| Week ending June 16, 2017 |

| Oil price falls continue to drive the MPI down |

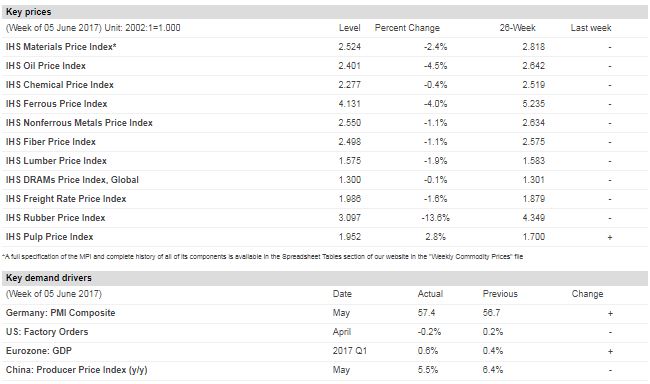

The IHS Materials Price Index (MPI) lost another 2.4% last week, taking its cumulative fall over the last four months to 17%. For a second consecutive week the MPI's retreat was broad-based, with 9 of 10 subindexes declining. Oil and rubber prices once again led the retreat, down 4.5% and 13.6%, respectively. Only pulp prices rose, moving up 2.8%.

Natural rubber prices have dropped by 25% over the last two weeks, reaching a low point for 2017. An end to seasonal rains and the release of stockpiled inventory have improved the supply picture, while concern over Chinese car sales has undercut the demand outlook. The combination has sent prices tumbling. Alongside oil and rubber, ferrous prices were also down sharply, with our subindex slipping 4.0% as iron ore prices continue to slide on Chinese steel production fears.

More generally, growing worries about oversupply continue to swirl around commodity markets. Last week's macroeconomic announcements do indicate global industrial activity is holding up well, although the mood is no longer as bright as it was a few months ago. Markets in the United States and Europe are seeing moderate growth; however, it is Asia, and especially China, where markets are focused. For China there is the growing realization that the second half of the year may not match the first six months of 2017. There is also the feeling that US stimulus in the form of tax cuts and infrastructure funding may be delayed. The net result is that some of the optimism priced into commodities late last year is now coming back out of markets.

|

| | IHS Materials Price Index |  |

|

| |

| Market Insight

For an overview of the IHS Materials Price Index, view this video.

Get the Materials Price Index delivered to your in-box weekly.

Subscribe here.

|

|  |

| | |

|

| Industrial Materials: Prices |  |

| Key Prices & Demand Drivers |  |

Construction Costs Increase at Slower Pace in May, IHS Markit Says

|

The headline IHS Markit PEG Engineering and Construction Cost Index registered 54.0 in May, down from 57.0 in April. |

Both the materials/equipment and labor categories showed increases, though compared to April, the cost increases were not as broad. The materials/equipment price index came in at 55.2, almost five points lower than in April, which was one of the highest figures recorded in the survey’s history. “Steel prices peaked in April and are now beginning to weaken. Price drops will continue through at least the third quarter, more likely until the end of the year,” said John Anton, senior principal economist at IHS Markit. “Upside risk comes from the ‘Buy American’ proposal for pipelines, which is causing concern among energy buyers and plate consumers. If the proposal is enacted in its strongest form, there could be shortages in supply and allocation.”

| | Learn More |

|

| About IHS Pricing & Purchasing | | The IHS Pricing & Purchasing Service | The IHS Pricing & Purchasing Service enables supply chain cost savings by providing timely, accurate price forecasts and cost analysis. Armed with a better understanding of suppliers' cost structures and market dynamics, organizations can effectively negotiate prices, strategically time buys, and boost the bottom line.

With a database of more than 80,000 historic prices and thousands of price, wage and input cost forecasts, IHS offers more coverage than any other provider in the market. IHS has been providing forecasts of key commodity, labor, and input costs since 1970 -- helping define the purchasing advice industry. | | Learn More |

|

| Commodity Price Forecasts & Supply Chain Cost Benchmarking. Learn More | | |

|

|

|