| John Mauldin | May 24, 2017 International Inflation Cycles Sync Up My friend Lakshman Achuthan, Co-Founder & Chief Operations Officer of the Economic Cycle Research Institute (ECRI), has done some really interesting work on international inflation cycles, and in today’s Outside the Box he shares it with us. This is a special treat – ECRI does not normally make its material available outside of its client base. I am truly grateful that he allows me to share this. Lakshman will be joining us at SIC this week in Orlando, to the great benefit of the attendees. It turns out that inflation volatility has been greatly dampened in the 11 OECD (advanced) economies in the 21st century, as compared to the late 20th century: It’s now only about a quarter of what it was then. Additionally, the domestic inflation cycles of these countries have increasingly come into sync. These two trends have made it possible for ECRI to devise a leading index of global inflation cycles that offers earlier and more accurate forecasts of cyclical turning points in international inflation. In concluding this short but groundbreaking piece, Lakshman adds, The synchronization of international inflation cycles highlights the importance of global factors in assessing domestic inflation prospects. Our analysis underscores the 21st-century reality that the timing of inflation cycles may be beyond the control of any individual central bank. Yet this very development makes it possible for ECRI to provide even earlier signals of peaks and troughs in the inflation cycle. Lakshman’s piece runs with an argument that my friend John Vogel wrote about this morning, highlighting another piece of research. I’ve been arguing for years that the world is basically in a long-term deflationary trend, despite all the monetary intervention and money printing. It’s a bit difficult to measure, but the cost of producing goods is dropping. Which means that the cost of living will continue to fall – at least as far as purchasing goods is concerned (as opposed to buying services like healthcare and education). As John writes (somewhat controversially): What I think is more interesting is the productivity created by CHEAP oil and natural gas. We don’t measure this, no fault of men like Prof. Gordon who think in straight lines. As the price of energy came down in the US, energy companies didn’t go out of business as some had forecast. They have pressed hard to find ways to find, drill and lift energy out of the ground in cost effective ways. While this effort may have hurt short term profits, it has also ensured the survival of service companies and E&P companies. Next, as the price for natural gas has come down and stayed down (with no sign of supply shortages), the industries that thrive on natural gas, such as chemicals, plastics, etc, have become more profitable. Third order: Lower feedstock may also lead to lower chemical prices that will feed into clothing, agriculture, etc, in the form of more competitive pricing of high quality stock to many industries. Organic chemistry applications are being reborn as reduced cost leads to more or better applications. This entire process means that we should be able to recreate entire industries that had gone to other countries, as wages no longer pose impediments to competitive pricing. In short, what we are seeing is the same ripple effect that lower cost semiconductors had on computer and electrical applications; now we are seeing it in industrial applications. However, it now has to be measured as a secondary or tertiary effect, rather than a direct application. Further, this helps explain why deflation is needed economically; it may be a salvation for employment…. If deflation can lead to a lower cost of living, we can recreate industrial jobs outside high cost of living cities. It is the opposite of the mega trends that others keep point to. The latest rage is co-living, where small living spaces with a bath replace an entire apartment. Gone are living rooms and kitchens. But even with this, rent in Chicago is $1000 per month and in NYC $1900 per month. In fact, the developers make more money this way than they do in conventional 1 and 2 bedroom apartments. Deflation will force relocation of jobs and therefore will force geographical redistribution. Because this is not being touted as a good solution, the transition will be rocky. But it must occur. It is the future of economic success for the entire country. The future is changing the world around us, but it’s a gradual transition that is not readily apparent on a day-to-day basis. If you pay attention to the long-term data, as Lakshman does, you can see that change is happening faster than we think.  I cooked yet another chili dinner, accompanied by my world-class prime (just because I could) for a group of investment advisors who flew into town to look at the latest programs we’ve developed. Last weekend you got your first peek, and I’ll have much more to share as we go along. I am really psyched about the Strategic Investment Conference this week in Orlando – we’re off to a great start! Not just all the cool information but all the many friends (and new friends) I’m sharing it with. Frankly, even with all the problems of the world, I see opportunities everywhere. A Muddle Through Economy may seem boring to some, but I think they are looking in the wrong places. I’m going to go ahead and hit the send button and dive right back into the whitewater here at SIC. You have a great week – and make sure you watch my Twitter feed for SIC updates. Your life is what happens to us when we dive right in and swim analyst,

