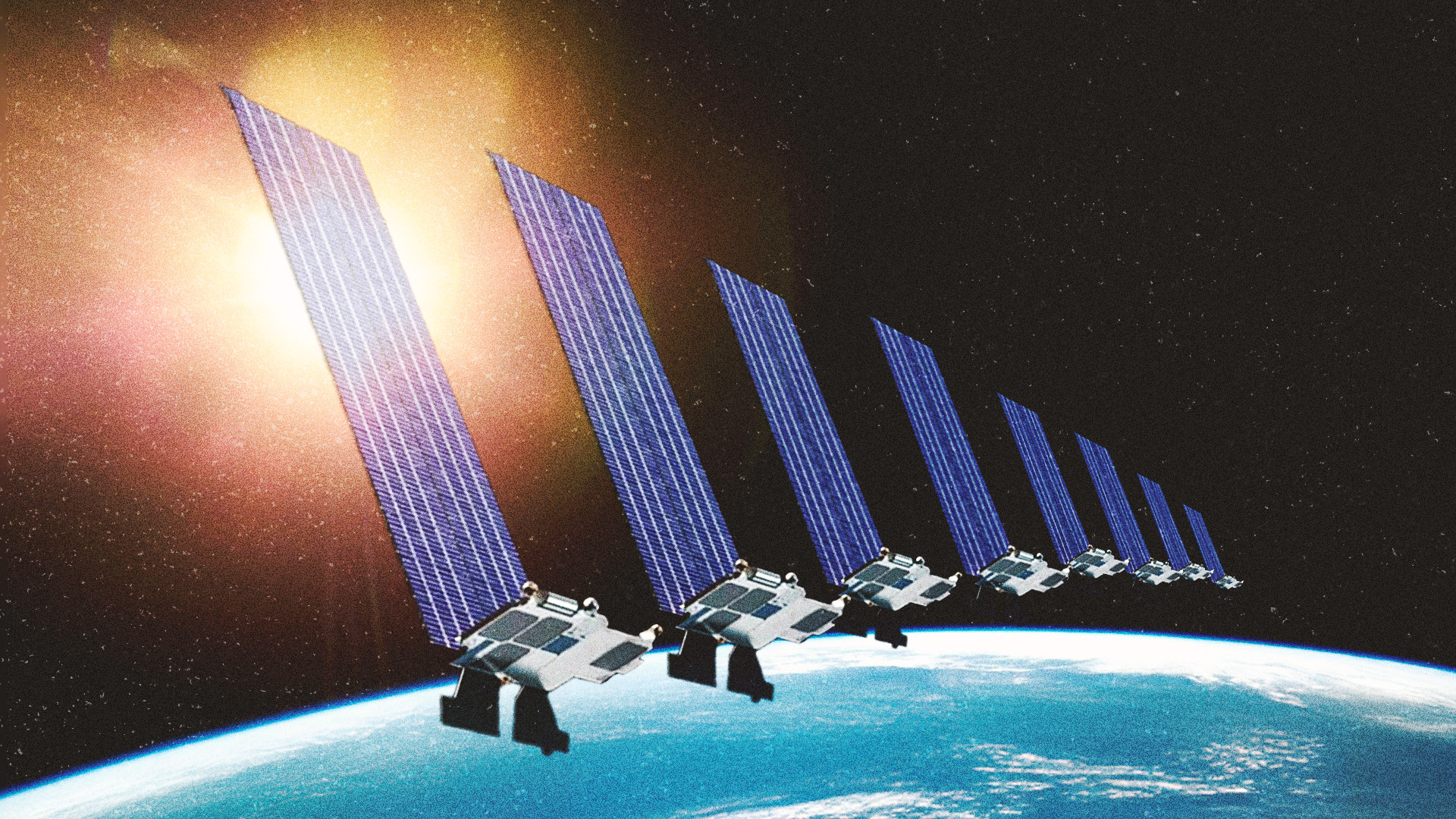

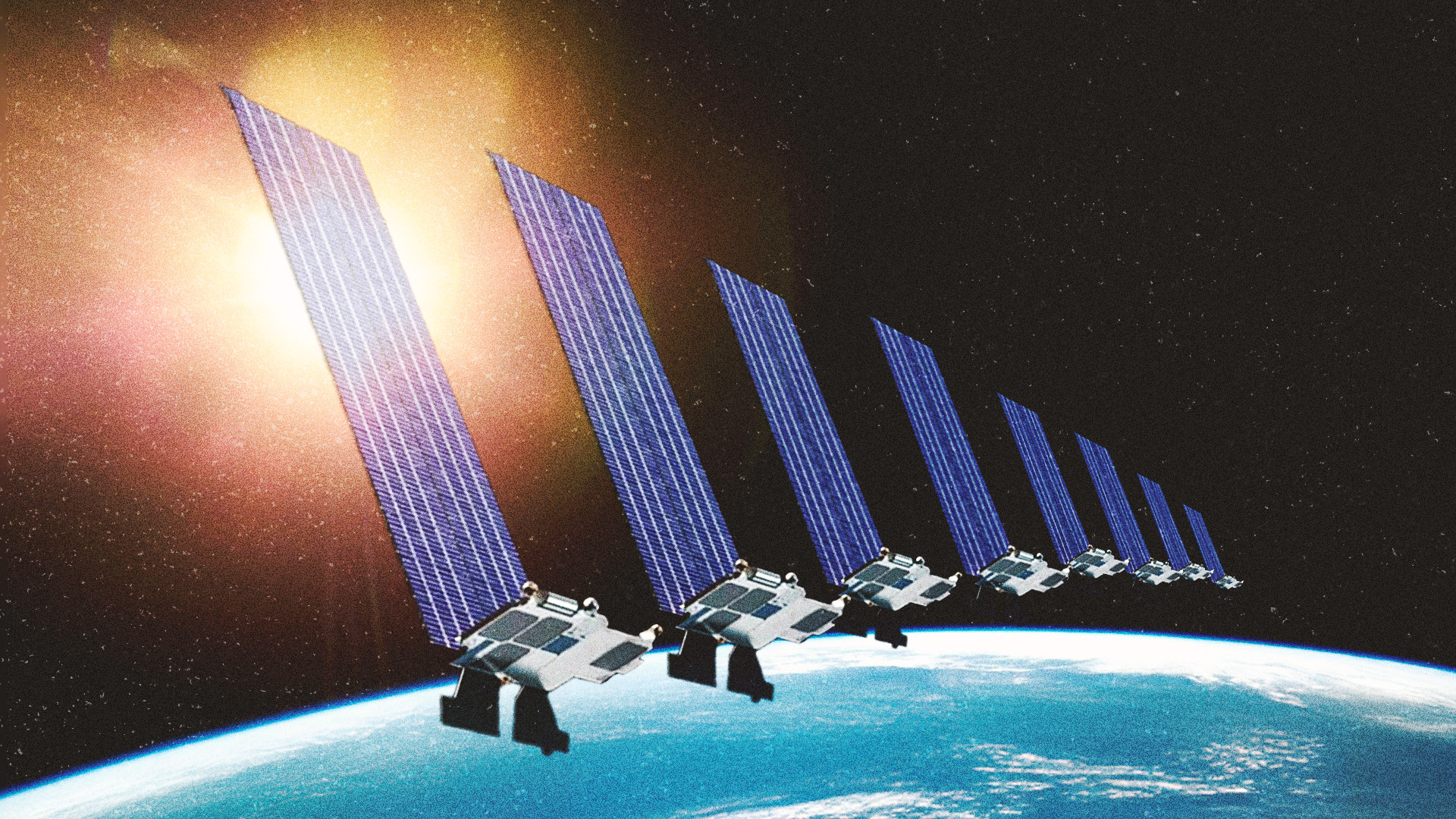

| The ceaseless drumbeat of economic data that’s pushed rate-cut prognosticators from pillar to post and back again is sounding a favorable note as far as Wall Street is concerned. A string of reports this week pointed to a slow start for the US economy in the second quarter, and that’s good news for a Federal Reserve looking for signs it can cut interest rates without jeopardizing chances of a soft landing. The turbocharged US economy, fueled by consumer spending and near-record employment, has managed to repeatedly send Team Recession packing. But it hasn’t been all that helpful when it comes to cooling down prices. Now it seems that new US home construction and manufacturing have been weaker than expected while retail sales took a steep dip. Can it be any surprise then that underlying inflation dropped for the first time in six months? Investors were predictably elated and stocks touched a record. Still, if for whatever reason you don’t like these numbers, wait awhile. There are always more on the way. “The US economic data have consistently landed on the low side of expectations of late, suggesting the economy is losing momentum in the face of restrictive monetary policy,” says Sal Guatieri, senior economist at BMO Capital Markets. “But the jury remains out on how quickly inflation will subside to provide some rate relief.” —David E. Rovella The world’s largest stock market hovered near all-time highs, with the Dow Jones Industrial Average dinging the historic 40,000 mark on those refreshed rate-cut bets. Just like the rest of the market, the oldest of Wall Street’s three main stock indexes rallied on prospects of a resilient economy, ebbing inflation and robust earnings. Here’s your markets wrap. A few old hands weighed in on the state of the great economic debate of our time and came to the conclusion that, when it comes to landing the plane, employment is the problem. Central bankers in the backstretch of their race to cool inflation still need labor markets to cool. That’s according to former US Federal Reserve Chair Ben Bernanke and former