To investors,

Below is a write-up from Sebastian Deri and the team at Polymarket, the largest blockchain-based information markets platform. They explain what information markets are and how they can be leveraged to get some of the highest quality news on major world events like COVID-19.

Why You Should Get Your News From the Blockchain

On Wednesday, July 21st, the BBC ran an article that Toshiro Muto, the head of the 2020 Tokyo Olympics organizing committee, had not ruled out cancelling the Olympics, which was scheduled to begin that Friday, two days later. Would the Tokyo Olympics actually be cancelled just days before it was set to start? Or was this all hot air? Wouldn’t it be nice to be able to cut through the B.S. and know what is likely to happen?

At Polymarket, we think this is yet another use of the blockchain: financially incentivizing the truth.

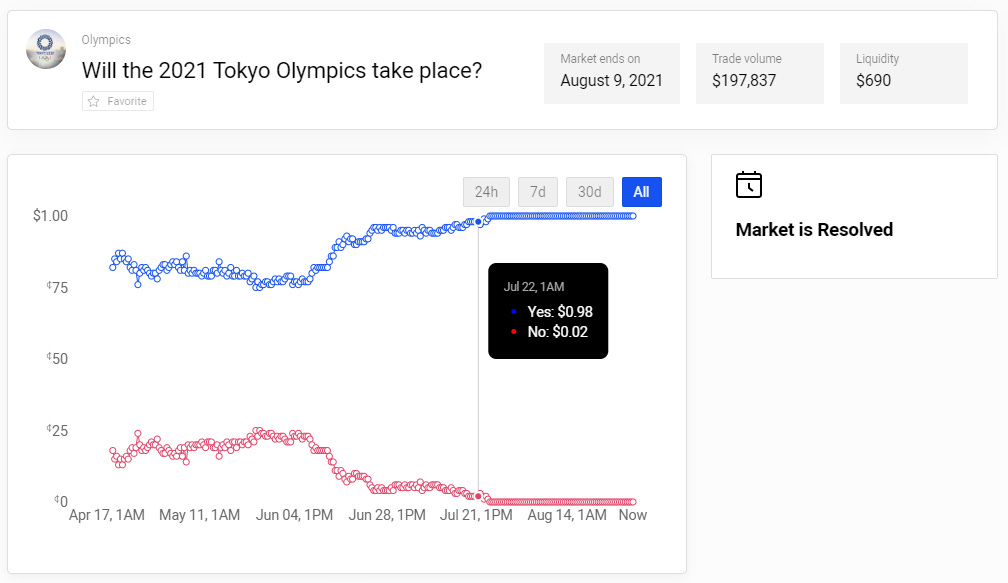

For those that don’t know, Polymarket is the world’s largest crypto-based information markets platform, built on Layer 2 of the Ethereum blockchain. In an information market, you trade on whether events will happen. For example, an event might be -- “Will the 2020 Tokyo Olympics take place as scheduled?” And then one can buy a “Yes” share, which pays out $1 if the Olympics take place as scheduled and $0 otherwise (vice versa for “No” shares). Until the truth is known, the shares trade at their expected probability of happening, so a “Yes” share trading at $0.85 cents indicates that the market believes there is an 85% chance that the Olympics will take place as scheduled.

These markets, which can be created in realtime, are how the blockchain can be used to financially incentivize the truth. The coronavirus pandemic provides a perfect example of this.

COVID at the Olympics

As early as April, three months before the announcement of a possible cancellation, our platform had a market on whether the Olympics would take place as scheduled. From the very beginning, the odds of “Yes” were trading at 85%, indicating that it was very likely that the Olympics would indeed be held, as scheduled, global pandemic notwithstanding. On the day of the announcement of a possible cancellation, the odds of “Yes” had climbed to 98%, and continued to stay right there in the hours and days after the announcement. In other words, the possible cancellation was just a bunch of hot air, likely meant to appease a group of Japanese residents protesting holding the Olympics due to spiking Covid cases in Japan. Indeed, in the end, the Olympics did end up taking place as scheduled. The dozens of articles about the possible cancellation and the hand wringing that followed could have been safely ignored with a glance at the market.

The Delta Variant and Third Wave

Sometimes, the opposite is the case. The news is slow to cover or give full attention to something that information markets are already reacting to. An example of this is the emergence of the Delta variant of the coronavirus, which eventually would lead to a third wave spike in Covid cases.