John Mauldin, Editor

Outside the Box

JohnMauldin@2000wave.com

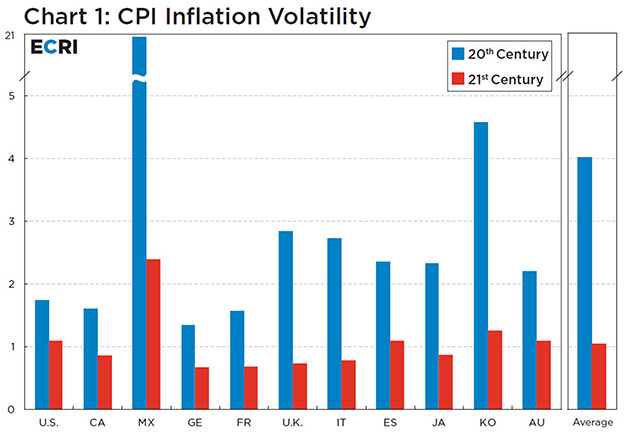

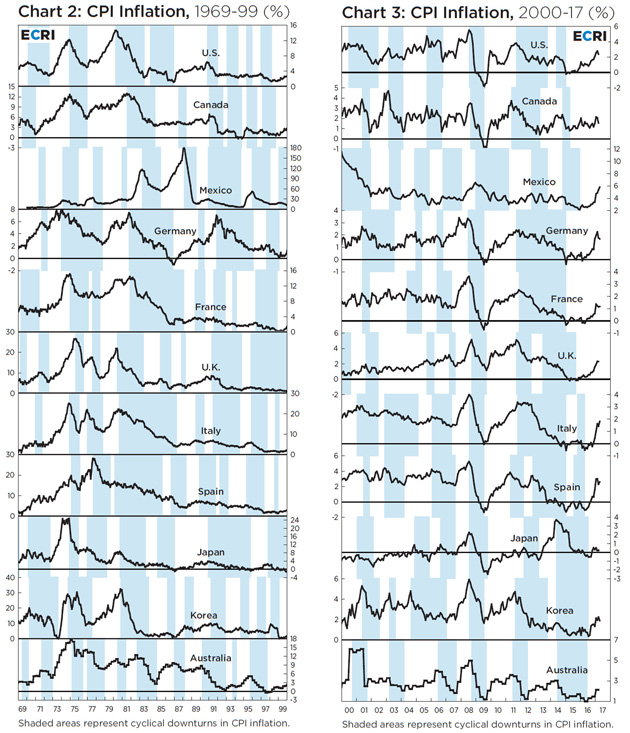

International Inflation Cycles Sync Up In the 21st century international inflation cycles have become more synchronized, enabling even earlier detection of cyclical turns in inflation. Taming Inflation The behavior of international inflation cycles has changed substantially in the 21st century in terms of the coordination of cyclical timing as well as amplitude. These shifts have made it feasible to devise a long leading index of those inflation cycles that works sequentially with ECRI’s 11 existing international future inflation gauges (FIGs), offering the earliest forecast of cyclical turning points in international inflation. To understand how dramatically the international inflation landscape has changed, we first showcase inflation volatility in the 11 OECD, i.e. rich-country economies, whose inflation cycles are regularly monitored by ECRI (Chart 1). For these economies, we present the five-year moving standard deviation of year-over-year (yoy) CPI growth – a proxy for its volatility – comparing the 20th-century (1969-99) and the 21st-century (2000-17) patterns.  Without exception, it is clear that inflation volatility in all 11 economies has decreased considerably in the 21st century (red bars) from the 20th century (blue bars), with Mexico seeing the greatest drop from the hyperinflationary highs of the 1980s, followed by Korea and the U.K. Across all countries, CPI inflation volatility in the 21st century is, on average, only about a quarter of what it was in the 20th century (rightmost set of bars). A number of factors are responsible for this plunge in volatility, including the waning power of OPEC – in part resulting in smaller oil shocks – alongside high oil prices incentivizing greater supply, as well as concerted efforts by major central banks to target and curb inflation. Also playing an important role were the disinflationary and deflationary effects of globalization, as China, India and ex-Soviet economies were integrated into the global economy, starting in the late 20th century. As globalization advanced, economies turned much more trade-dependent by the early years of the 21st century (ICO Focus, October 2016), with significant consequences for international inflation cycles, as we shall now detail. Inflation Cycles Increasingly in Sync More than a decade ago, we showed that cycles in industrial growth for major economies tend to be more or less synchronized (ICO, October 2006). A key reason for such synchronization has been the growing global interdependence among countries through expanding trade and financial linkages. It therefore makes sense to monitor global industrial growth cycles, and to do so we have employed a set of sequential leading indexes. We now examine whether there is also a distinct international inflation cycle marked by broadbased cyclical upturns and downturns in inflation rates across different economies. That is, do economies exhibit similar cyclical patterns in inflation, or do they move independently? If a single international inflation cycle can be identified, monitoring a country’s inflation outlook would entail monitoring both this international inflation cycle and country-specific swings in inflationary pressures. Aligning the yoy CPI growth rates of the 11 economies for which ECRI has developed country-specific FIGs over the two different timespans shown in Charts 2 and 3 offers some visual clues. White areas and blue bars represent cyclical upturns and downturns, respectively, in each country’s CPI growth. The reason for splitting the overall timespan into two periods, namely, 1969-99 and 2000-17, is that the drop in volatility is so sharp that cycles in the 21st century become largely imperceptible when plotted on the scales appropriate for the earlier period.  