| Week ending November 24, 2017 |

Chemical price surge masks softness in commodity markets

|

Commodity markets begin to show weakness as economic data softens in China

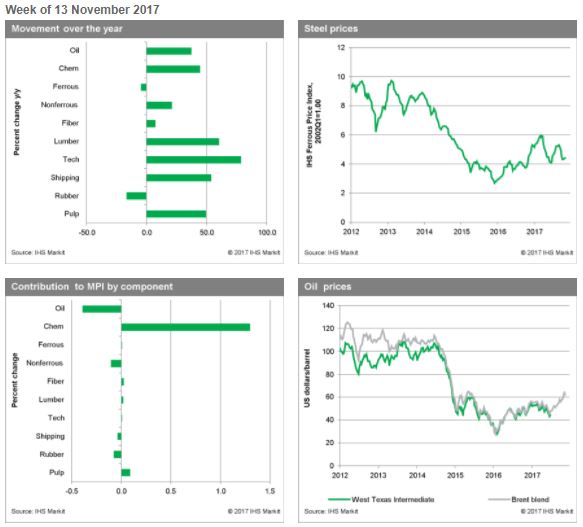

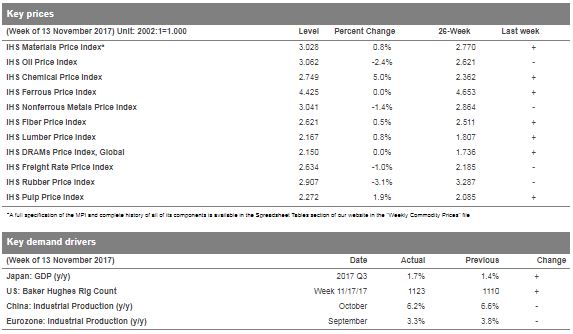

The IHS Materials Price Index (MPI) gained 0.8% last week, building on a 2.7% increase the prior week, and closing in on its highest level since February. However, gains last week were not broad-based, with the chemicals subindex soaring 5.0% masking declines or anemic growth in nearly all other subindexes.

Chemical prices rose strongly on a supply squeeze for benzene in the US Gulf Coast brought on by residual effects from Hurricane Harvey and a handful of unplanned operational issues in October. In contrast to chemicals, a number of the MPI's subindexes posted declines, including oil, nonferrous metals, and rubber. Rubber prices have been extremely volatile in 2017, falling nearly 50% since peaking in February. Rubber's decline can be traced to worries about oversupply and slowing in top buyer China.

Last week there were several softer macroeconomic announcements, although it was developments in China that sent a shudder through commodity markets. Chinese industrial production for October showed year-over-year (y/y) growth at 6.2%, down from 6.6% in September. China's central bank also staged its largest intervention in over a year, injecting $47 billion into financial markets to calm fears that the crackdown on debt-fueled growth will slow the economy sharply. The move did steady the yuan and at week's end helped prevent a more prolonged sell-off in commodity markets. Notwithstanding the Peoples Bank of China's best efforts, we expect slower growth in China, coupled with a slow tightening in financial markets globally, to produce a more benign commodity market environment in 2018.

|

|

|

| | IHS Materials Price Index |  |

|

| |

| Market Insight

For an overview of the IHS Materials Price Index, view this video.

Get the Materials Price Index delivered to your in-box weekly.

Subscribe here.

|

|  |

| | |

|

| Industrial Materials: Prices |  |

| Key Prices & Demand Drivers |  |

Construction costs rose again in October

|

Construction costs rose again in October, according to IHS Markit and the Procurement Executives Group (PEG). |

The current headline IHS Markit PEG Engineering and Construction Cost Index registered 61.8, up from 58.4 in September.

All downstream materials, ranging from transformers to electrical equipment, showed a higher index figure relative to last month. This is indicative of price increases in raw materials filtering to downstream materials. "Electrical equipment prices will experience modest escalation over the next two years, driven by double-digit increases in the price of copper,” said John Bauman, principal economist - pricing and purchasing, IHS Markit. “However, prices for two other important input categories – fabricated metals and plastics – are expected to weaken and provide some relief.”

| | Learn More |

|

| About IHS Pricing & Purchasing | | The IHS Pricing & Purchasing Service | The IHS Pricing & Purchasing Service enables supply chain cost savings by providing timely, accurate price forecasts and cost analysis. Armed with a better understanding of suppliers' cost structures and market dynamics, organizations can effectively negotiate prices, strategically time buys, and boost the bottom line.

With a database of more than 80,000 historic prices and thousands of price, wage and input cost forecasts, IHS offers more coverage than any other provider in the market. IHS has been providing forecasts of key commodity, labor, and input costs since 1970 -- helping define the purchasing advice industry. | | Learn More |

|

| Commodity Price Forecasts & Supply Chain Cost Benchmarking. Learn More | | |

|

|

|