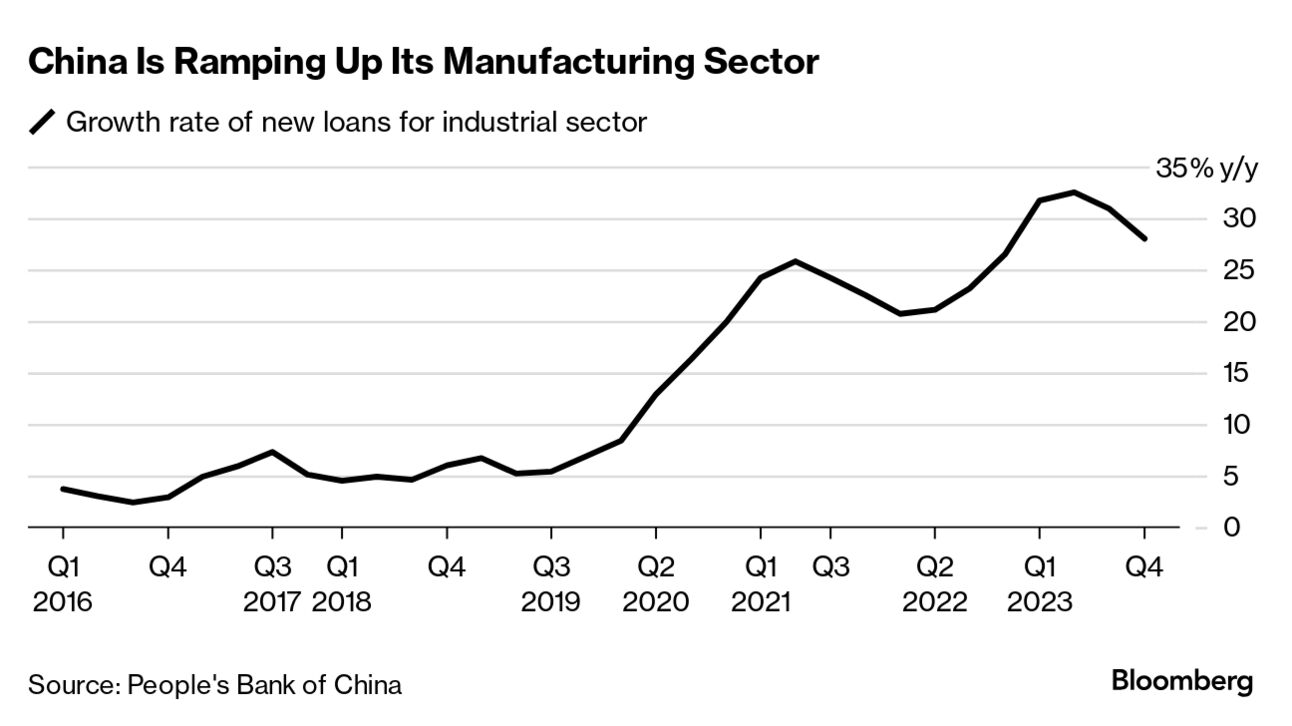

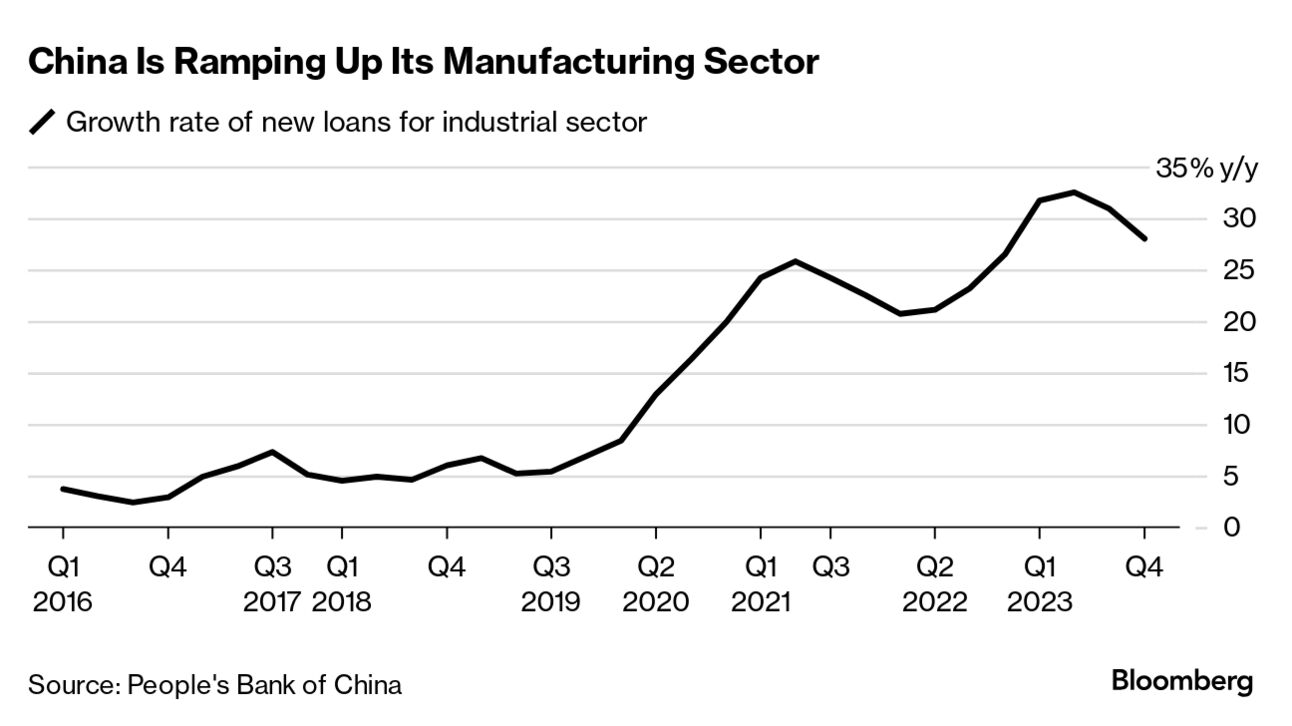

| With a number of market watchers warning of a bubble, traders are increasingly on the lookout for signs of the cliff’s edge. But if you ask JPMorgan’s chief global equity strategist, they may not see the edge until it’s too late. Dubravko Lakos-Bujas warned his bank’s clients on Wednesday they could be “stuck on the wrong side” when the five-month rally eventually falters, encouraging them to consider diversifying their holdings. He also reiterated his warning that excessive crowding in the market’s best-performing stocks raises the risk of an imminent correction. “It just might come one day out of the blue,” he said. “This has happened in the past, we’ve had flash crashes. One big fund starts de-levering some positions, a second fund hears that and tries to re-position, the third fund basically gets caught off guard, and the next thing you know, we start having a bigger and bigger momentum unwind.” —David E. Rovella Defying or perhaps affirming that warning, depending on your perspective, Wall Street traders sent stocks to another record Wednesday, part of a final stretch to a quarter that’s seen the market surge 10%. Even the troubled laggards of the megacap space, Apple and Tesla, climbed while artificial intelligence darling Nvidia fell. “The S&P 500 continues to defy all of the naysayers,” said Chris Zaccarelli at Independent Advisor Alliance. Chinese leader Xi Jinping met with a group of American business leaders in Beijing, including Blackstone’s Stephen Schwarzman and Qualcomm’s Cristiano Amon, as he seeks to restore confidence in China’s shaky economy. “China’s reform will not stop and its opening up will not stop,” Xi said. The country is planning “major measures to comprehensively deepen reforms” and build a “first-class business environment.” That may be, but US Treasury Secretary Janet Yellen slammed Xi’s use of subsidies to turbocharge domestic manufacturers in key new industries. “There is no country in the world that subsidizes its preferred, or priority, industries as heavily as China does,” Yellen said in an interview with MSNBC, highlighting “massive” aid to electric-car, battery and solar producers. “China’s desire is to really have global domination of these industries,” she said. Yellen, who is to visit China soon, declined to say whether the Biden administration was prepared to threaten Beijing with retaliatory trade actions if China doesn’t reduce its subsidies.  