| Bloomberg Evening Briefing Americas |

| |

| California Governor Gavin Newsom filed a lawsuit to halt President Donald Trump’s tariffs, as the fusillade of litigation challenging the 78-year-old Republican’s effort to consolidate power increasingly targets his biggest policy. The suit, like several before it, questions Trump’s use of emergency powers to justify a trade war that’s both thrown global commerce into chaos and seen as threatening the US and the world with recession. California accounts for roughly 14% of the nation’s gross domestic product, has a population of 40 million and would be considered one of the largest economies in the world if it were a country. The International Emergency Economic Powers Act, passed in 1977, gives a US president broad authority to regulate certain financial transactions when declaring a national emergency in response to an “unusual and extraordinary threat.” It has traditionally been used to place sanctions on countries, companies and individuals. Trump, in his unprecedented use of the IEEPA to instead impose import tariffs, cited in part the “extraordinary threat” of undocumented immigrants entering the country as justification. The number of immigrants, however, had already fallen precipitously months before he took office. “Congress hasn’t authorized these tariffs, much less authorized imposing tariffs only to increase them, then pause them, then imminently reinstate them on a whim, causing our nation and the global economy whiplash,” California Attorney General Rob Bonta said. —David E. Rovella Trade wars, tariff threats and logistics shocks are upending businesses and spreading volatility. Understand the new order of global commerce with the Supply Lines newsletter. |

