| U.S. stocks rose in a broad-based rally as gains seemed to signal improving investor confidence despite looming Fed tightening. The S&P 500 climbed, led by gains in financials and materials sectors, while Apple, Microsoft and Amazon lifted the Nasdaq 100. “The primary market trend appears higher aided by an economy on solid footing and resilient earnings,” said Keith Lerner, co-chief investment officer at Truist Advisory Services. “We are also encouraged that the market is already pricing in a great deal of rate hikes, that investor sentiment has reset sharply, and that valuations have pulled back.” Here’s your markets wrap. —Natasha Solo-Lyons Bloomberg is tracking the coronavirus pandemic and the progress of global vaccination efforts. Peloton shares surged on the announcement that CEO John Foley will step down and become executive chairman, handing over control to former Spotify CFO Barry McCarthy, who will become CEO and president on Feb. 9. But good news for Wall Street spells very bad news for Peloton employees: The company pledged to to cut 2,800 jobs globally, including around 20% of its corporate positions.  John Foley Photographer: Michael Nagle/Bloomberg Protests by truckers over Covid-19 restrictions widened across Canada, with blockades slowing or halting traffic at key U.S. border crossings. Prime Minister Justin Trudeau slammed demonstrators for “trying to blockade our economy, our democracy and our fellow citizens’ daily lives,” adding “a few people shouting and waving swastikas does not define who Canadians are,” referring to images from the initial days of the protest. Confirmed coronavirus deaths surpassed 900,000 in the U.S., the most of any nation. Hong Kong will limit gatherings on private premises for the first time as it turns to stricter measures to fight an outbreak there. By contrast, Europeans are responding to a waning omicron wave by booking summer vacations. Here’s the latest on the pandemic. The Russian government cast doubt on French President Emmanuel Macron’s comment that he was given assurances by President Vladimir Putin that Moscow wouldn’t escalate tensions with Ukraine. Macron was in Kyiv Tuesday to meet with President Volodymyr Zelenskiy one day after Putin stated some ideas discussed with the French leader could form “the basis for future common steps.” Here’s the latest on the crisis. JPMorgan strategists have identified what they say is a near bulletproof indicator that stock markets are poised to rally: The VIX buy signal that’s proven 100% accurate outside of recessions. The U.S. Department of Justice seized $3.6 billion in Bitcoin that was stolen in the 2016 Bitfinex hack. The case represents the largest financial seizure ever, with two people charged for allegedly seeking to launder 119,754 Bitcoin. Cathie Wood’s ARK Investment Management sold almost 4 million Twitter shares on Monday, the most in one day since at least May. The stepped up selling comes as the social-media company is set to announce earnings on Feb. 10.  |

