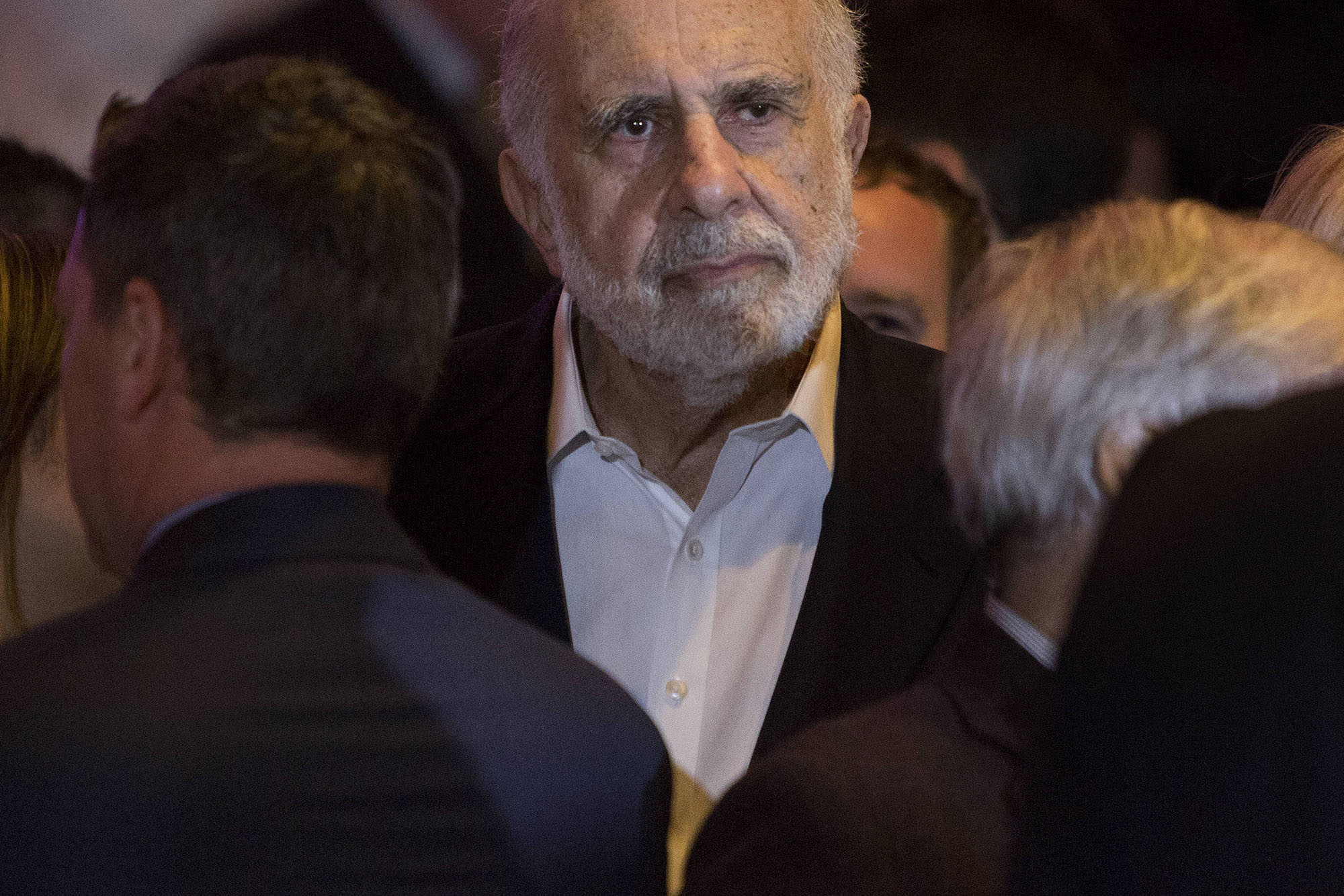

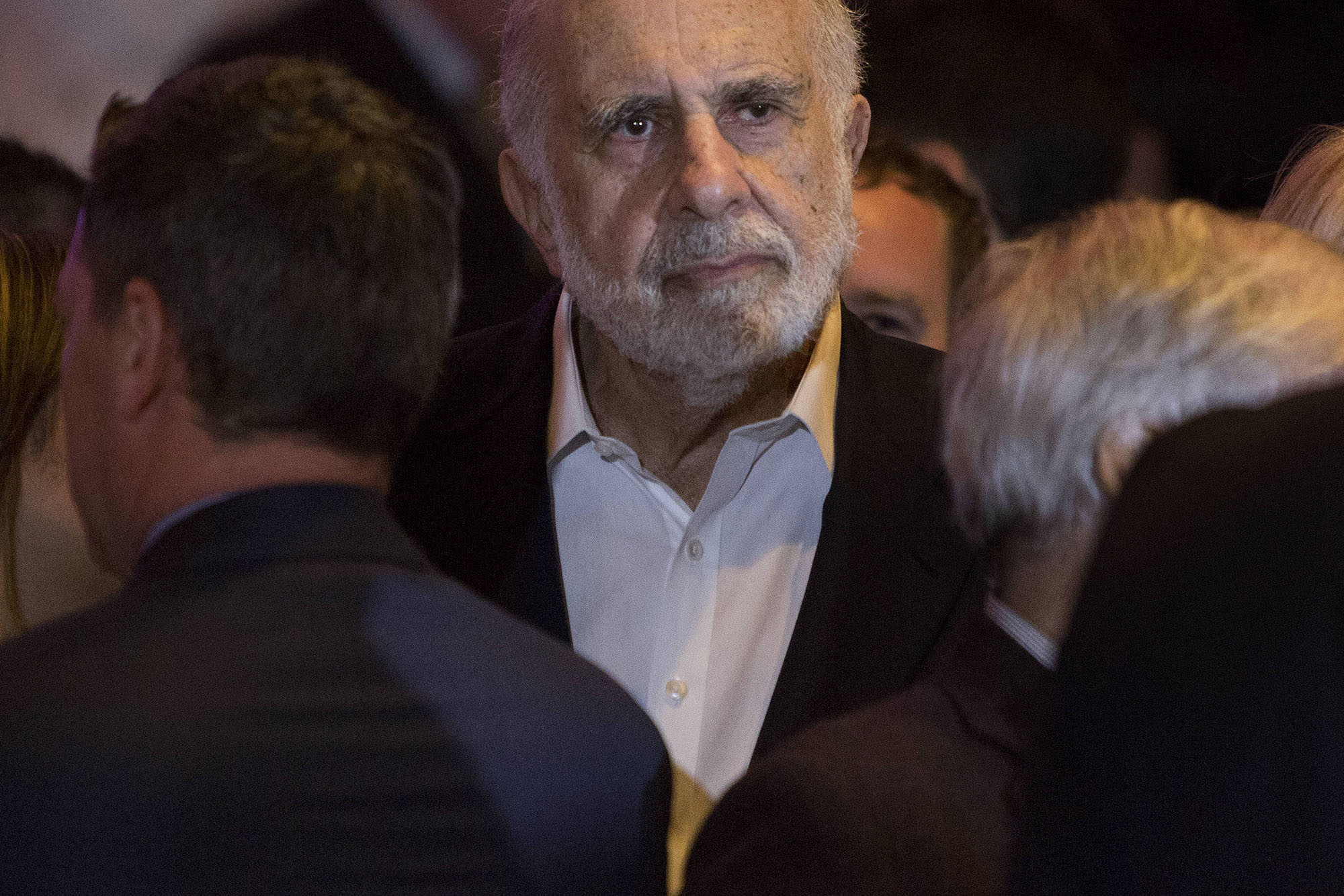

| On Monday, the question was raised as to whether the 2023 banking crisis was near an end, thanks in part to the largesse of JPMorgan. On Tuesday, Wall Street answered with a Bronx cheer. Investors targeted two more regional banks while taking the broader market down with them. PacWest and Western Alliance led the big selloff in regional lenders as trading in both triggered multiple volatility halts. PacWest fell 28% to close at a record low while Western Alliance tumbled 15%. The pair has shed more than $5 billion in market value so far this year. The KBW Regional Banking Index dropped 5.5% on Tuesday, the most since the crisis began back in March. Charles Schwab, a brokerage with a banking arm that’s come under pressure by the recent rout, fell 3.3%. And they weren’t the only victims: Comerica and Zions Bancorp each tumbled more than 10% while Metropolitan Bank Holding dropped 20%. —David E. Rovella According to Janet Yellen, there’s one month left for Republicans to relent on their refusal to raise the debt limit (so the US can pay its existing bills) unless the White House meets their demands (future cuts that will likely slash climate, education and social funding). Now, it turns out there may only be seven days left. President Joe Biden invited top congressional leaders for a meeting on the matter, but fear in markets has been rising for some time now, with yields on Treasury bills for early June soaring. Democrats are already looking at some radical options to keep the world’s largest economy from defaulting. But Stanley Druckenmiller, the hedge fund investor and long-time deficit hawk, said the current crisis of choice is dwarfed by the dangers of unchecked future government spending. “The fiscal recklessness of the last decade has been like watching a horror movie unfold,” he said. Skynet hasn’t become sentient yet, but