Comparing the two charts, it is apparent that there is greater alignment of cyclical upturns and downturns in the 21st century than in the 20th century. For instance, in the 30-year period from 1969 to 1999, the 11 economies experienced roughly concurrent inflation cycle downturns only three times, starting in the mid-1970s, early 1980s, and early 1990s (Chart 2). Since 2000, however, these economies have already had four fairly concerted inflation cycle downturns in 17 years – starting around the early 2000s, the mid-2000s, 2008 and 2011 – and are currently all in cyclical upturns (Chart 3). To objectively measure the degree of synchronization of cyclical upturns and downturns among the 11 economies, we calculated the concordance of cyclical swings, i.e., the proportion of months during which those economies were in simultaneous inflation cycle upturns or downturns. According to this measure, the proportion of time that all 11 economies spent in synchronized upturns or downturns has more than tripled in the 21st century, while the proportion of time that over 80% of the economies were in the same phase of the inflation cycle rose more than 1½ times (not shown). Predicting International Inflation Cycles With 21st century inflation cycles across major economies becoming fairly synchronized, it makes sense to define and forecast the resultant international inflation cycle. The international inflation cycle consists of cyclical upswings and downswings in the yoy growth rate of the 11-Country CPI (11CPI), a weighted average of the 11 individual countries’ CPIs (Chart 4, bottom line). Meanwhile, ECRI’s 11-Country Future Inflation Gauge (11FIG, middle line) is constructed in an analogous weighted manner, combining the 11 corresponding future inflation gauges. The 11FIG is a summary measure of underlying inflation pressures across these economies, and leads cyclical turning points in 11CPI growth by a little over one quarter, on average.  Adding to this toolkit, we introduce the International Long Leading Future Inflation Gauge (ILLFIG, top line), designed to be a long leading indicator of the international inflation cycle. The ILLFIG leads the 11FIG by almost one quarter, on average, at cycle turning points, therefore leading the international inflation cycle by a little over half a year, on average. Together, the ILLFIG and the 11FIG serve as a sequential leading indicator system for international inflation cycles, increasing the forecast horizon and enhancing the clarity of the international inflation outlook. As the chart shows, in the most recent cycle, the ILLFIG and 11FIG turned up in early 2015, signaling with conviction an upcoming cyclical upswing in international inflation pressures. Indeed, 11CPI growth started to turn up, as well, in the fall of 2015. In their latest readings, both indexes remain elevated, though slightly off their recent highs. With the yo-yo years unfolding as the major developed economies experience long-term declines in secular trend growth (ICO, March 2012), lowflation, and even occasional deflation, has become the norm. Meanwhile, with CPI inflation volatility having dropped markedly, especially in the 21st century, international inflation cycles have become more subdued. The synchronization of international inflation cycles highlights the importance of global factors in assessing domestic inflation prospects. Our analysis underscores the 21st-century reality that the timing of inflation cycles may be beyond the control of any individual central bank. Yet this very development makes it possible for ECRI to provide even earlier signals of peaks and troughs in the inflation cycle. Currently, both the ILLFIG and the 11FIG remain in cyclical upturns, and close to multiyear highs. However, they both dipped in their latest readings. As such – and especially in the context of the global industrial growth downturn that is now at hand (ICO Essentials, April 2017) – they bear watching for early signs of a potential reversal in the global reflation cycle that we flagged last summer (ICO Essentials, August 2016).

