| Week ending February 23, 2018 |

A narrow retreat signals stabilizing commodity prices

|

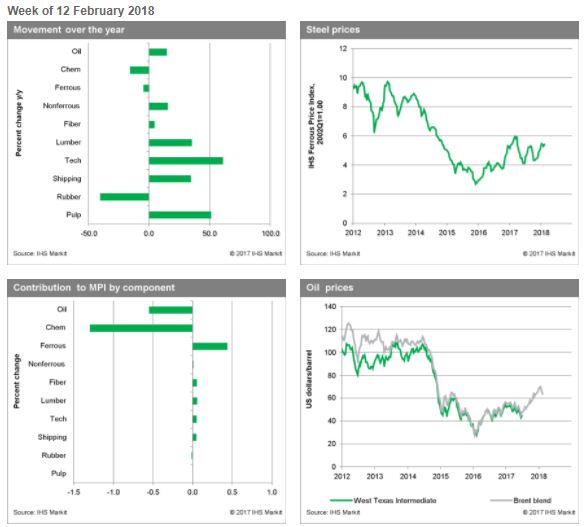

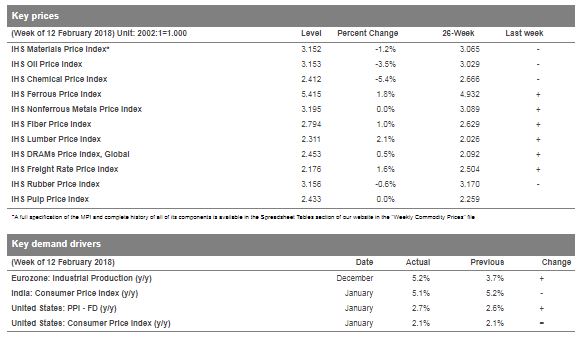

Chemicals and oil lead the retreat in commodity prices

The IHS Materials Price Index (MPI) fell 1.2% last week, its third consecutive decline, putting the index's year-to-date change in negative territory. Only three subindexes fell last week, while two stayed flat; the relatively narrow retreat helps to highlight that commodity markets, in fact, showed a degree of stability after two volatile weeks.

Chemicals led the fall in prices last week, declining 5.4% as ample supply continues to weigh on prices. Ethylene prices fell 9.5% as downstream demand continued to experience woes. In propylene markets, prices fell another 3.0% as dehydrogenation plant operations improved and inventory levels pushed higher. Crude oil prices dropped 3.5%, which also put downward pressure on chemicals. US crude markets remain well supplied with the Energy Information Administration (EIA) reporting an inventory build of 1.8 million barrels last week as refinery operations slowed.

Data releases last week helped market jitters recede and prices stabilize. In the United States, January’s Consumer Price Index report came in a bit higher than expected, but not alarmingly so. Meanwhile, consumer sentiment remains strong despite the volatility of the last two weeks—the Bloomberg Consumer Comfort Index rose to 57.0, a new high for the expansion. Data on industrial production in the Eurozone and India indicated continued strength in December, which also seemed to buoy commodity markets in the absence of any hard data from China because of the New Year holiday. A looming threat, however, did emerge last week with release by the US Commerce Department of the section 232 steel and aluminum reports. Both reports concluded that imports are "weakening our internal economy" and open the door to wide-ranging and potentially severe trade actions.

|

|

|

| | IHS Materials Price Index |  |

|

| |

| Market Insight

For an overview of the IHS Materials Price Index, view this video.

Get the Materials Price Index delivered to your in-box weekly.

Subscribe here.

|

|  |

| | |

|

| Industrial Materials: Prices |  |

| Key Prices & Demand Drivers |  |

Construction Labor Costs Reach Highest Level in Almost Three Years, IHS Markit Says

|

Construction costs rose again in November, according to IHS Markit and the Procurement Executives Group (PEG). |

The current headline IHS Markit PEG Engineering and Construction Cost Index registered 60.2, supported by strong figures in both the materials/equipment and labor sub-indexes. The materials/equipment price index was 60.9 in November, moving up from the October figure of 58.9. Price increases were widespread. Current subcontractor labor prices rose at a fast pace in November: the index figure came in at 58.5, the highest reading since December 2014. “Subcontractor rates continued to accelerate over November and expectations for future increases reached a five-year high,” said Emily Crowley, principal economist - pricing and purchasing, IHS Markit. “Tightening labor market conditions combined with an uptick in activity are driving expectations of future rate increases. Currently the U.S. South and West are having the most trouble finding workers leading to stronger wage escalation, whereas the end of major projects in Eastern Canada are keeping pressure off of wages in that region.”

| | Learn More |

|

| About IHS Pricing & Purchasing | | The IHS Pricing & Purchasing Service | The IHS Pricing & Purchasing Service enables supply chain cost savings by providing timely, accurate price forecasts and cost analysis. Armed with a better understanding of suppliers' cost structures and market dynamics, organizations can effectively negotiate prices, strategically time buys, and boost the bottom line.

With a database of more than 80,000 historic prices and thousands of price, wage and input cost forecasts, IHS offers more coverage than any other provider in the market. IHS has been providing forecasts of key commodity, labor, and input costs since 1970 -- helping define the purchasing advice industry. | | Learn More |

|

| Commodity Price Forecasts & Supply Chain Cost Benchmarking. Learn More | | |

|

|

|