Zoom in on the “regularly recurring” part. A recurring event is one that happens repeatedly. Wherever on Earth you may be, the sun reliably rises and falls every day. Those are reliably recurring events. They’re also regularly recurring because we can know in advance exactly when they will happen.

The historical cycles I’ve described in this series have been recurring for many centuries. Their roots in human nature make their recurrence fairly reliable. But they aren’t regular in the same way as sunrise. Their timing varies, both randomly and for other reasons we don’t fully understand.

I say all this because some readers tell me the “cycles” I’ve been discussing are nonsensical hocus-pocus. I disagree, but these readers have a point. It’s true they lack the kind of regularity seen in other natural cycles. That makes the details somewhat vague, particularly the timing. Yet I think debates about whether the cycle will turn next year or five or 10 years from now miss the more important point: A turn is coming relatively soon, and we should use whatever time we have to get ready.

And while we use the term “cycle,” you could also describe it as a pattern. As noted above, using the term cycle seems to generate some concept of regularity, perhaps not as regular as night and day, but still having some type of predictable periodicity.

The cycles or patterns or whatever we want to call them that I am describing in this series of letters are anything but precisely or even relatively predictable in regard to timing. But they show patterns, or at least rhymes (borrowing from Mark Twain).

Today we’ll continue reviewing Peter Turchin’s new book End Times, which describes his theory of “cliodynamics” and how elite overproduction tends to precede societal crises. As with Neil Howe and George Friedman, I can only give you a few highlights. You really should read the book. You will learn much.

Navigating the financial landscape with John Mauldin:

In a world of economic uncertainty, the strength of your financial strategy holds the key to your future stability. Whether we're facing a recession, a potential soft landing, or even the specter of a market crash, the decisions you make today will shape your financial destiny. Click here for more details. |

Let me start with a clarification. Last week I described Dr. Turchin as an emeritus professor at the University of Connecticut. That was correct but the “emeritus” part may imply he has retired. In fact, he now works at the Complexity Science Hub Vienna (Austria), where he leads a research group probing social complexity and collapse. The work looks fascinating; modern computing enables a kind of historical analysis that was once reserved for the natural sciences. I’ll be following it with great interest.

In last week’s letter I said Turchin had identified a cycle that tends to repeat every 50 years or so. It’s actually more complex than that. The book describes it in detail; here’s a short version from an email exchange we had, reiterating my thoughts above:

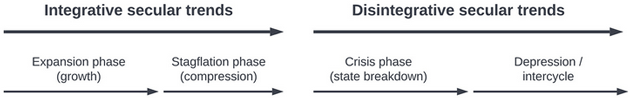

“These are not precise mathematical cycles, with fixed periods and complete predictability. The additional complexity arises in that there are two dynamic processes, each with its own characteristic periodicity (again, not fixed, but rather stochastic). There is a roughly 50-year (40–60 years) cycle arising from generational cycles, which I have referred to as the ‘fathers and sons’ cycle. And then there is the ‘secular’ cycle, characterized by a roughly century-long integrative phase and a century-long disintegrative phase. The overall period of secular cycles is typically around 150–300 years, but this periodicity varies a lot depending on the characteristics of societies.”

Peter has identified two recurring sequences. The generational cycle is somewhat more regular because it is connected to the human lifespan. The broader secular cycle can vary more widely but still follows a recognizable order. This graphic from one of his earlier books helps clarify it.

Source: Secular Cycles by Peter Turchin and Sergey Nefedov

If that seems a little familiar, look back at the George Friedman graphic I shared two weeks ago. His version also shows overlapping cycles (which he calls Institutional and Socioeconomic).

They arrived at these structures for entirely different reasons, but I think the similarity is notable. When two different methodologies (and three counting Neil Howe, plus two others we will review in future letters) point to a crisis period in our near future, we should probably pay attention.

Peter Turchin’s data shows these cycles have occurred in many different societies over multiple millennia, and they rarely end well. They tend to be especially bad for the members of each period’s elite class, who usually lose their wealth and power. Often, they lose their lives as the society they once ruled is conquered or disintegrates.

However, while peaceful outcomes are rare, they do happen. Turchin describes two examples in End Times. I want us to look at them more closely because they may help us navigate the years ahead.

Both examples stem from what Turchin calls the “Age of Revolutions,” roughly 1830‒1870, when nearly all the large powers experienced revolutions and/or civil wars. The two notable exceptions were the British and Russian Empires. Both faced similar pressures but handled them quite differently from others.

Turchin describes the British example first. The country entered the period with the masses enduring overcrowded, impoverished conditions which (importantly) the elites had no interest in improving.

“In 1819, a massive popular protest demanding full male suffrage and improvement of working conditions in Manchester was brutally suppressed by the authorities. Fifteen people died and hundreds were injured when the crowd of 60,000 protesters was charged by the cavalry with sabers drawn. The Peterloo Massacre, as it became known, shocked the nation…

“Fierce debates broke out within elite factions about how to address the unrest. In 1831, this conflict led to the British Parliament being dissolved, resulting in elections just one year after the previous elections and a victory for the reformers, though the issues remained contentious…

“Turbulence lasted until 1867 when the franchise was extended to all male citizens. In between, several more riots and protests occurred while a series of labor laws and other reforms aimed at improving the living conditions of the urban working poor were passed.”