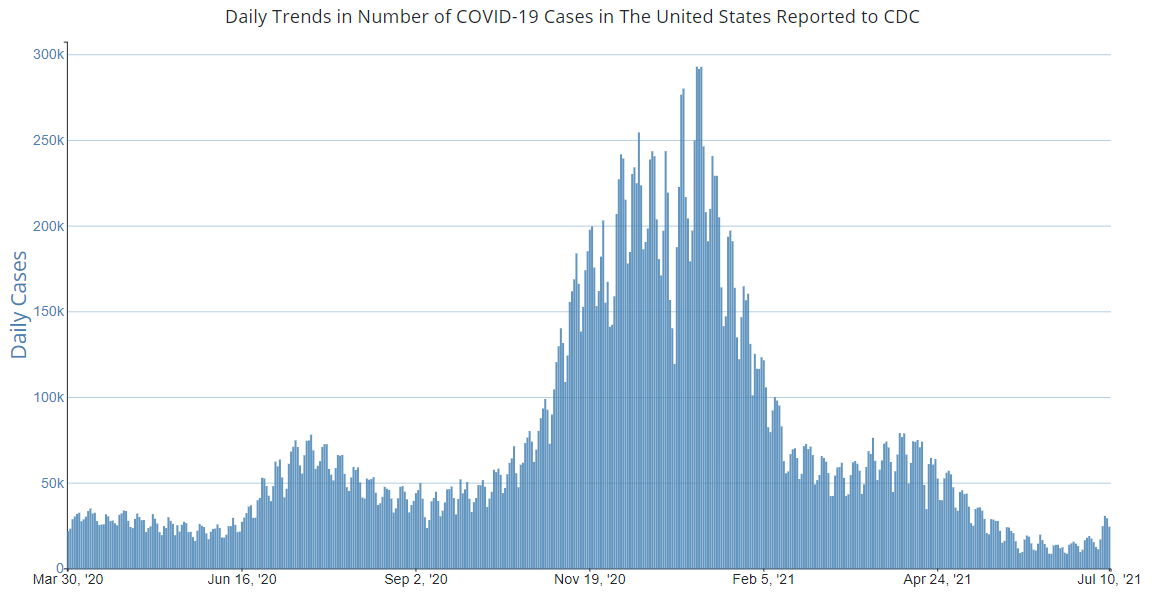

From June and into the first week of July of 2021, daily Covid cases were at record lows. From record highs of 100-200k daily cases in January of 2021, daily cases were down to around 10-15k cases in June and July. Indeed, on July 10th, 2021, daily Covid cases were at 20k, and the front page article of the New York Times was about new CDC guidance pushing for a full reopening of schools in the coming months. It seemed like the virus might be winding down and we would be returning to pre-pandemic life.

However, as a hedge that things really were returning to normal, a market was launched on Polymarket on July 9th, 2021, asking the simple question -- “Will there be any day before the end of the year, where daily cases would spike to 100k or higher?” Any day with 100k or more cases would indicate the Delta variant was a serious threat, likely to bring us back to winter peak levels of Covid. If that wasn’t on the horizon, then the odds of “Yes” on the market should have been trading very low - say, below 10%.

This wasn’t what we saw. By the end of the day, on July 9th, the first day the market was open, the odds of “Yes” were at 65%. This indicated that the market thought it was more likely than not that we’d see a return similar to the winter peak/second wave levels of Covid.