| Get Varying Expert Opinions in One Publication with John Mauldin’s Outside the Box

Every week, celebrated economic commentator John Mauldin highlights a well-researched, controversial essay from a fellow economic expert. Whether you find them inspiring, upsetting, or outrageous... they’ll all make you think Outside the Box. Get the newsletter free in your inbox every Wednesday. |

Share Your Thoughts on This Article

http://www.mauldineconomics.com/members Outside the Box is a free weekly economic e-letter by best-selling author and renowned financial expert, John Mauldin. You can learn more and get your free subscription by visiting http://www.mauldineconomics.com. To subscribe to John Mauldin's e-letter, please click here:

http://www.mauldineconomics.com/subscribe Outside the Box and MauldinEconomics.com is not an offering for any investment. It represents only the opinions of John Mauldin and those that he interviews. Any views expressed are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest and is not in any way a testimony of, or associated with, Mauldin's other firms. John Mauldin is the Chairman of Mauldin Economics, LLC. He also is the President of Millennium Wave Advisors, LLC (MWA) which is an investment advisory firm registered with multiple states, President and registered representative of Millennium Wave Securities, LLC, (MWS) member FINRA and SIPC, through which securities may be offered. MWS is also a Commodity Trading Advisor (CTA) registered with the CFTC, as well as an Introducing Broker (IB) and NFA Member. Mill ennium Wave Investments is a dba of MWA LLC and MWS LLC. This message may contain information that is confidential or privileged and is intended only for the individual or entity named above and does not constitute an offer for or advice about any alternative investment product. Such advice can only be made when accompanied by a prospectus or similar offering document. Past performance is not indicative of future performance. Please make sure to review important disclosures at the end of each article. Mauldin companies may have a marketing relationship with products and services mentioned in this letter for a fee. Note: Joining the Mauldin Circle is not an offering for any investment. It represents only the opinions of John Mauldin and Millennium Wave Investments. It is intended solely for investors who have registered with Millennium Wave Investments and its partners at www.MauldinCircle.com or directly related websites. The Mauldin Circle may send out material that is provided on a confidential basis, and subscribers to the Mauldin Circle are not to send this letter to anyone other than their professional investment counselors. Investors should discuss any investment with their personal investment counsel. John Mauldin is the President of Millennium Wave Advisors, LLC (MWA), which is an investment advisory firm registered with multiple states. John Mauldin is a registered representative of Millennium Wave Securities, LLC, (MWS), an FINRA registered broker-dealer. MWS is also a Commodity Trading Advisor (CTA) registered with the CFTC, as well as an Introducing Broker ( IB). Millennium Wave Investments is a dba of MWA LLC and MWS LLC. Millennium Wave Investments cooperates in the consulting on and marketing of private and non-private investment offerings with other independent firms such as Altegris Investments; Capital Management Group; Absolute Return Partners, LLP; Fynn Capital; Nicola Wealth Management; and Plexus Asset Management. Investment offerings recommended by Mauldin may pay a portion of their fees to these independent firms, who will share 1/3 of those fees with MWS and thus with Mauldin. Any views expressed herein are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest with any CTA, fund, or program mentioned here or elsewhere. Before seeking any advisor's services or making an investment in a fund, investors must read and examine thoroughly the respective disclosure document or offering memorandum. Since these firms and Mauldin receive fees from the funds they recommend/market, they only recommend/market products with which they have been able to negotiate fee arrangements. PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER. Alternative investment performance can be volatile. An investor could lose all or a substantial amount of his or her investment. Often, alternative investment fund and account manager s have total trading authority over their funds or accounts; the use of a single advisor applying generally similar trading programs could mean lack of diversification and, consequently, higher risk. There is often no secondary market for an investor's interest in alternative investments, and none is expected to develop. All material presented herein is believed to be reliable but we cannot attest to its accuracy. Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staffs may or may not have investments in any funds cited above as well as economic interest. John Mauldin can be reached at 800-829-7273. |