Turchin quotes scholars who generally agree this period was as close as Britain had been to revolution in centuries. Violence did occur, but not to the same extent as in other European countries. Why not?

One reason was the country’s overseas empire provided places some of the more unhappy groups could go. But more important, Turchin thinks, was elite willingness to adopt previously unthinkable reforms:

“In 1832, the franchise was extended to smaller landowners and some urban residents. The Reform Act of 1832 also shifted the balance of power away from the landed gentry in favor of the upwardly mobile commercial elites.

“In 1834 the country's Poor Laws were amended in an attempt to increase state support for infirm and out-of-work laborers… One of the most important measures that alleviated immiseration was the repeal of the Corn Laws that had imposed tariffs on the import of grains, benefiting large landowners but inflating the price of staple food products in domestic markets. Another important dynamic during this period was the struggle of workers to establish their right for trade unions.

“These different developments resulted in real wages regaining by 1850 the ground they had lost since 1750. After 1867, worker wages started growing at a [then] historically unprecedented rate, doubling in the next 50 years.”

Britain’s ruling elites didn’t do all this easily or quickly. Change took almost 50 years of dispute and negotiation. Nor was it inexpensive; these reforms involved creating enormous new spending programs. Nonetheless, Britain avoided revolution because its elites willingly met at least some of the “immiserated” majority’s demands.

Russia was in a different situation. Allied with the British, it had defeated Napoleon and become continental Europe’s strongest land power. But Russia also lagged in modernizing its economy as the Industrial Revolution unfolded. That might have been because at the time Russia still had serfdom (essentially a form of slavery) and a large peasant class in only slightly better conditions. From the Russian elite perspective, the “wealth pump” was working pretty well. No need for those newfangled factories.

With food supply and arable land dwindling, resistance grew among the peasantry. But it still took an external shock to convince the Russian elite that reform was inevitable (emphasis mine):

“The shock of the humiliating defeat in the Crimean War, which delegitimized the tsarist regime, coupled with fear that exploding peasant resistance might turn into a repeat of Pugachev's rebellion convinced the Russian ruling class that the serfs had to be emancipated.

“After reading de Tocqueville's book on the French Revolution, the emperor's brother, Grand Duke Konstantine, remarked, ‘If we do not carry out a peaceful and complete revolution with our own hands, it will inevitably happen without us and against us.’

“In his address to the Moscow nobility, Alexander II himself expressed the same sentiment, stating ‘We live in such an age that it will happen sooner or later. I think you are of the same mind as me: it would be better to begin to abolish the serfdom from above than to wait until it abolishes itself from below.’”

And that’s exactly what happened. Alexander II freed the serfs and enacted other reforms. These measures took time to work but eventually defused the tension and averted a revolution (or at least delayed it; the Romanov regime fell a few decades later).

Many nobles lost their ability to maintain their status, and their children soon resorted to education as an alternative means of income, usually in the government. But this soon created too many elites chasing too few positions leaving both upper and lower classes frustrated and 50 years later the first Russian Revolution, which was brutally suppressed, then the Bolshevik revolution.

Looking at both Britain and Russia, Turchin notes two common threads. Both societies had not just elites but competent elites who understood the need to adapt. And both were fortunate to have leaders who were willing to sacrifice their own short-term selfish interests for the greater long-term good.

Do we have those now? We’d better hope so.

The United States in the 2020s doesn’t have the kind of nobility that ruled Britain and Russia in the mid-19th century, but we do have ruling elites. They take a different form in a representative democracy; power lies partially in the political and bureaucratic classes but even more in those who can influence the politicians and bureaucrats. That typically means the wealthy, though there are certainly influential non-wealthy groups.

But like the nobility, our wealthy ruling class has multiple factions with sharply different goals and methods. We also have counter-elites (those currently on the outside looking in) who think they should have power and aren’t happy about it. Then we have much larger middle and lower classes, who move in and out of alignment with different elite factions. These aren’t simply partisan differences. They are far more dynamic and difficult to predict.

Could the kind of reforms that would soften the crisis get through this messy process? In today’s bitterly divisive environment, it’s hard to see how we get there before a crisis forces us to think and do what we now consider unthinkable and undoable.

Turchin’s solution is for the elites to change what he calls the wealth pump back to the benefit of the working class. That may be a partial answer. But a good part of the decrease in the wealth inequality of the late 1800s to 1929 was simply the destruction of wealth in the Great Depression.

Turchin offers his take on the solution near the end of the book:

“The American ruling class today finds itself in the predicament that has recurred thousands of times throughout human history. Many common Americans have withdrawn their support from the governing elites. They’ve flipped up ‘a throbbing middle finger in the face of America’s ruling class.’ Large swaths of degree holders, frustrated in their quest for elite positions, are breeding grounds for counter-elites, who dream of overthrowing the existing regime.