International Monetary Fund Chief Economist Olivier Blanchard, who undertook a research project for the Peterson Institute for International Economics in a joint project with ten central banks. “In most countries, traversing the last mile back to central bank inflation targets will likely require bringing labor markets into better balance by reducing vacancy-unemployment ratios,” they wrote.  Ben Bernanke Photographer: Al Drago/Bloomberg China sold a record amount of Treasury and US agency bonds in the first quarter, potentially highlighting the Asian nation’s desire to diversify away from American assets. Beijing offloaded a total of $53.3 billion of both bonds in the first quarter. Belgium, often seen as a custodian of China’s holdings, disposed of $22 billion of Treasuries during the period. China’s investments in the US are garnering renewed investor attention given that, no matter who wins the election in November, things are not looking up for US-China relations. President Joe Biden just unveiled sweeping tariff hikes on a range of Chinese imports while Donald Trump, who launched a trade war against China when he was in office, threatened to impose a levy of more than 60% on Chinese goods if he is returned to the White House. Over in meme-stock land, Renaissance Technologies loaded up on shares of pajama-trade darlings AMC Entertainment and GameStop ahead of the latest rally. The quantitative fund founded by the late Jim Simons bought 3.82 million shares of AMC in the first quarter and 1 million shares of GameStop. Shares of AMC and GameStop more than doubled at the start of the week in a surge reminiscent of the 2021 trading craze when retail traders bid the stocks up to record highs. A half-century after Jack Bogle founded Vanguard Group, the $9 trillion fund giant is doing what in the past would have been considered unthinkable: hiring an outsider to be chief executive. And one from BlackRock no less. To many, handing the reins to Salim Ramji—once considered a possible successor to BlackRock chief Larry Fink—sends a clear message: Vanguard, known as the great popularizer of the low-cost index fund, is about to change.  