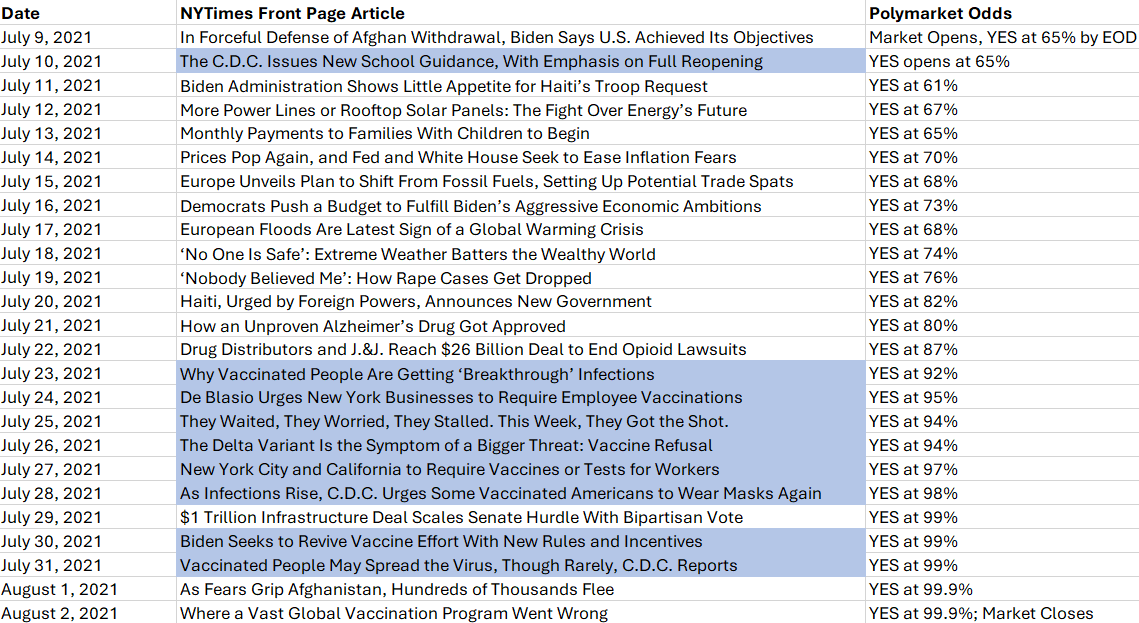

Meanwhile, the news was lagging behind this emerging threat. Below is a chart of the New York Times frontpage headlines against the Polymarket odds. After the initial headline about reopening, there wasn’t another leading story about Covid until July 23rd, 2021. By that time, the market odds were at 92% “Yes” that we’d see a third wave ushered in by the Delta Variant. Once it was on the front page of the New York Times, it was already a done deal.

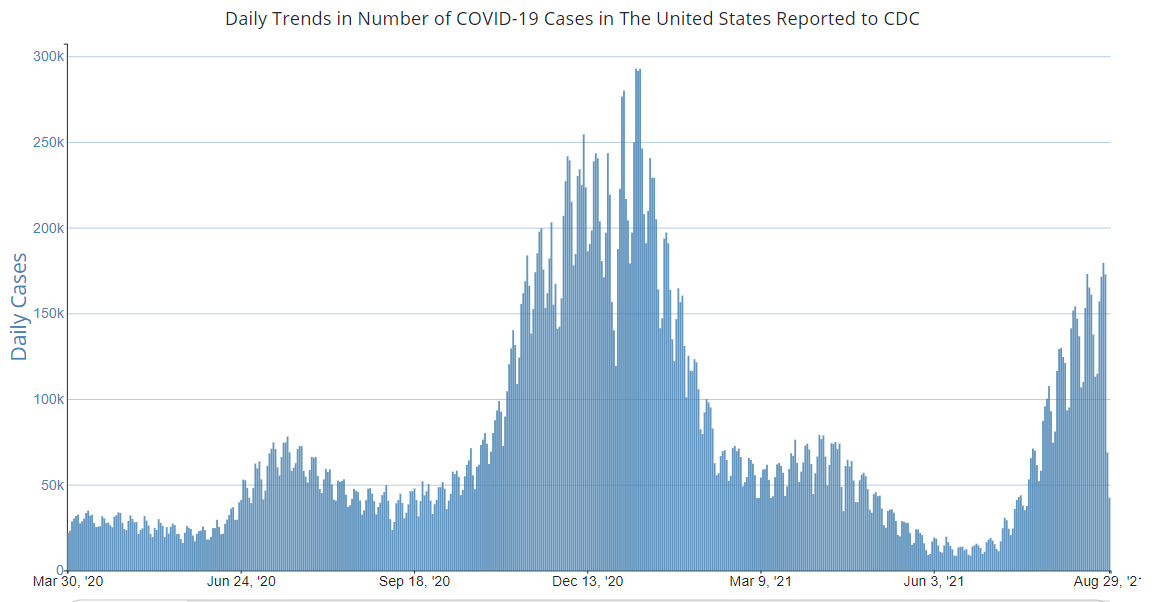

By August 3rd, the reality that the markets had predicted hit. There were days with over 100k cases. Indeed, by that point, there was already another market up (which is still actively trading) on whether there would be any day before October 1, 2021 with 200k cases.

The news was unfolding on Polymarket and discussed in our Discord server, just not in the headlines.

