Only a Handful of Companies Thrive for 70 Years

The companies dominating the market today aren't going to be the same ones dominating a few decades from now.

This sounds like an obvious statement. Every single year, innovative technology gives life to new companies that will go on to shape our future. These innovations will push even the best businesses of today into irrelevance.

What's shocking to me (Jeff Havenstein) is how few companies are able to maintain their market position.

Since 1955, Fortune magazine has published a list of the top 500 companies ranked by sales. Today, you'll see names like Walmart (WMT), Amazon (AMZN), and Apple (AAPL) toward the top.

But none of these three leaders were on the Fortune 500 list back in 1955. They weren't even founded yet... Walmart in 1962, Apple in 1976, and most recently, Amazon in 1994.

| Recommended Link: |

Crisis Alert: SIX Recession Signals Now Flashing RED Stocks are clinging to near-record valuations. But with political chaos... trade wars... tariffs... and record debt, it's clear: A reckoning may be coming. (In fact, six rock-solid recession indicators are now ALL flashing red.) That's why, for the first time in nearly a year, we're sharing our firm's No. 1 strategy for times of financial turmoil. It's a way to see income AND capital gains potential... all virtually guaranteed by LAW. For the next few days, we're sharing the full strategy at no cost. Full details here. |  |

|---|

|

To be on the Fortune 500 list for 70 years straight is special. In fact, only 49 companies have achieved the feat... Lockheed Martin (LMT), Chevron (CVX), Coca-Cola (KO), and Bristol-Myers Squibb (BMY) are some of the most recognizable names.

This means that the other 90% of companies on the 1955 list have either merged, gone bankrupt, or fallen out of the top 500.

It's hard to consistently grow sales year after year. A company has to adapt to new technologies and changing consumer preferences.

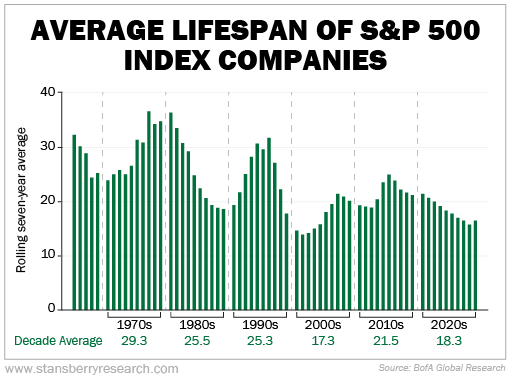

The chart below shows the average lifespan of companies in the S&P 500 Index. In the 1970s, the average lifespan was 29 years. In the 2020s, it's projected to be just over 18 years. This just highlights the amount of disruption and turnover among market leaders today.

Take a look...

So how do companies maintain their dominant positions?

Fortune says these leaders must be "champions of adaptability, nimbly responding to an ever-changing environment." The magazine also cites authors Jim Collins and Jerry Porras' bestseller Built to Last: Successful Habits of Visionary Companies, which claims the best companies will "preserve the core and stimulate progress."

If you want an example of this, look no further than Coca-Cola.

Everyone knows Coca-Cola for its sodas Coke and Sprite. Coca-Cola has kept these brands relevant for many decades. But it has also brought on new products to adapt to changing times.

As Doc Eifrig and I have written about many times before in our publications, Coca-Cola's real advantage when it releases a new product is its distribution.

For example, coming into the 1990s, the bottled-water craze was in full swing. Brands like Evian were poised to take down soda giants Coca-Cola and PepsiCo.

Rather than fold, Coca-Cola launched its own water brand in 1999 – Dasani. It quickly became a multibillion-dollar brand.

And when competitor National Beverage (FIZZ) suddenly saw the public going wild for its LaCroix sparkling water in the 2010s, Coca-Cola added new flavors to its Dasani line.

Also consider that when energy drinks got hot, Coca-Cola partnered with Monster Beverage (MNST).

Plus, when coconut water became the next big thing, Coca-Cola's Zico brand captured significant shelf space – and market share. (Note: Coca-Cola has since sold Zico.)

The point is that Coca-Cola does have strong brands. But its true advantage is operational.

Because of its extensive global presence, any time Coca-Cola launches a new product, the company can quickly spread it across supermarket shelves, vending machines, and restaurant menus. This allows Coca-Cola to respond quickly to changing consumer preferences.

Of course, very few companies can achieve Coca-Cola's sustained success. There's a reason why only 49 companies have remained on the Fortune 500 for the past seven decades.

When we look for stocks to buy, we take a long-term approach. We're investors, not traders. Our ideal holding period is many years. So we always have to question whether a company we're looking at will still be a leader in its niche 10, 20, or even 30 years from now.

This requires a company to have some sort of moat – like Coca-Cola's global distribution or Lockheed Martin's manufacturing capabilities and relationship with the U.S. Department of Defense. And it also requires a company to invest heavily in research and development (R&D).

For example, the business we're buying this month in our health care-focused newsletter Prosperity Investor spends 9% of its sales on R&D. That's the most among its competitors. (Our issue publishes in just a few hours, if you want to check it out.)

If you're a long-term equity investor, you need to consider all these factors when you go to buy a stock. You're trying to find companies that will survive and thrive over the years, after all.

The worst-case scenario that you want to avoid is holding shares of a company that goes bankrupt – as many on the Fortune list did in the years following... and as many have done recently. If a company's balance sheet collapses, its share price will plummet, and any dividend it pays will end. You may walk away with nothing.

Shareholders have no guarantees... But bondholders have much more safety.

Their interest payments are legal obligations. So unlike stock investors, bondholders have a right to be paid by the company.

Even in the event of a bankruptcy liquidation, the proceeds go to the secured creditors and bondholders, while shareholders get squat.

U.S. corporate bankruptcies soared to a 14-year high in 2024, and there could be more turbulence ahead. My colleague Mike DiBiase is even calling for a recession this year.

In that case, bonds would be the perfect opportunity to profit while the stock market falls into chaos. If you can purchase corporate bonds at a discount – when they trade for less than face value – and hold them to maturity, you'll receive the full face value when the bond principal is paid off. That can make for incredible gains... regardless of what the broader economy is doing.

In short, investing in bonds can be much more straightforward than investing in equities. And with storm clouds looming on the horizon, now is the perfect time to look at "distressed debt" specifically. Get all the details here.

| Recommended Link: |

Is This Elon's True Agenda? Now that Elon Musk has positioned himself inside President Donald Trump's administration, every investor in America is trying to figure out what he might do next. One veteran tech investor claims he knows the playbook. He says Elon's not crazy or impulsive... You just need to know the full story (including why it could soon change life in America forever). Click here to see how this could impact you. |  |

|---|

|

What We're Reading...

Here's to our health, wealth, and a great retirement,

Jeff Havenstein

February 5, 2025

| Follow us on |  |  |

|