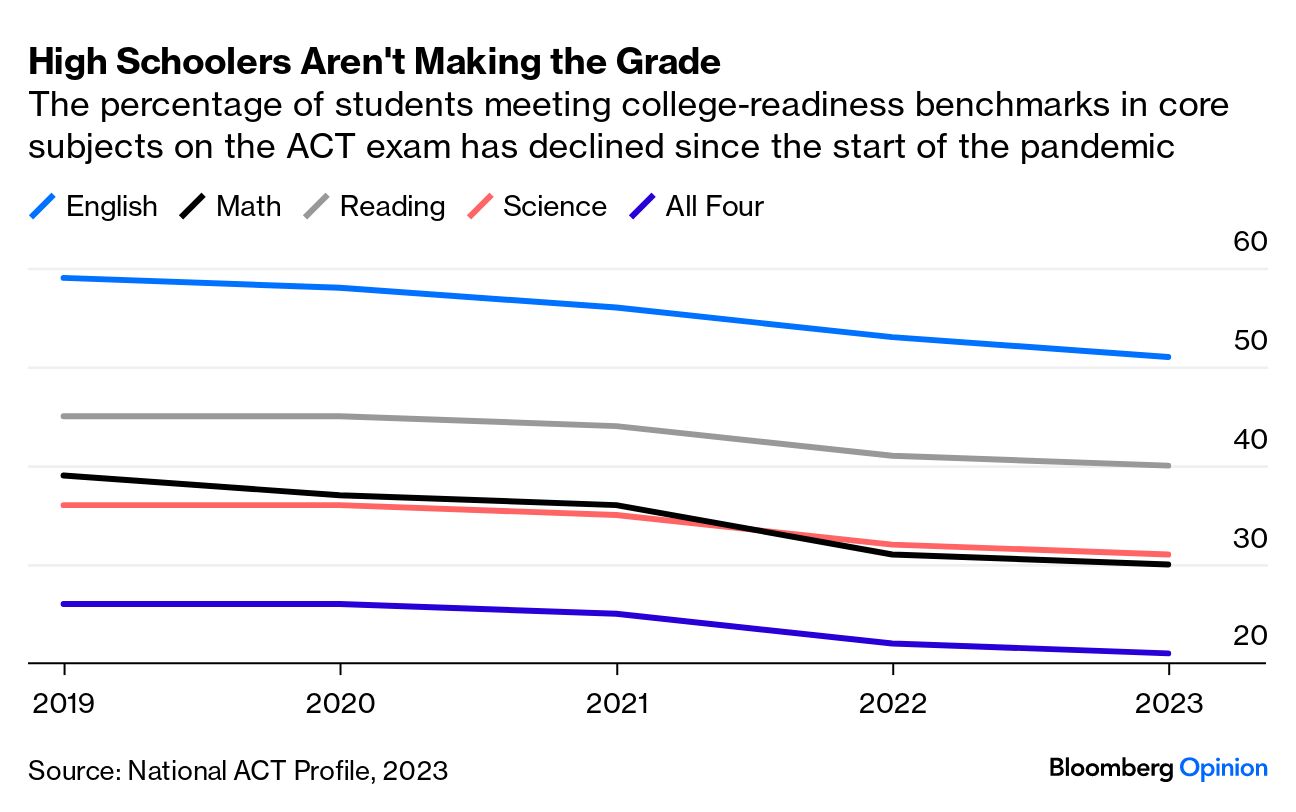

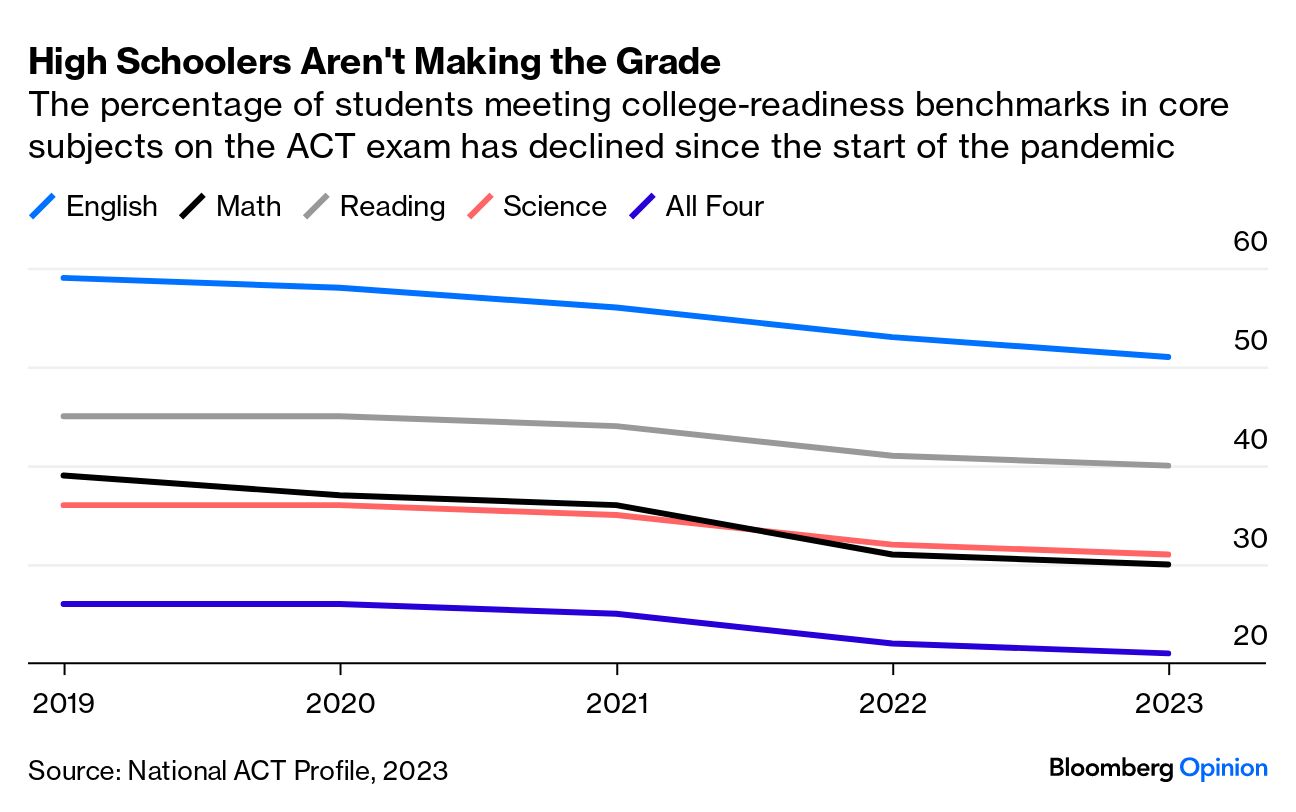

| US consumer spending, inflation and the labor market have all cooled in recent weeks, adding to evidence that the economy is slowing—seemingly matching the Federal Reserve’s preferred glide path toward a soft landing. Inflation-adjusted personal spending rose only 0.2% last month after a downwardly revised 0.3% advance in September. Separate data Thursday showed recurring applications for unemployment benefits rose to their highest level in about two years. The question now is when to pull up—and whether the central bank does it too early or too late. “The Fed is on hold for now but their pivot to rate cuts is getting closer,” Bill Adams, chief economist at Comerica Bank, said in a note. “Inflation is clearly slowing, and the job market is softening faster than expected.” —David E. Rovella Multimanager funds like Ken Griffin’s Citadel dominate the hedge fund industry and have grown to oversee more than $1 trillion, which includes a healthy dose of leverage. But the explosive rise has led these industry giants to pile into many of the same trades. That’s built unease among regulators, investors and traders. While Griffin has vocally opposed any notion that his firm and its rivals pose systemic risks or (god forbid) need more regulation, even he acknowledges that crowded trades could lead to widespread losses if everyone bails at once.  Bloomberg New Economy’s Erik Schatzker, left, interviews Ken Griffin, chief executive of Citadel Advisors, right, during the Bloomberg New Economy Forum in Singapore on Nov. 9. Photographer: Bloomberg A bond exchange-traded fund crossed $100 billion for the first time. A $14 million inflow on Wednesday managed to finally push assets in the Vanguard Total Bond Market ETF to 12 figures, a milestone that marries two of the year’s biggest trends: The highest yields in a long time have made fixed-income more appealing while relatively low-cost, tax-efficient ETFs have consistently stolen market share from their pricier mutual fund brethren. Money has poured into bond ETFs of all stripes amid a resilient labor market and a year of robust economic