|

|

To investors,

Many financial assets are trading sideways as we enter the summer months. This can cause investors to question whether certain investment ideas have been disproven and/or should be shut down.

Humans are really bad at being bored.

But Charlie Munger said it best when he stated, “the big money is not in the buying and the selling but in the waiting.” To those who can survive these sideways months are likely to have relief on the way in the second half of the year.

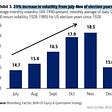

Bank of America’s research team recently put out a report showing a 25% increase in volatility from July to November of election years. You can expect movement in the second half of this year.

This level of volatility would be a welcomed change from the current boredom. During the boredom, some asset prices like bitcoin have traded slightly down. Some have traded flat. And others, like the S&P 500, continue to grind higher at a slow pace.

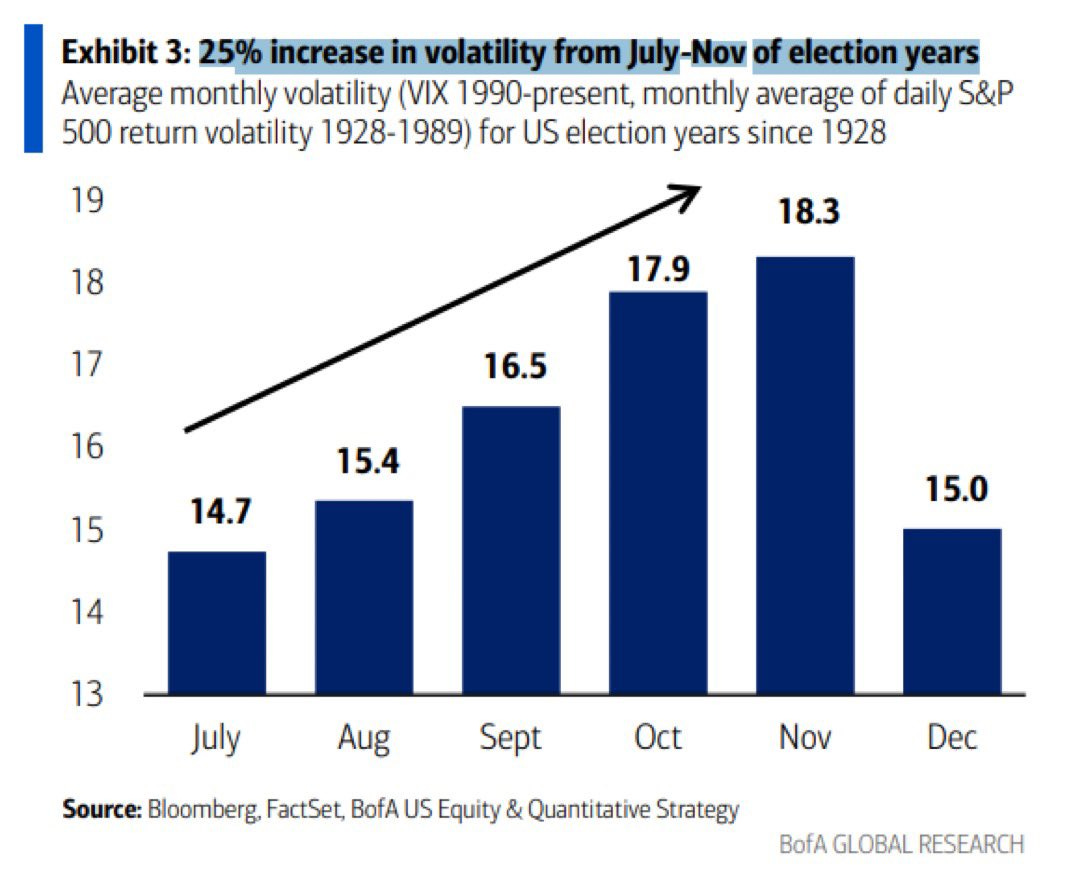

For example, the 500 largest companies in the US have not seen a draw-down of at least 2.05% in more than 375 days, which marks the longest such stretch since the Great Financial Crisis.

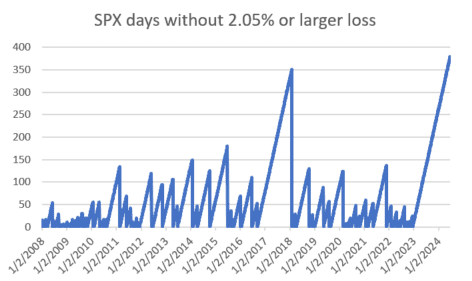

And we know that many new all-time highs packed into the first 6 months of the year usually leads to a monster year for the stock market. Momentum is a hell of a drug. Already this year, we have seen 30 new all-time highs in the S&P, which suggests the second half of the year should be volatile and fun.