And even traditional financial markets were lagging behind our platform. It wasn’t until the morning of Monday, July 19th, 2021, that markets woke up to a drawdown, that was widely attributed to the rapidly increasing covid cases. That morning, the Dow, NASDAQ, and S&P 500 all opened 1% down, and closed the day, even further down, with the Dow seeing its biggest single day loss the whole year at that point.

Unlike traditional financial exchanges, which only operate during certain hours, and on certain days of the week, trading on Polymarket is open 24 hours a day, 7 days a week, 365 days a year.

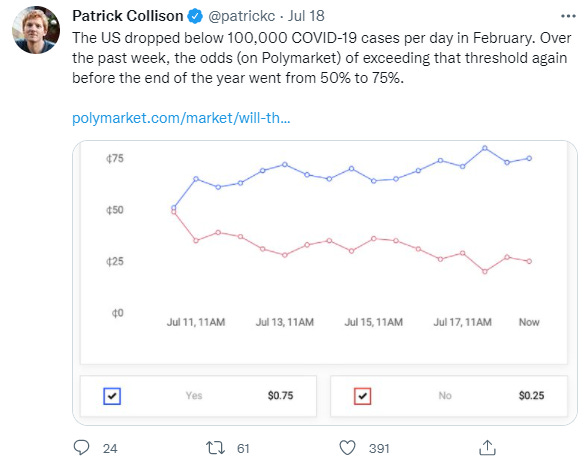

While investors in traditional markets had to wait for the markets to open on Monday, July 19, traders on our platform could continue to check the odds of a huge spike over the weekend as well. Indeed, this is likely why Patrick Collision, CEO and co-founder of Stripe, and one of the most respected minds in finance, was quoting our market odds on Sunday, July 18th, 2021, to get a better handle on the emerging spike in cases.

This is Web 3.0. Decentralized networks, operating 24/7, creating financial incentives for the truth. This is what will eat traditional finance alive. Join us.

For a limited time, sign up with referral code “Pomp” to get up to $100 reimbursed on your first day of trading!

SPONSORED: Unstoppable Domains allows you to replace cryptocurrency addresses with a single, easily-readable name like mine, Pomp.crypto. Instead of worrying about getting 1 character wrong in a long string of random letters and numbers, get your own Unstoppable Domain here.

THE RUNDOWN:

The Postal Service’s Law Enforcement Arm Is Buckling Down on Crypto: The U.S. Postal Inspection Service, the law enforcement arm of the U.S. Postal Service, is re-thinking the way it handles crypto-related investigations. According to an internal audit report published last Thursday, the agency said its management of seized cryptocurrency assets and crypto-related investigative procedures need to be improved. Read more.

Visa’s secret crypto strategy: Fun: “The competitive advantage crypto has that most people haven't understood yet is that we just have more fun,” says Cuy Sheffield, Visa’s head of crypto. The payments giant is practicing what it preaches: It revealed on Monday that it followed the Internet’s “cool kids” and purchased a non-fungible token, or NFT, of a CryptoPunk, one of 10,000 iconic computer-generated characters, for $150,000. Read more.

El Salvador to Create $150M Bitcoin Trust to Facilitate Exchange to US Dollars: El Salvador’s government has agreed to create a $150 million bitcoin trust to facilitate exchange between bitcoin and U.S. dollars in the country, according to a report by local newspaper El Diario de Hoy. El Salvador’s Minister of Economy, María Luisa Hayém Brevé, said there is a possibility of increasing the initial $150 million allocation, which was agreed to on Monday by the deputies of the Finance Commission of the Legislative Assembly. Read more.

Slovenia Financial Agency Proposes New 10% Crypto Tax: Slovenia’s tax agency, the Financial Administration, has proposed new rules for crypto taxation, the Slovenian Press Agency reported on Tuesday. According to the report, 10% tax will be imposed on any transactions when cryptocurrencies are spent on goods or exchanged for cash. Read more.

Billionaire Investor John Paulson: Cryptocurrencies Will ‘Go to Zero:’ Hedge fund manager John Paulson made $20 billion predicting the downfall of the US housing market in 2008. Now, he’s predicting cryptocurrencies will “go to zero.” “Cryptocurrencies, regardless of where they’re trading today, will eventually prove to be worthless,” Paulson told Bloomberg in an interview. “Once the exuberance wears off, or liquidity dries up, they will go to zero. I wouldn’t recommend anyone invest in cryptocurrencies.” Read more.

