To investors,

It is no secret that Turkey is experiencing painfully high levels of inflation right now. Economists’ expectations for inflation numbers in December are just over 30%, which includes estimations that range from 26% to 37%. Regardless of where the number officially ends up, the inflation that Turkish citizens are dealing with is hard to comprehend for investors in the developed, western world.

Governments are not thrilled in these scenarios to take responsibility due to previous monetary or fiscal decisions. Instead, they historically blame corporations for price gouging, implement price controls, and even institute capital controls in the most extreme examples. The higher the inflation gets, the more severe the government’s response tends to be.

The United States is experiencing nearly 7% inflation and we see our politicians calling out various industries, from beef producers to grocery stores, in regards to alleged price gouging. If history serves as a guide, it is unlikely that the corporations are actually price gouging. It is much more likely that their labor and material costs have drastically increased, so they need to raise their prices in order to still have any profit.

Turkey has already gone one step further than the United States though. They are not only accusing corporations of price gouging, but they are actually using the police to enforce a form of price controls. Here is a video that was released by the local authorities that shows them in various grocery stores.

Mürsel YILDIZKAYA @m_yildizkaya

Polatlı Belediyesi olarak fahiş fiyatlara karşı sıkı denetimlerimizi sürdürüyoruz. Bu zor günlerde hemşehrilerimizin; fakir, fukaranın yanında olmayanın, her zaman karşısında olacağız. https://t.co/sk4Vn4togc

The second tweet is translated by Google as saying:

“As Polatlı Municipality, we continue our strict controls against exorbitant prices. In these difficult days, our fellow citizens; We will always be against those who are not on the side of the poor and the poor.”

This reminds me of the classic “I am from the government and I am here to help you.” Obviously, these grocery store owners are unlikely to hike prices for the fun of it. They are dealing with a high inflation environment that has only become worse through 2021. If you put yourself in their position, I’m not sure there is much to do other than to continue to increase prices at the same rate as the devaluation of the currency.

The scary part of this video is that you have the police intervening in markets, which obviously doesn’t allow for free market forces to take hold. You can’t have a system of supply and demand if you also have artificial constraints on the market. As we know from history, these types of price and capital controls can actually exacerbate the situation, rather than help to fix it. Regardless, this is a nasty situation for business owners and citizens alike.

Let’s bring it back to the United States though. Politicians who have accused grocery stores domestically of price gouging have not looked at the numbers it appears.

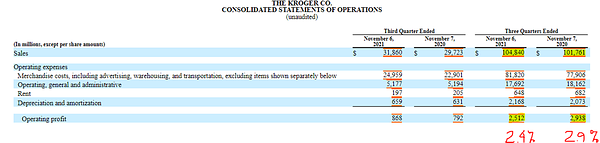

We can use Kroger as one example of what the actual financials are telling us:

Not only is Kroger actually making less money this year, even though food prices are 5-6% higher based on the national average, but the business is also operating on a measly 2.4% profit margin. Those razor thin margins mean that the business must be insanely accurate at predicting supply chain and labor costs, along with any changes to demand.

Whether we are talking about the United States, Turkey, or many other countries around the world, business owners are facing significantly higher inflation than usual. They are going to have to raise prices. This is how capitalism and free markets work. We shouldn’t allow politicians and central bankers to gaslight us. A large portion of the problem stems from undisciplined monetary and fiscal policy. The market intervention is not a solution.

Besides ensuring that we are educated on how markets work and what the financials of these businesses are, it is important to focus on another simple idea as well:

High inflation erases hope for the most financially vulnerable in a society. Politicians attack corporations and business owners in response, which demonizes success. These are some of the ingredients of how societies crumble. It doesn’t have to be this way though. The popular saying of “money is the root of all evil” can be slightly changed to be more accurate — “fiat money is the root of all problems.”

Fix the money, fix the world. Billions of people around the world stand to benefit from a global store of value that can’t be debased or devalued by any one person, group, or government. We are well on our way to that solution. It can’t come fast enough for those living under high inflation though.