Salim Ramji Source: Vanguard Group KKR-backed software company OneStream is said to have confidentially filed with the US Securities and Exchange Commission for an initial public offering that could come within a few months. The company is seeking to be valued at up to $6 billion. A maker of software that’s used by chief financial officers and finance teams, OneStream counts Tidemark, Partners Fund Capital and Alkeon Capital Management as investors. Elon Musk’s Starlink operates more than 5,000 satellites that provide high-speed internet to close to 2.5 million people in places that once couldn’t easily access the web. But Starlink’s quick success, the unpredictable nature of its owner and its use in war zones have become a recipe for major controversy. In the Bloomberg Originals mini-documentary How Starlink Kickstarted a Consumer Space Race, we explain that deep-pocketed rivals like Musk’s fellow multibillionaire Jeff Bezos are seeing an opportunity—and moving on it.  An unofficial beer trail is cropping up in New York, connecting warmly welcoming taprooms and farm-to-stein tasting sessions. Brewers are creating a Napa Valley on the Hudson—but for beer. The seeds were sown 11 years ago, when the state enacted legislation allowing brewers to serve consumers directly if their beers were largely local. This official “farm brewery” designation threw beermakers a lifeline, but it also gave establishments in the agri-rich Hudson Valley an opportunity to showcase the region. Out are the dark and industrial spaces typical of brewpub culture. In are modern, warm, whitewashed rooms, walkable gardens and welcoming tastings. There are even bees.  Hudson Valley Brewery’s outdoor beer garden Photographer: Ike Edeani Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive Bloomberg’s flagship briefing in your mailbox daily—along with our Weekend Reading edition on Saturdays. The Big Take Asia podcast: Each week, Bloomberg’s Oanh Ha reports on critical stories at the heart of the world’s most dynamic economies, delivering insight into the markets, tycoons and businesses driving growth across the region and around the world. Listen in here. |