McKinsey warned some US consultants last week they are running out of time to win promotion, raising the “up or out” pressure on staff as the global consulting industry struggles. The memos were sent to some engagement managers and associate partners in North America, reminding them staff in this role have an average of two and a half years to be promoted. Pharmaceutical behemoth Novo Nordisk A/S charges almost $1,000 a month in the US for its blockbuster weight-loss medicine Ozempic (it charges much less elsewhere). The drug industry often defends such sky-high prices by saying they make possible the research and development that leads to breakthroughs. Critics like US Senator Bernie Sanders counter that these corporate giants are larding on the profits while collapsing Medicare. Now, a new study has revived questions about the cost of top-selling treatments for diabetes and obesity. It says that Novo can make a month’s supply of Ozempic for as little as 89 cents.  Photographer: Christian Schultz/Getty Images Three artificial intelligence companies that operate on blockchain are in talks to merge their crypto tokens, a move aimed at helping them develop a decentralized AI platform. SingularityNET, Fetch.ai and Ocean Protocol are said to be discussing merging their tokens into an ASI token that would have a fully diluted value of about $7.5 billion. Struggling electric vehicle-maker Fisker dramatically reduced the price of the Ocean sport utility vehicle—its only model—as the company fights to stay in business. The biggest cut the US company is making applies to the top-end version of the Ocean, called Extreme. Fisker will slash the price by $24,000—a 39% discount—to $37,499. Other versions of the vehicle also will be much cheaper, a move Fisker said was designed to position the Ocean as “a more affordable and compelling EV choice.”  The Fisker Ocean all-electric SUV Photographer: Mario Tama/Getty Images North America Canada’s population growth rate has been increasing at a sizzling pace for years, largely thanks to a steady flow of international students and workers but also the promise of its well-regarded social safety net. But a combination of crises are beginning to pull that net apart as the huge, sparsely populated country faces some difficult policy choices.  Tents for the unhoused at Clarence Square Parkette in Toronto. Photographer: Chloe Ellingson Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive Bloomberg’s flagship briefing in your mailbox daily—along with our Weekend Reading edition on Saturdays. Bloomberg Technology Summit: Led by Bloomberg Businessweek Editor Brad Stone and Bloomberg TV Host and Executive Producer Emily Chang, this full-day experience in downtown San Francisco on May 9 will bring together leading CEOs, tech visionaries and industry icons to focus on what's next in artificial intelligence, the chip wars, antitrust outcomes and life after the smartphone. Learn more. |