemic peak in February 2020 as labor shortages and soaring material costs impede new construction (Chart 4). Building permits rose to 1650k annualized, retracing half of their September decline, suggesting construction activity will pick up in the near term to meet current strong demand.

* Existing home sales ticked up to 6.34 million annualized but have fallen 5.8% yr/yr, reflecting a mix of limited housing supply and surging prices that have dampened demand among prospective buyers and eaten into housing affordability. Rising new and existing home prices have pushed many, particularly lower- and middle-income households, on to the rental market, which according to Zillow’s Observed Rent Index, has experienced price increases of 14.3% yr/yr (Chart 5). Rents are likely to rise substantially further as individuals move back to metropolitan areas following the mid-pandemic exodus to suburbs and rural America, while leases signed at discounted rates last year will be adjusted upward on renewal.

Chart 1: New Home Sales

Chart 2: Fannie Mae National Housing Survey - % Respondents Saying Bad Time to Buy a Home

Chart 3: Housing Authorized and Not Started vs. Housing Units Under Construction

Chart 4: Housing Starts

Chart 5: Zillow Observed Rent Index (yr/yr, %)

Mickey Levy, mickey.levy@berenberg-us.com

Mahmoud Abu Ghzalah, mahmoud.abughzalah@berenberg-us.com

© 2021 Berenberg Capital Markets, LLC, Member FINRA and SPIC

Remarks regarding foreign investors. The preparation of this document is subject to regulation by US law. The distribution of this document in other jurisdictions may be restricted by law, and persons, into whose possession this document comes, should inform themselves about, and observe, any such restrictions. United Kingdom This document is meant exclusively for institutional investors and market professionals, but not for private customers. It is not for distribution to or the use of private investors or private customers. Copyright BCM is a wholly owned subsidiary of Joh. Berenberg, Gossler & Co. KG (“Berenberg Bank”). BCM reserves all the rights in this document. No part of the document or its content may be rewritten, copied, photocopied or duplicated in any form by any means or redistributed without the BCM’s prior written consent. Berenberg Bank may distribute this commentary on a third party basis to its customers.