| Week ending March 3, 2017 |

Price declines emerge as the remarkable run of the last four months appears set for a pullback

|

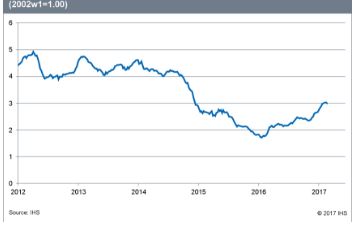

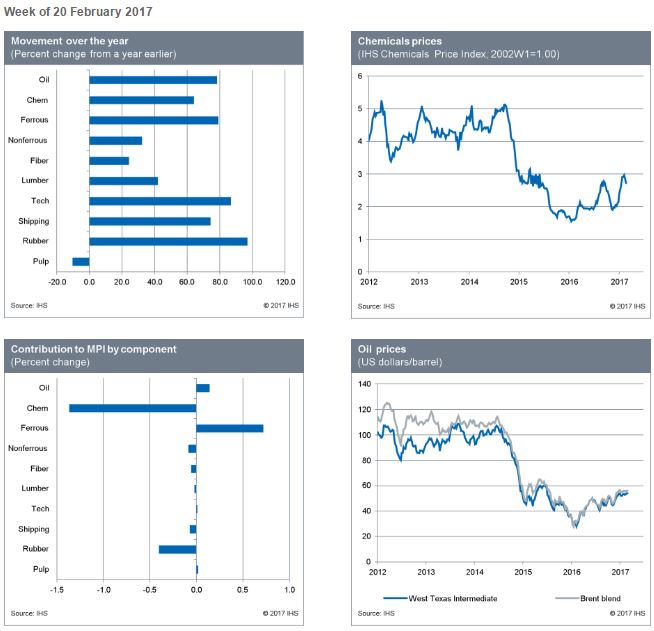

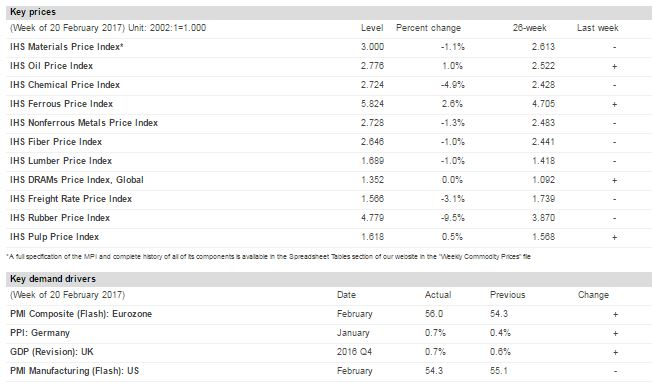

The IHS Materials Price Index (MPI) fell for the first time in more than four months last week, down 1.1%, breaking its longest-ever positive run. This decline had looked imminent for several weeks and was eventually driven by large falls in the chemical and rubber sub-indices, which fell 4.9% and 9.5%, respectively.

The long-awaited decline was fairly strong, with only 3 of the 10 sub-indices gaining last week. Our chemicals index was driven lower by a near 15% fall in ethylene prices as supply remains ample with minimal outages and demand less robust than expected. Rubber prices were also sharply lower as the Thai government, taking advantage of high prices, sold off inventories, flooding the market with ready supply.

Last week's macroeconomic releases provided downward pressure for commodity prices. Minutes from the Federal Reserve meeting three weeks prior indicated a further interest rate hike would be appropriate "fairly soon," strengthening the dollar—a negative for commodity prices. The US February Flash Manufacturing Purchasing Managers' Index came in at 54.3, still in expansionary territory but a slowdown on the prior month. Alongside these recent announcements, the continued slowdown in the Chinese property sector is a serious concern, one that will add further downward weight on commodity prices if the recent softening persists. |

| | IHS Materials Price Index |  |

|

| | | Market Insight | | For an overview of the IHS Materials Price Index, view this video. |

|  | | |

|

| Industrial Materials: Prices |  |

| Key Prices & Demand Drivers |  |

| Copper-Based Wire and Cable Prices at Highest Level in Almost Five Years | Construction costs rose again in February, recording the fourth consecutive month of price recovery.

|

The headline IHS PEG Engineering and Construction Cost Index registered 55.2 in February, down from 57.7 in January. Strength was evident for materials markets, though for labor markets, the headline index tipped below the neutral point. The materials/equipment price index came in at 58.0 in February, with the materials sub-index showing rising prices in 10 of the 12 categories tracked. Ocean freight from Europe to the U.S. recorded another month of falling prices and electrical equipment prices were flat. The copper-based wire and cable index experienced the highest escalation compared to January. The last time the copper index registered this level was back in March 2012. "Copper prices are reacting to the closure of two of the world's largest mines: Grasberg in Indonesia, because of a dispute with government over its export permit, and Escondida in Chile, because of a strike,” said John Mothersole, research director at IHS Pricing and Purchasing. “Both events are temporary, though they do tighten the market and support higher prices, at least for a time.”

| | Learn More |

|

| About IHS Pricing & Purchasing | | The IHS Pricing & Purchasing Service | The IHS Pricing & Purchasing Service enables supply chain cost savings by providing timely, accurate price forecasts and cost analysis. Armed with a better understanding of suppliers' cost structures and market dynamics, organizations can effectively negotiate prices, strategically time buys, and boost the bottom line.

With a database of more than 80,000 historic prices and thousands of price, wage and input cost forecasts, IHS offers more coverage than any other provider in the market. IHS has been providing forecasts of key commodity, labor, and input costs since 1970 -- helping define the purchasing advice industry. | | Learn More |

|

| Commodity Price Forecasts & Supply Chain Cost Benchmarking. Learn More | | |

|

|

|