Hope you have a great start to your day. I’ll talk to everyone tomorrow.

-Pomp

SPONSORED: Mode allows you to buy, earn and grow Bitcoin, all in one app. Not only is it an easy and safe way to buy and hold Bitcoin, Mode allows you to pay and receive up to 10% Bitcoin Cashback for FREE from its growing list of online partner brands.Mode, the UK fintech app is one of a kind.

They are FCA registered and are listed on the LSE. They chose to hold Bitcoin on their balance sheet. They are piloting a Bitcoin Payroll product to pay UK employees in BTCMode is offering 0% trading fees on all Bitcoin buys and sells. Available on the App Store and Google Play.

Download Mode today and enjoy 0% trading fees on all Bitcoin buys and sells until Dec 31, 2021. Click here to get started. Only available in the UK.

THE RUNDOWN:

Kraken to Develop NFT Marketplace Offering Token-Backed Loans: Crypto exchange Kraken is developing a marketplace for non-fungible tokens where users can arrange loans using the tokens as collateral, the exchange’s founder and CEO Jesse Powell said in a Bloomberg News interview published Friday. The marketplace will provide custody, and the exchange is figuring out how to determine the liquidation value of NFTs deposited so that users can use them as collateral for loans, Powell said. Read more.

Iran Banning Crypto Mining Until March 6 to Save Power: Iran is banning authorized crypto mining in the country until March 6 in an attempt to save power and avoid blackouts this winter, according to a Bloomberg report. The move will free up 209 megawatts of power for use by the country’s households, according to Mostafa Rajabi Mashhadi, the director of state-run Iran Grid Management Co., who was interviewed by state TV. Read more.

India’s Central Bank Recommends Basic Version of CBDC: As India grapples with uncertainty around cryptocurrency regulation, the Reserve Bank of India (RBI), the country’s central bank, said it is inclined to offer a basic central bank digital currency (CBDC) initially before implementing a more sophisticated version. A report titled “Trend and Progress of Banking in India 2020-21″ released on Tuesday elaborates on the thinking of the RBI on a CBDC. Read more.

Crypto Futures See $300M in Losses After Spot Market Drops: A drop in crypto markets from Monday evening (UTC) prompted almost $300 million in liquidations across several crypto futures contracts, data from analytics tool Coinglass showed. More than 109,000 traders’ positions were liquidated in the past 24 hours. Read more.

LISTEN TO THIS EPISODE OF THE POMP PODCAST HERE

Kevin McGarvey is the Co-Founder & President of All Out Parking Lots. Kevin has built a great 30 person small business and has recently converted to a Bitcoin Standard. They have put Bitcoin on the balance sheet and have started paying out weekly Bitcoin bonuses to employees.

This is a fascinating conversation to understand how an entrepreneur of a non-public, non Wall Street backed, company can successfully convert to the Bitcoin Standard to run their business.

LISTEN TO THIS EPISODE OF THE POMP PODCAST HERE

Podcast Sponsors

These companies make the podcast possible, so go check them out and thank them for their support!

Mode allows you to buy, earn and grow Bitcoin, all in one app. Not only is it an easy and safe way to buy and hold Bitcoin, Mode allows you to pay and receive up to 10% Bitcoin Cashback for FREE from its growing list of online partner brands. Download Mode today and enjoy 0% trading fees on all Bitcoin buys and sells until Dec 31, 2021. Only available in the UK.

Cryptocurrency is the future, so don’t get left in the past, bet with MyBookie and you can get in the game now! The best part is, MyBookie accepts well-known cryptocurrencies like Bitcoin and Ethereum so you can bet and withdraw with Crypto. To get you kickstarted with crypto, use my promo code (POMP) to double your first crypto deposit up to at MyBookie.