artificial intelligence is already wreaking havoc in the financial and corporate worlds. The speed of disruption brought on by a worldwide rush into the new technology was on full display this week, sending shares of education-technology company Chegg plunging, leading IBM to halt some hiring for roles that may soon be automated and prompting a chatbot ban at Samsung.  Geoffrey Hinton Photographer: Noah Berger/AP Indeed, more of AI’s creators are issuing grave warnings about what happens when humans rely on the better angels of other people’s nature rather than robust regulation. Parmy Olson writes in Bloomberg Opinion that the tectonic mea culpa of AI godfather Geoffrey Hinton, formerly of Google, is worrying. He has told several news outlets that Big Tech is moving too fast and that AI is achieving human-like capabilities more quickly than expected. Olson writes that Hinton’s concerns would have been more effective if they had come years earlier, when other researchers were ringing the same alarms. Carl Icahn has made a career out of starting corporate brawls. But on Tuesday, he found himself on the receiving end, opposite the bête noire of C-suites everywhere. Icahn Enterprises fell as much as 27% Tuesday, their biggest intraday drop since 2010, after it became clear that short-seller Hindenburg Research—of Adani and Block fame—is coming for Icahn.  Carl Icahn Photographer: Victor J. Blue Millions of Chinese travelers thronged major cities and tourist hotspots across the nation over its Labor Day break, the first normal holiday period for many after three years of pandemic restrictions and a catastrophic Covid wave. More than 159 million trips were made by car, rail, airplane and waterways in the first three days of the five-day holiday which ends Wednesday, up 162% from the same period last year. Pakistan took the crown for Asia’s fastest inflation from Sri Lanka, as a weaker currency and rising food and energy costs