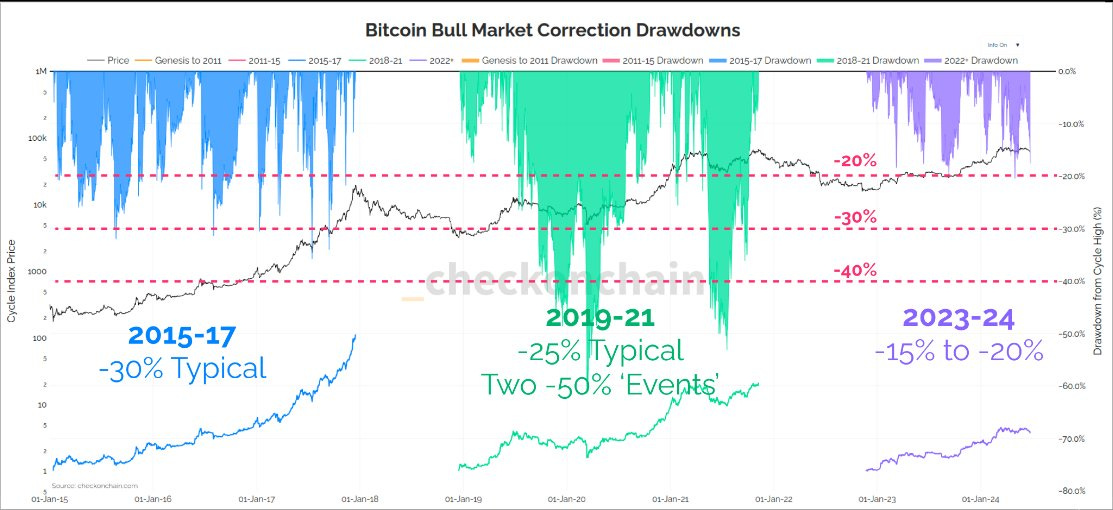

And bitcoin seems to have some positive data, although the asset has traded off its all-time high a few weeks ago. Checkmate, one of the leading on-chain analysts, points out how weak the bitcoin drawdowns have been in this bull market.

So what is my take? Volatility in the stock market should be expected for the second half of the year, but bitcoin appears to be losing the asymmetric volatility in both directions. The asset doesn’t drawdown as much as it used to and my expectation is the asset won’t have the parabolic bull markets that we have grown accustomed to.

Bitcoin is growing up. The price will grind up over time. There are new market participants here. This is the next step of mass adoption.

Just don’t pigeon hole yourself into only investing in one asset. Volatility can show up in different places at different times. Make sure you are prepared to capitalize on it.

Hope you have a great day. I’ll talk to everyone tomorrow.

-Anthony Pompliano

Nic Carter is the Co-Founder and General Partner at Castle Island Ventures.

In this conversation, we talk about bitcoin, artificial intelligence, energy consumption, regulation, politics, Trump vs Biden stance on crypto, stablecoins, impact of ETH ETF, and future outlook on the industry.

Listen on iTunes: Click here

Listen on Spotify: Click here

My Conversation with Castle Island’s Nic Carter

Podcast Sponsors

Meanwhile is the world’s first licensed and regulated life insurance company built for the Bitcoin economy.

iTrustCapital allows you to buy and sell cryptocurrency in a tax-advantaged crypto IRA. Open and fund an account today to receive a $100 USD funding bonus.

Supra - Join Supra’s early integration program for zero-cost access to the fastest oracles and dVRF across 50+ blockchains.

BetOnline - Use crypto to bet on sports, casino games, horse racing, poker and more with promo code POMP100.

Espresso Displays - The world's thinnest touchscreen portable monitor. Expand your workspace and work from anywhere.

CrossFi is the Apple Pay for Crypto. For the first time in history, anyone with a web 3 wallet can spend crypto through a physical or virtual Visa card where Visa is accepted.

ResiClub - Your data-driven gateway to the US housing market.

Opening Bell Daily - Get the 5-minute newsletter that Wall Street reads.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

You're currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription.