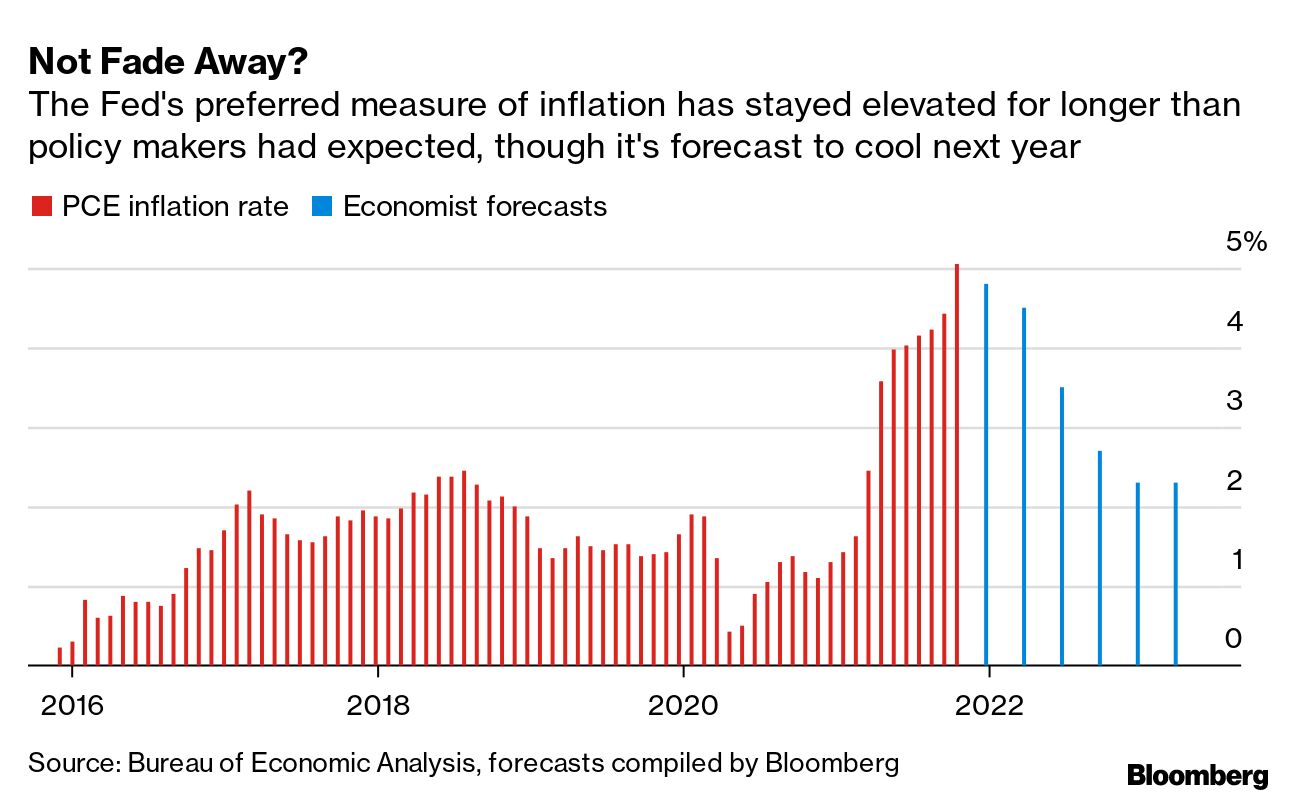

| In some of the first data to come back on the omicron variant of the coronavirus, researchers in South Africa, where it was first identified, say the mutation is spreading faster than the delta strain. There also seems to be a greater risk of reinfection—where previously infected people get the virus again. Three times higher, in fact. But scientists also said hospitalizations in South Africa remain muted, a sign that may be attributable in part to vaccinations. Shabir Madhi, a vaccinologist at the University of the Witwatersrand, said he’s “optimistic that in this resurgence, while the total number of cases will probably be greater, hospitalizations and deaths will be lower.” —David E. Rovella Bloomberg is tracking the coronavirus pandemic and the progress of global vaccination efforts. While omicron is being detected in more countries every day, the existing global surge tied to delta is accelerating. In the U.K., coronavirus cases have jumped, while in Oslo an outbreak is sending everyone back to the home office. In the U.S., President Joe Biden called on health providers to expand the availability of vaccines and boosters. There were 135,000 new confirmed cases in the U.S. alone just yesterday—more than any other country—and more than 1,500 deaths. Here’s the latest on the pandemic. More Fed officials made the case for speeding up removal of economic supports for the U.S. economy amid higher inflation, backing the message delivered by Chair Jerome Powell. There’s a reason for the urgency. Wall Street is getting ahead of the science and hoping to make some money in the process. The recent market turmoil caused by the emergence of the omicron strain may offer investors a chance to buy the dip. The theory is that early reports suggesting the variant is less deadly will be borne out. Here’s your markets wrap. Drought has gripped every inch of California for 30 straight weeks, or more than half a year, according to the U.S. Drought Monitor. Even worse, across 11 western states, some 94% of the land is in drought conditions. Over at the C-suite in Goldman Sachs, the executives don’t think they’re getting paid enough. For decades, a top spot at the Wall Street powerhouse famously described as a fearsome cephalopod was seen as the pinnacle of money and power. But in today’s era of hyper-wealth creation, the bank’s most senior leaders, led by Chief Executive Officer David Solomon, have come to believe they’re losing out. So they’re looking for ways to juice their own eight-digit pay packages.  David Solomon Photographer: Simon Dawson/Bloomberg The U.S. government is getting closer to booting Chinese companies off American stock exchanges for not complying with Washington’s disclosure requirements. She’s best known as the “Queen of shell companies,” a financier who briefly became Hong Kong’s richest woman by striking deals in some of the wildest corners of the city’s stock market. Now Pollyanna Chu has a new role: investment banker for embattled China Evergrande Group billionaire Hui Ka Yan.  Pollyanna Chu  |

Not the Broadway show, mind you, but the real deal. It’s been two decades since Enron filed for bankruptcy in what until WorldCom collapsed seven months later was an unprecedented financial implosion. The energy-trading giant’s downfall, triggered by revelations of shady accounting practices, still reverberates throughout the business and political world today. The deceptive practices of its executives, some of whom served jailtime, helped spur the passage of federal laws and regulations designed to improve the accuracy of financial reporting. The word Enron itself is shorthand for disaster. So where are all the big players now?  Ken Lay, founder of Enron Corp., arrives at FBI headquarters in Houston, Texas July 8, 2004. Photographer: Craig Hartley Sustainable Business Summit—Focus on Finance: Bloomberg brings together global business leaders and investors to discuss driving innovation and scaling best practices in sustainable business and finance. Join us Dec. 8-9 and hear from executives at Carlyle, Honeywell, Ørsted and more as they provide insight into maximizing performance, social impact and profit. Learn more here. |