| Week ending January 5, 2017 |

Broad-based commodity price gains continue in the final week of 2017

|

Commodity prices end 2017 on a high, with the latest uptrend stretching back to October.

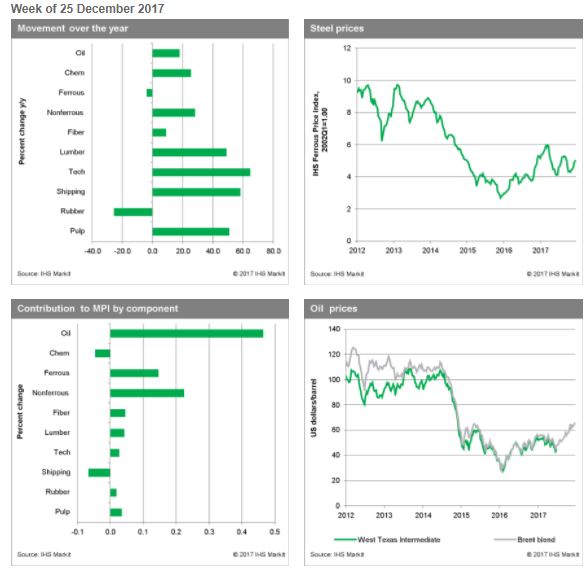

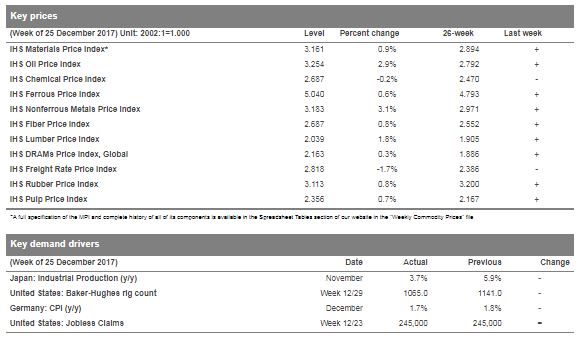

The IHS Markit Materials Price Index (MPI) increased by 0.9% last week, continuing the upward run that stretches back to October. Last week’s gain was broad-based, with only the chemicals and freight sub-indices posting falls. Nonferrous metals and oil were the biggest movers, up 3.1% and 2.9%, respectively.

Our nonferrous metal index has surged over the last two weeks, up over 6%, to hit its highest level since late 2011. Copper, aluminum, and nickel have all moved up strongly on optimism over global manufacturing and construction activity. Oil prices also gained, with the Brent price hitting the highest weekly level since 2014 on supply disruptions (Libya, Venezuela, and the Forties Pipeline) and political unrest in Iran.

Last week was a relatively quiet week with the Christmas holiday minimizing the number of data releases. This said, the new year begins with real momentum in commodity markets. Fiscal stimulus in the United States will reinforce an already solid global manufacturing expansion. The question is, are markets becoming a bit exuberant or complacent? Volatility is extremely low, while trading volumes in many markets are thin, reflecting a normal holiday lull. Watch long interest rates and the US dollar. Yields on 10-year US Treasuries are projected to rise in 2018, as policy accommodation is withdrawn, while the US dollar will receive support because of positive interest rate differentials and overseas profits moving back to the United States because of tax cuts. Neither development is supportive of a continuing rally in commodity prices.

|

|

|

| | IHS Materials Price Index |  |

|

| |

| Market Insight

For an overview of the IHS Materials Price Index, view this video.

Get the Materials Price Index delivered to your in-box weekly.

Subscribe here.

|

|  |

| | |

|

| Industrial Materials: Prices |  |

| Key Prices & Demand Drivers |  |

Construction Labor Costs Reach Highest Level in Almost Three Years, IHS Markit Says

|

Construction costs rose again in November, according to IHS Markit and the Procurement Executives Group (PEG). |

The current headline IHS Markit PEG Engineering and Construction Cost Index registered 60.2, supported by strong figures in both the materials/equipment and labor sub-indexes. The materials/equipment price index was 60.9 in November, moving up from the October figure of 58.9. Price increases were widespread. Current subcontractor labor prices rose at a fast pace in November: the index figure came in at 58.5, the highest reading since December 2014. “Subcontractor rates continued to accelerate over November and expectations for future increases reached a five-year high,” said Emily Crowley, principal economist - pricing and purchasing, IHS Markit. “Tightening labor market conditions combined with an uptick in activity are driving expectations of future rate increases. Currently the U.S. South and West are having the most trouble finding workers leading to stronger wage escalation, whereas the end of major projects in Eastern Canada are keeping pressure off of wages in that region.”

| | Learn More |

|

| About IHS Pricing & Purchasing | | The IHS Pricing & Purchasing Service | The IHS Pricing & Purchasing Service enables supply chain cost savings by providing timely, accurate price forecasts and cost analysis. Armed with a better understanding of suppliers' cost structures and market dynamics, organizations can effectively negotiate prices, strategically time buys, and boost the bottom line.

With a database of more than 80,000 historic prices and thousands of price, wage and input cost forecasts, IHS offers more coverage than any other provider in the market. IHS has been providing forecasts of key commodity, labor, and input costs since 1970 -- helping define the purchasing advice industry. | | Learn More |

|

| Commodity Price Forecasts & Supply Chain Cost Benchmarking. Learn More | | |

|

|

|