drove price gains to a record in April. Consumer prices rose 36.4% in April from a year earlier, the highest since 1964. The Pakistani rupee is one of the worst performing currencies globally so far in 2023, declining 20% to the dollar. Pakistan’s inflation is expected to rise further after authorities raised taxes and fuel prices to meet the International Monetary Fund’s conditions for the revival of a $6.5 billion loan program. The Nigerian government had been seeking to confiscate a London mansion as part of a probe into one of the biggest corruption scandals in the West African nation’s history. A Bloomberg investigation has revealed that a firm belonging to the son of Nigeria President-Elect Bola Tinubu bought the mansion for $11 million.  President-elect Bola Tinubu Photographer: Kola Sulaimon/AFP/Getty Images High interest rates have transformed the US real estate market in a matter of months, and in unexpected ways. Housing supply is constrained but there’s a glut of office space. Persistent fear of recession is driving down prices in some areas while demographic changes are keeping them elevated in others. Higher rates are pricing out first-time buyers, but those who can pay with cash are snapping up deals. Landlords are defaulting on debt while homebuilders are seeing a surge in demand. It’s a confusing picture for anyone who’s looking to buy or invest. Yet these weird market shifts present opportunities.  Illustration: Chris Harnan Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive it in your mailbox daily along with our Weekend Reading edition on Saturdays. The Bloomberg Wealth Asia Summit returns on May 9. Join us in Hong Kong or online as we sit down with the region’s leading investors, economists and money managers to discuss the mindset of next generation investors, Web3 and investing in art. Speakers include top executives from Amundi, Hong Kong Monetary Authority and Sotheby’s. Register here. |