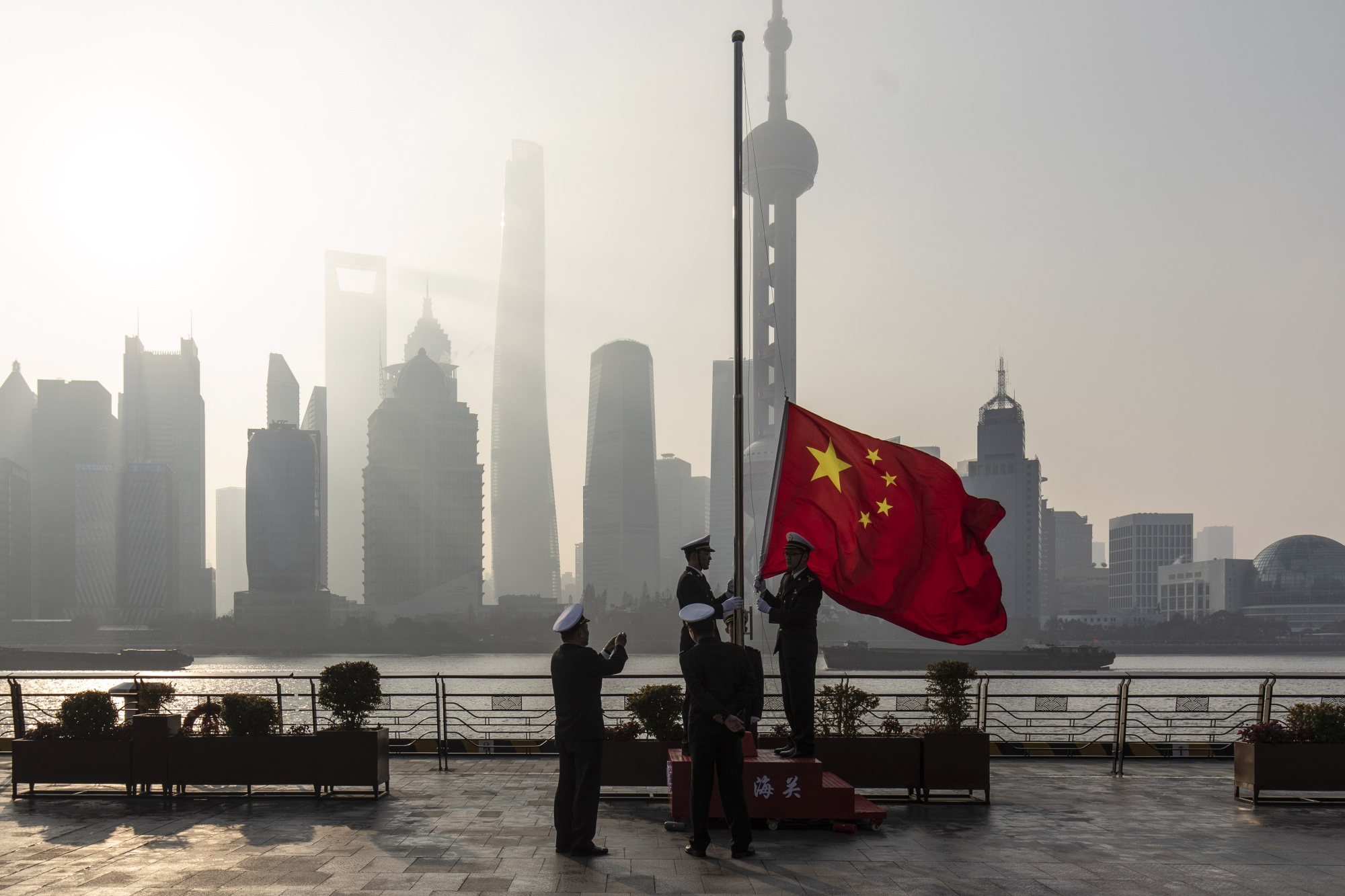

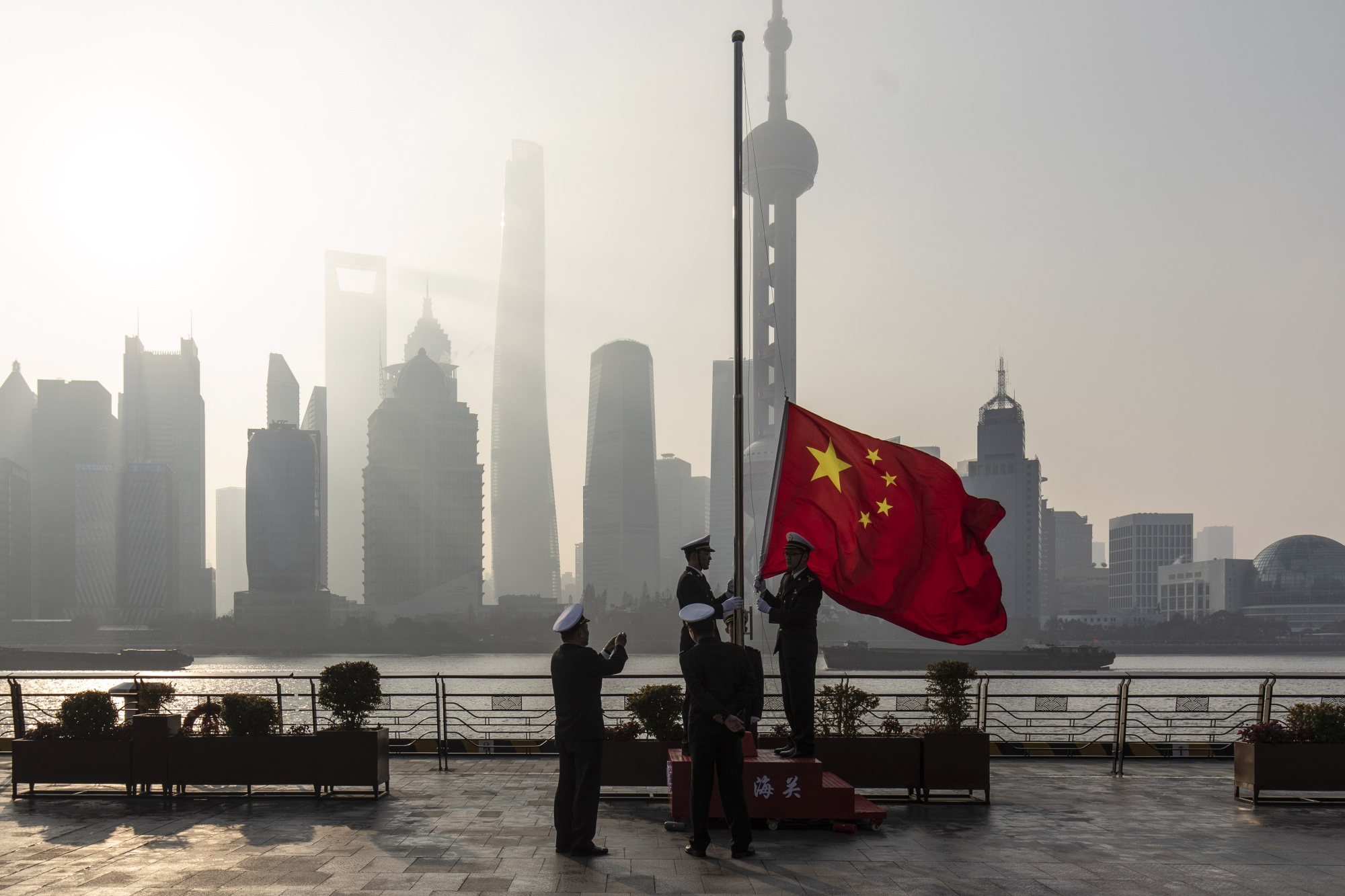

Each year, an estimated 30,000 people in China are secretly detained, often without public charges or access to lawyers. Many of them are dissidents and activists. But China has also heightened its scrutiny of the wealthy and powerful. Investigations have intensified under President Xi Jinping’s “common prosperity” campaign, which the government touts as an effort to alleviate wealth inequality. The Communist Party says it’s tackling corruption, anticompetitive behavior and financial and security risks. Critics say it’s clamping down on threats to its dominance.  China customs officers raise the Chinese flag in Shanghai on Jan. 4. Photographer: Qilai Shen/Bloomberg Like getting the Evening Briefing? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and gain expert analysis from exclusive subscriber-only newsletters. Diversity is a business issue. Sign up now for our weekly Bloomberg Equality newsletter to get the latest on how companies and institutions are confronting issues of gender, race and class. |