LISTEN TO THIS EPISODE OF THE POMP PODCAST HERE

Benyamin Ahmed is a 12-year old from London who has made more than $400,000 selling NFTs in the last few weeks. He is incredibly smart and was a joy to speak with.

In this conversation, we discuss NFTs, booking $400,000 in revenue, being 12 years old, teacher’s reaction, potentially buying the school and renaming it, and what Benyamin is planning next.

LISTEN TO THIS EPISODE OF THE POMP PODCAST HERE

Podcast Sponsors

These companies make the podcast possible, so go check them out and thank them for their support!

Polymarket - Polymarket is the world’s leading information markets platform where you can trade on the most pressing global questions and see unbiased, real-time data on what the market thinks will happen – all on the blockchain. Will Cardano support smart contracts by October? Will the US have more than 100,00 covid cases before 2022? For a limited time, sign up with referral code “Pomp” to get your first trade reimbursed up to $100. Click here to get started!

Cosmos is building the Internet of Blockchains, marking a new era of interoperability, scalability, and usability. The free flow of assets and data between blockchains with bridges to Ethereum and Bitcoin will unleash the potential of DeFi, NFTs, and much more. Dive into Cosmos at cosmos.network/pomp

Choice is a new self-directed IRA product that allows you to buy Bitcoin with tax-advantaged dollars, while still holding your private keys. You can go to retirewithchoice.com/pomp to sign up today.

BlockFi provides financial products for crypto investors. Products include high-yield interest accounts, USD loans, and no fee trading. To start earning today visit: http://www.blockfi.com/Pomp

Crypto.com allows you to buy, sell, store, earn, loan, and invest various cryptocurrencies in an user friendly mobile app. Join over one million users today. You can download and earn $50 USD with my code “pomp2020” when you sign up for one of their metal cards today.

Circle is a global financial technology firm that enables businesses of all sizes to harness the power of stablecoins and public blockchains for payments, commerce and financial applications worldwide. Circle is also a principal developer of USD Coin (USDC), the fastest growing, fully reserved and regulated dollar stablecoin in the world. The free Circle Account and suite of platform API services bridge the gap between traditional payments and crypto for trading, DeFi, and NFT marketplaces. Create seamless, user-friendly, mainstream customer experiences with crypto-native infrastructure under the hood with Circle. Learn more at circle.com.

Gemini is a leading regulated cryptocurrency exchange, wallet, and custodian that makes it simple and secure to buy bitcoin, ether, and over 30 other cryptocurrencies. Offering industry-leading security, insurance and uptime, Gemini is the go-to trusted platform for beginner and sophisticated investors alike. Open a free account in under 3 minutes at gemini.com/pomp and get $20 of bitcoin after you trade $100 or more within 30 days.

LMAX Digital - the market-leading solution for institutional crypto trading & custodial services - offers clients a regulated, transparent and secure trading environment, together with the deepest pool of crypto liquidity. LMAX Digital is also a primary price discovery venue, streaming real-time market data to the industry’s leading analytics platforms. LMAX Digital - secure, liquid, trusted. Learn more at LMAXdigital.com/pomp

Mask Network - The portal to the new, open internet. Building on top of the existing social networks, the Mask extension allows borderless cryptocurrency transfer, decentralized file storage and sharing, decentralized finance, and many other features that were once impossible to interact with on traditional social media. Visit mask.io/pomp and use the extension to start exploring the decentralized application world.

Okcoin - Okcoin is one of the most popular licensed exchanges. Okcoin is the first to bring new cryptos to market, offering some of the lowest fees in the industry, an easy to use app, and Earn feature! It’s easier than ever to sign up, buy and trade crypto in just 2 minutes on Okcoin with credit & debit cards or just link your bank account to the best new crypto assets. So get started, and go to okcoin.com/pomp

Matrixport - Matrixport is Asia’s fastest growing digital asset platform with $10 billion in assets under management and custody. It offers one-stop crypto financial solutions including fixed income, DeFi in 1-click, structured products, Cactus Custody™, spot OTC and lending. Go download the Matrixport App and enjoy a welcome offer of 30% APY on USDC for new users.

Masterworks - Masterworks.io is the leading platform for blue-chip art investing with over 185,000 registered users. They have purchased over $180MM in art from artists like Banksy, Basquiat and KAWS.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable.

Nothing in this email is intended to serve as financial advice. Do your own research.

You’re on the free list for The Pomp Letter. For the full experience, become a paying subscriber.