| Week ending June 23, 2017 |

| Oil continues to drag on the MPI as uncertainty in markets lingers |

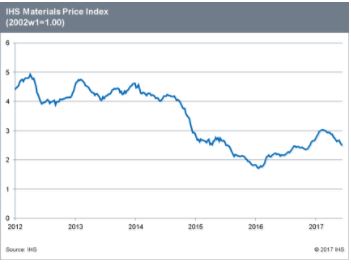

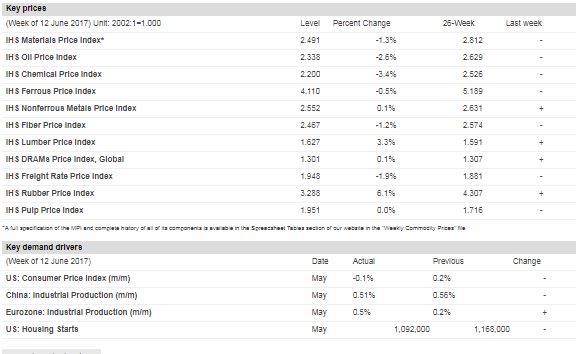

The IHS Materials Price Index (MPI) dropped again last week, falling another 1.3%. It is now down 18% from its year high in February. As opposed to the broadly based retreats of the previous two weeks, only half of the index's subcomponents declined. Oil continues to be a source of weakness, declining 2.6% last week, with the softness passed through to chemicals and shipping rates, which fell by 3.6% and 1.9%, respectively.

Crude inventories did fall by 1.7 million barrels last week in the United States; however, a surprising increase in gasoline stocks reinforced concerns about an oversupplied US market, leading to a tumble in crude prices. The persistent softness in oil prices is forcing many producers to re-calibrate costs as hopes for a dramatic rebound diminish, on more indication that prices may be lower for a longer period than previously thought.

Mixed economic reports last week did little to provide clarity regarding global growth prospects. In the United States, industrial production was flat in May, slightly weaker than anticipated. Meanwhile, Eurozone industrial production moved in line with expectations, increasing by 0.5% month on month (m/m). Chinese industrial production also increased by roughly 0.5%, narrowly beating expectations. Consumer inflation in the United States remains soft; it fell 0.1% m/m in May for a variety of reasons, including lower medical care inflation, falling gasoline prices, and the drawn-out effects of a price war between wireless telephone carriers. The Federal Reserve remained undeterred despite the weak inflation report and lifted the federal funds rate by 25 basis points as expected. Prospects for global growth remain bright, although data last week did little to lower the uncertainty prevailing in global markets.

|

| | IHS Materials Price Index |  |

|

| |

| Market Insight

For an overview of the IHS Materials Price Index, view this video.

Get the Materials Price Index delivered to your in-box weekly.

Subscribe here.

|

|  |

| | |

|

| Industrial Materials: Prices |  |

| Key Prices & Demand Drivers |  |

Construction Costs Increase at Slower Pace in May, IHS Markit Says

|

The headline IHS Markit PEG Engineering and Construction Cost Index registered 54.0 in May, down from 57.0 in April. |

Both the materials/equipment and labor categories showed increases, though compared to April, the cost increases were not as broad. The materials/equipment price index came in at 55.2, almost five points lower than in April, which was one of the highest figures recorded in the survey’s history. “Steel prices peaked in April and are now beginning to weaken. Price drops will continue through at least the third quarter, more likely until the end of the year,” said John Anton, senior principal economist at IHS Markit. “Upside risk comes from the ‘Buy American’ proposal for pipelines, which is causing concern among energy buyers and plate consumers. If the proposal is enacted in its strongest form, there could be shortages in supply and allocation.”

| | Learn More |

|

| About IHS Pricing & Purchasing | | The IHS Pricing & Purchasing Service | The IHS Pricing & Purchasing Service enables supply chain cost savings by providing timely, accurate price forecasts and cost analysis. Armed with a better understanding of suppliers' cost structures and market dynamics, organizations can effectively negotiate prices, strategically time buys, and boost the bottom line.

With a database of more than 80,000 historic prices and thousands of price, wage and input cost forecasts, IHS offers more coverage than any other provider in the market. IHS has been providing forecasts of key commodity, labor, and input costs since 1970 -- helping define the purchasing advice industry. | | Learn More |

|

| Commodity Price Forecasts & Supply Chain Cost Benchmarking. Learn More | | |

|

|

|