|

What You Need to Know Today |

|

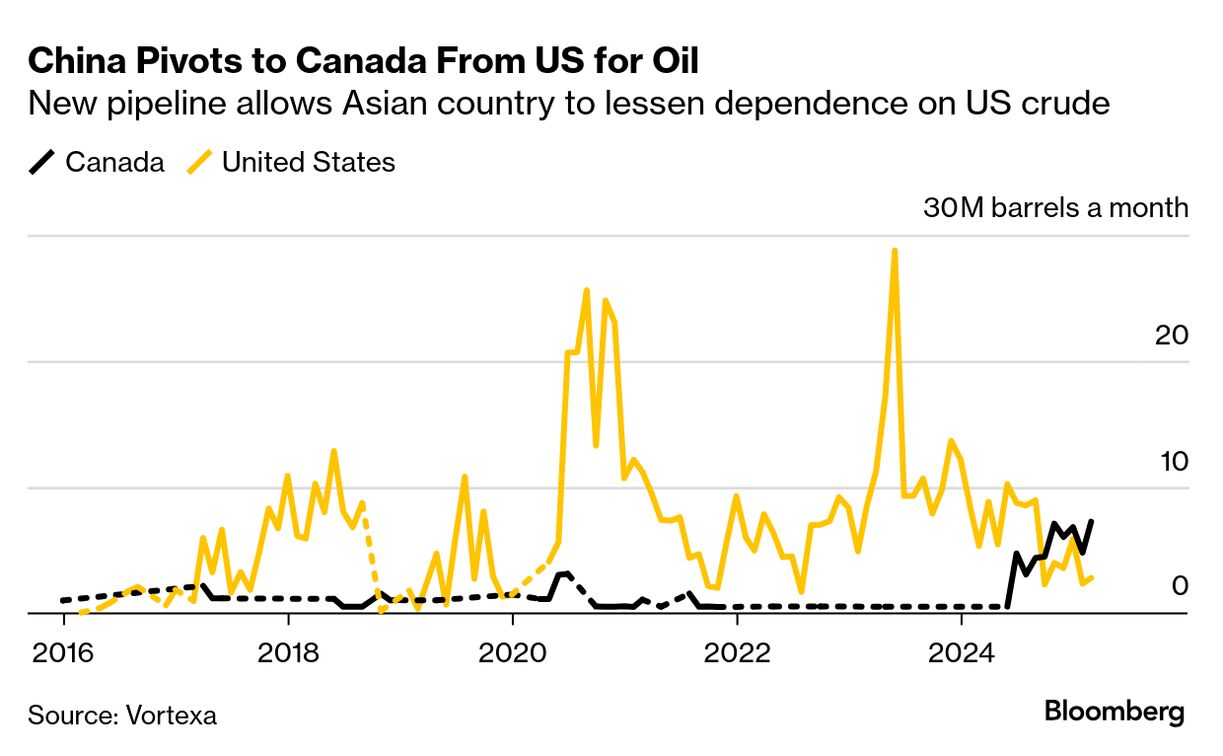

| Not only has China been largely ignoring—or dictating the terms of engaging with—Trump’s repeated invitations for talks over his trade war, but its most recent economic numbers appeared to show some surprisingly positive signs. Now the country is taking advantage of America’s alienation of friend and foe alike to buy its oil elsewhere. Chinese refiners are importing record amounts of Canadian crude after slashing purchases of US oil by roughly 90% amid the escalating trade tensions. A pipeline expansion in Western Canada that opened less than a year ago has presented China and other East Asian oil importers with expanded access to the vast crude reserves in Alberta’s oilsands region.  While China had been looking more to Canada’s oil before Trump took office, Chinese crude imports from a port near Vancouver soared to an unprecedented 7.3 million barrels in March and are on pace to exceed that figure this month. Meanwhile, Chinese imports of US oil have collapsed to 3 million barrels a month from a peak of 29 million in June. |

|

|

| |

|

| A relatively calm day on the stock market turned turbulent after Jerome Powell made clear the Federal Reserve remains on a war-footing against inflation, even if that means risk assets suffer. With Trump having thrown markets into disarray over the past few weeks with his on-again, off-again tariffs, tariff threats and tariff retreats, investors were hoping for some solace from the central bank. But no such luck. The Fed chair said he expects inflation to rise because of Trump’s tariffs, which will likely also put the labor market under pressure. Powell and other Fed policymakers have expressed support for holding rates steady as they try to sort out the impact from the administration’s scattershot policies. The S&P 500 ended trading Wednesday down 2.2%. Technology stocks took a beating with the Nasdaq 100 tumbling 3% after the White House imposed new restrictions on Nvidia’s chip exports to China. The yield on 10-year Treasuries fell around five basis points to 4.28%. As of now, S&P 500 losses during Trump’s second term have erased gains going all the way back to August 2024. Here’s your markets wrap. |

|

|

| |

|

| The Trump administration’s resistance to and in some cases rejection of the federal judiciary’s constitutional powers has earned it its first finding of contempt, a grave escalation in the deepening crisis at the heart of American government. A federal judge who had been repeatedly attacked by Trump and his aides found there is “probable cause” to hold administration officials in criminal contempt of court for sending scores of men and boys to an El Salvador prison despite his order to halt the deportations. The administration has claimed without providing evidence that the deportees are gang members. A Bloomberg investigation revealed the vast majority had never been charged in the US with anything other than immigration or traffic violations. A Maryland US senator meanwhile was turned away from meeting with a man imprisoned in El Salvador who the Trump administration illegally deported and now refuses to bring back—despite a US Supreme Court order that it facilitate his return. |

|

|

| |

|

| |

What You’ll Need to Know Tomorrow |

|

| |

| |

| |

| Qatar Economic Forum: Join us May 20-22 in Doha, where since 2021 the Qatar Economic Forum powered by Bloomberg has convened more than 6,500 influential leaders to explore bold ideas and tackle the critical challenges shaping the global economy. Don’t miss this opportunity. Request an invitation today. |

|

| Enjoying Evening Briefing Americas? Get more news and analysis with our regional editions for Asia and Europe. Check out these newsletters, too: Explore all newsletters at Bloomberg.com. |

|

| |

Before it’s here, it’s on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can’t find anywhere else. Learn more. Want to sponsor this newsletter? Get in touch here. |

|

| You received this message because you are subscribed to Bloomberg's Evening Briefing: Americas newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. |

|

|