growth. Toronto-Dominion Bank missed earnings estimates and announced a restructuring charge tied to the elimination of 3% of its employees through firings and attrition. The bank, Canada’s second largest, said Thursday that it took C$266 million ($195 million) in after-tax restructuring charges in the fiscal fourth quarter related to staff cuts as well as reworking its real estate footprint. A plan to draft more Ukrainian men into the army has been sitting on President Volodymyr Zelenskiy’s desk since June. But so far he’s defied pressure from the military to sign it. Instead, last week he asked for a package better tailored to a nation preparing to endure yet another winter of fighting Russia. But the government again put off plans to lower the draft age during war for men with no military experience to 25 from 27. “The law should have taken effect—the parliament fully backed it,” Roman Kostenko, a lawmaker on the parliamentary defense committee, said. “Conscription is taking place with difficulty now.”  Volodymyr Zelenskiy, center, at a frontline command post in Kupyansk, Ukraine, on Nov. 30. Source: Ukrainian Presidency US Secretary of State Antony Blinken warned Israel that it must not repeat the scale of destruction and displacement inflicted on the northern Gaza Strip as it prepares to attack farther south. “I underscored the imperative for the US that the massive loss of civilian life and displacement on the scale that we saw in northern Gaza not be repeated,” Blinken said in Tel Aviv on Thursday. Gaza health authorities report Israel has killed at least 15,000 Palestinians, more than 1 out of every 200 residents of Gaza, in the weeks since Hamas killed 1,200 Israelis in a surprise Oct. 7 attack. According to the United Nations, at least 1.8 million Palestinians have been displaced. OPEC+ agreed to deepen its production cuts following a slump in crude prices and predictions of a renewed surplus next year. Members of the group agreed to make 1 million barrels a day of additional oil-supply cuts at a meeting on Thursday. That reduction comes alongside the much-anticipated extension into next year of Saudi Arabia’s voluntary output curb of the same size. And in a surprise