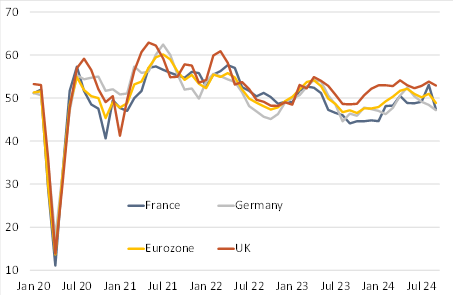

France and Germany weigh on Eurozone, UK remains stronger: While it is most likely, in our view, that the European Central Bank will wait until its meeting on 12 December before making its next 25bp cut, the surprisingly weak sentiment among eurozone purchasing managers in September slightly increases the risk that it could cut rates as early as its next meeting on 17 October. The Eurozoneâs composite PMI fell to 48.9 in September from 51.0 in August, below the Bloomberg consensus and our own expectations of 50.8 and 50.4 respectively (see table and chart 1). While the Eurozoneâs composite PMI fell below 50, indicating contraction, half of the fall since August was due to drop in Franceâs PMI. That reflected a reversal of the boost from the Paris Olympics in August and should therefore be interpreted with caution. Nonetheless, the eurozone economy appears to be stagnating. In the largest economy, Germany, sentiment in the manufacturing sector deteriorated further (40.3 in September after 42.4 in August) and support for the economy from growth in the services sector (50.6 in September after 51.2 in August) continued to wane. In contrast, economic activity in the UK has not slowed significantly, with the PMIs pointing to continued expansion in both the manufacturing and services sectors in September, albeit at a more moderate pace than in August.

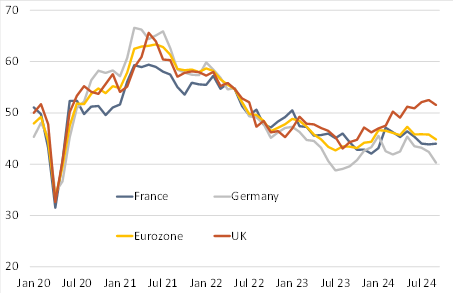

The downward trend in Germany continues: The German economy has been stagnating for more than two years, and the September PMIs, which showed the private sector economy sinking deeper into contraction, offer little hope that economic growth will pick up in the near future. The composite PMI signalled a contraction for the third consecutive month, falling to 47.2 in September from 48.4 in August. Its latest reading was the lowest since February and indicative of a material decline in total output. The drag from the manufacturing sector increased, with the index falling to a 12-month low of 40.3 and moving further away from the 50-point mark that separates expansion from contraction. At the same time, support for the economy from growth in the services sector continued to wane, with the services PMI now very close to the 50-point threshold (50.6). The prospects for the future are not looking good either. A continued sharp decline in backlogs of work shows that German companies are fulfilling orders faster than new ones received, risking a further drop in output ahead. Firms also continued to trim workforce as their expectations for activity over the coming year deteriorated. This can be explained by the current problems of the German car manufacturers, which are now spilling over to their suppliers. The country is likely to remain in a state of near-stagnation until the spring of 2025, before the ECB's interest rate cuts and rising real wages provide a push to the economy.

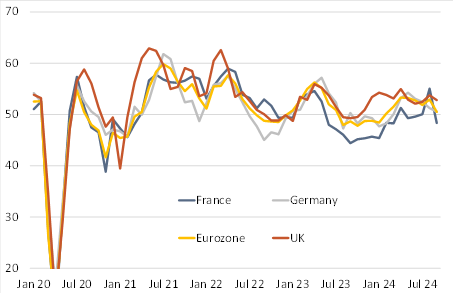

Donât read much into French fall: The fall in the Franceâs composite PMI following the boost from the Olympic Games in August was larger than expected, but we doubt the French economy has entered a serious slump. Instead, it is likely to continue growing slowly. Admittedly, the drop from 53.1 in August to 47.4 in September was much larger than the decline expected by the Bloomberg consensus to 51.5. However, the PMI survey is a measure of the number of companies reporting a fall in activity, rather than the depth of any contraction. Itâs not surprising that many services firms saw activity dip following the Olympics. Comfortingly, the average of the Franceâs composite PMI in August and September is just above 50. Further reassurance comes from the fact that almost all of the drop in the composite index was due to the fall in the services activity PMI which was most affected by the Olympics.

UK economy not slowing much: Although the UKâs composite PMI slipped back alongside that of the eurozone in September, it suggests the risk to forecasts of a significant slowdown in growth in the third quarter are to the upside. After GDP rose by 0.7% qoq in Q1 and 0.6% in Q2, the PMI survey points to growth of about 0.5% q/q in Q3. So even though economic activity stalled on a month-over-month basis in June and July, there is an upside risk to our forecast of a 0.3% q/q expansion in the third quarter. In particular, the UK manufacturing sector appears to be outperforming its peers in the Eurozone â see Chart 3. Moreover, there was some more evidence that uncertainty about fiscal policy is weighing on business sentiment as well as consumer confidence (the latter slumped to a six-month low in September). Respondents to the PMI survey reported that clients were postponing decisions until after the 30 October autumn budget. While that may restrain activity for the next month, we doubt the outcome will be as severe as firms fear. Our view remains that strong domestic demand and lower interest rates will support stronger economic growth than the consensus forecast in 2025.

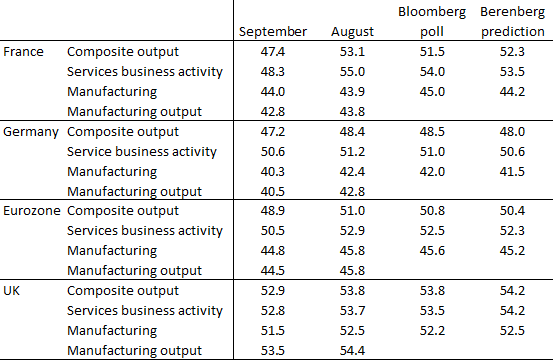

Table: European PMIs |

|

Bloomberg poll: consensus expectations. The headline manufacturing figure is a weighted average of new orders (30%), output (25%), employment (20%), suppliersâ delivery times (15%) and stocks of purchases (10%). For the PMI calculation the suppliersâ delivery times index is inverted so that it moves in a comparable direction to the other indices. Sources: S&P, HCOB, CIPS, Refinitiv |

Chart 1: PMI â Composite output |

|

PMI survey data, values above 50 indicate economic expansion. Sources: S&P, HCOB, CIPS |

Chart 2: PMI â Services activity |

|

Sources: S&P, HCOB, CIPS |

Chart 3: PMI â Manufacturing |

|

Sources: S&P, HCOB, CIPS |

Andrew Wishart

Senior UK Economist

+44 20 3753 3017

Felix Schmidt

Senior Economist

+49 69 91 30 90 - 1167