“Most wealth holders are unwilling to sacrifice any personal advantage for the sake of preserving the status quo. The technical term for it is ‘revolutionary situation.’ For the ruling class, there are two routes out of a revolutionary situation. One leads to their overthrow. The alternative is to adopt a series of reforms that will rebalance the social system, reversing the trends of popular immiseration and elite overproduction. The American ruling elites did it once, a century ago. Can they do it again? What does history suggest?

“…The optimistic take is that it is possible to shut down the wealth pump and rebalance social systems without resorting to a revolution or catastrophic war. Death may be the ‘great leveler,’ as Scheidel argues, but it is not the only one. Fear—or putting it a bit more charitably, intelligent foresight—can also work, and did work in the success stories.

“…Finally, just as in war, money is the most important fuel powering organizations. Naked enthusiasm is not enough for a sustained, long-term effort, although money plus enthusiasm is better than just money.

“…The plutocrats can afford (literally) to plan, and implement their plans, for the long term.

“…Cumulative cultural evolution equipped us with remarkable technologies, including social technologies—institutions—that enable our societies to deliver an unprecedentedly high—and broadly based—quality of life. Yes, this capacity is often not fully realized—there is great variation between different states in providing well-being for their citizens. But in the longer term, such variation is necessary for continuing cultural evolution. If societies don’t experiment in trying for better social arrangements, evolution will stop.

“Even more importantly, when selfish ruling classes run their societies into the ground, it is good to have alternatives—success stories. And it falls to us, ‘the 99 percent,’ to demand that our rulers act in ways that advance our common interests. Complex human societies need elites—rulers, administrators, thought leaders—to function well. We don’t want to get rid of them; the trick is to constrain them to act for the benefit of all.”

That’s easy to suggest, but difficult as hell to implement. To be clear, I don’t agree with every detail of Turchin’s approach. But I think something similar will be necessary to avert a devastating financial crisis that could be even more severe than the Great Depression.

As we will see in later letters, we have borrowed and spent ourselves into an economically untenable situation. Resolving the debt crisis will require wrenching changes. It will likely be better to do it in advance rather than in the heat of the moment, though history suggests that is extraordinarily difficult. Not impossible, merely difficult. There will be no good choices.

Let’s think back to Neil Howe. In Turning Time, Part 2 I described how he thinks (optimistically?) the Boomer Generation’s last act will be to clean up the mess it had a large part in creating. Here’s that quote again.

“With the Crisis itself placing new burdens on the lives of younger generations, Boomers will choose to retain their moral authority by arguing—uncharacteristically—to impose sacrifices on themselves and other older Americans for the sake of their community. This will seem less surprising in the context of their own families; most Boomers today are already providing generously, sometimes more generously than they can afford, for their own children and grandchildren. But it will seem more surprising when they do so in the context of the national community and support tax and benefit changes that hit their own ranks the hardest. But the logic will be inexorable. The young, acting on behalf of the community at a time of peril, will now have a much better claim on resources than they do. So Boomers will let go.

“Everything will be on the table. A persuasive case will be made for taxing consumption and assets along with meaningful inheritance taxes, since these draw the most revenue out of affluent elderly age brackets… Stricter tax compliance measures will flush assets out of the tax havens of Boomer plutocrats. Rationing of high-end luxury services and goods may be instituted to save resources, if such opulence has not already been driven into the shadows by social stigma.”

This sounds quite similar to what happened in Britain and Russia almost 200 years ago: elites recognizing that reform is coming and seeking to put their own imprint on it.

Remember Turchin’s quote of Grand Duke Konstantine: “If we do not carry out a peaceful and complete revolution with our own hands, it will inevitably happen without us and against us.” I suspect the Grand Duke would have preferred to avoid a revolution but seeing change was inevitable, he decided to make the best of it. So as unlikely as it may seem, Turchin shows us precedents.

I don’t think today’s elites have reached that point yet. The various factions still think they can arrange events to reach their preferred outcome. They see no need to compromise or sacrifice anything.

Changing those attitudes may require a crisis. But it would be nice to avoid one.

Shane and I are off on Sunday to London and then to Paris on Thursday. Charles Gave’s 80th birthday party is on Saturday the 9th. I will be in town with lots of friends. I really look forward to spending some time with Louis Gave, who should be no stranger to long-time readers as I quote him often.

My partner Ed D’Agostino did one of his best podcast interviews with Louis this week, partly on why most media (like the WSJ) get China wrong. You can read the transcript, watch the video, or listen to the audio podcast. It is a wide-ranging and eye-opening interview I highly recommend.

Shane has never been to London or Paris, and I am really looking forward to her first introduction for a short dive and maybe next summer spending a longer period in her favorite places. Next year I will be turning 75 and she will be turning 50, so I think a longer vacation is probably in order.

Finally, as I don't want to be writing during our trip, I am finishing up next week's letter which will be an in-depth analysis of my own investment portfolio: the good, the bad, and the really ugly. I have never done this, because I think most people should probably do as I say, not as I do. Ironically, I would never recommend a money manager who puts clients in a portfolio that looks like mine. But we'll get into that next week.

And with that, I will hit the send button. Have a great week and do at least one thing outside of your normal routine. All the best, and don't forget to follow me on X!

Your really not happy contemplating a crisis analyst,