move, Brazil will join the cooperation charter of the OPEC+ oil alliance. The charter, open to all oil producing countries, doesn’t bind signatories or limit their sovereign rights. America’s high schools face a growing crisis: Millions of students who entered ninth grade in the fall of 2020, at the height of the Covid-19 pandemic, are set to graduate this spring with little hope of recovering from the learning loss incurred while schools were shut. Simply put, Bloomberg’s Editorial Board writes, they’re running out of time. These students may leave school unprepared for either college or the workforce—greatly increasing their risks of unemployment, poverty, depression and even early death.  Dinner with Barack Obama, mansions on both coasts and dazzling modern art collections. All solid bragging points when you’re sitting at finance’s top table. Yet for the three core founders of HPS Investment Partners, how they spend their fortune is much less striking than how they made it. In 2016, the private credit firm bought itself out of JPMorgan in a complicated deal valuing it at close to $1 billion. Now the shop could be worth roughly eight times as much. Perhaps more than anyone else, the usually secretive HPS has come to personify the remarkable rise of private credit as a usurper of traditional Wall Street lending. And the founding trio has the billions of dollars to prove it.  HPS founders Scott Kapnick, Scot French and Michael Patterson Photographer: Sarah Blesener/Bloomberg Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive Bloomberg’s flagship briefing in your mailbox daily—along with our Weekend Reading edition on Saturdays. New From Bloomberg: Get CityLab Design Edition, our weekly newsletter on architecture, design and development. Bloomberg Green at COP28: World leaders will gather in Dubai on Dec. 4-5 in an effort to accelerate global climate action. Against the backdrop of the United Nations Climate Change Conference, Bloomberg will convene corporate leaders, government officials and industry specialists from NGOs, IGOs, business and academia for events and conversations focused on creating solutions to support the goals set forth at COP28. Register here. |