Coin Cloud has been serving customers since 2014 and has established itself as the world's leading digital currency machine (DCM) operator. More than just a Bitcoin ATM, Coin Cloud machines make it easy to buy and sell Bitcoin and 30+ other digital assets with cash. To get your $50 in free Bitcoin, visit www.Coin.Cloud/Pomp

Compass Mining is the world's first online marketplace for bitcoin mining hardware and hosting. Compass was founded with the goal of making it easy for everyone to mine bitcoin. Visit compassmining.io to start mining bitcoin today!

Choice is rebuilding the way bitcoiners approach retirement by making it possible to invest in bitcoin and 19 other digital assets inside your IRA. Choice enables you to trade real bitcoin, other crypto, and stocks without having to pay a dime in capital gains. Join me and the 20,000 other bitcoiners who have started their tax-efficient stack, and open your Choice Account today. Search ‘stack sats’ in the app store or visit www.choiceapp.io/pomp

BlockFi provides financial products for crypto investors. Products include high-yield interest accounts, USD loans, and no fee trading. To start earning today visit: http://www.blockfi.com/Pomp

Gemini is a leading regulated cryptocurrency exchange, wallet, and custodian that makes it simple and secure to buy, sell, store, and earn bitcoin, ether, and over 40 other cryptocurrencies. Open a free account in under 3 minutes at gemini.com/pomp and get $20 of bitcoin after you trade $100 or more within 30 days.

CityCoins are programmable tokens that allow citizens to become stakeholders in their favourite cities. MiamiCoin was the first CityCoin launched and within it’s first two months it has already raised over $10 million USD in donations for the City of Miami. Join the CityCoins Discord to become part of the community, and help us build towards a crypto civilization.

Crypto.com allows you to buy, sell, store, earn, loan, and invest various cryptocurrencies in an user-friendly mobile app. Join over one million users today. You can download and earn $50 USD with my code “pomp” when you sign up for one of their metal cards today.

Circle Yield offers qualified businesses superior returns on USDC holdings for terms of up to 12 months. Managed by professional financial institutions, Circle Yield is the best way to earn returns on your USDC. Visit circle.com/pomp today; terms apply.

Nasdaq-listed BTCS was the first US-public company to secure today’s top layer one protocols. Recently, BTCS launched the beta version of its digital asset analytics dashboard! From across multiple exchanges, the BTCS Data Analytics Dashboard lets you evaluate your entire portfolio’s performance with plans to add year-end reports and yield earning on your crypto through linking to staking pools. Test out the BTCS Data Analytics Dashboard today at BTCS.com

LMAX Digital is the market-leading solution for institutional crypto trading & custodial services - offering clients a regulated, transparent and secure trading environment, together with the deepest pool of crypto liquidity. LMAX Digital is also a primary price discovery venue, streaming real-time market data to the industry’s leading analytics platforms. LMAX Digital - secure, liquid, trusted. Learn more at LMAXdigital.com/pomp

Okcoin is one of the most popular licensed exchanges. Okcoin is the first to bring new cryptos to market, offering some of the lowest fees in the industry, an easy to use app, and Earn feature! It’s easier than ever to sign up, buy and trade crypto in just 2 minutes on Okcoin with credit & debit cards or just link your bank account to the best new crypto assets. So get started, and go to okcoin.com/pomp

Matrixport is Asia’s fastest growing digital asset platform with $10 billion in assets under management and custody. It offers one-stop crypto financial solutions including fixed income, DeFi in 1-click, structured products, Cactus Custody™, spot OTC and lending. Go download the Matrixport App and enjoy a welcome offer of 30% APY on USDC for new users.

Ethernity.io is the world’s first authenticated and licensed NFT platform, trusted by over 150,000 members. Visit Ethernity.io, where you can buy and sell authenticated NFTs from top notable figures, rights, license, and IP holders you can’t find anywhere else; the start of an entire ecosystem bringing utility to #NFTs.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable.

Nothing in this email is intended to serve as financial advice. Do your own research.

You’re a free subscriber to The Pomp Letter. For the full experience, become a paid subscriber.