| Week ending January 19, 2017 |

Commodity markets remain buoyant

|

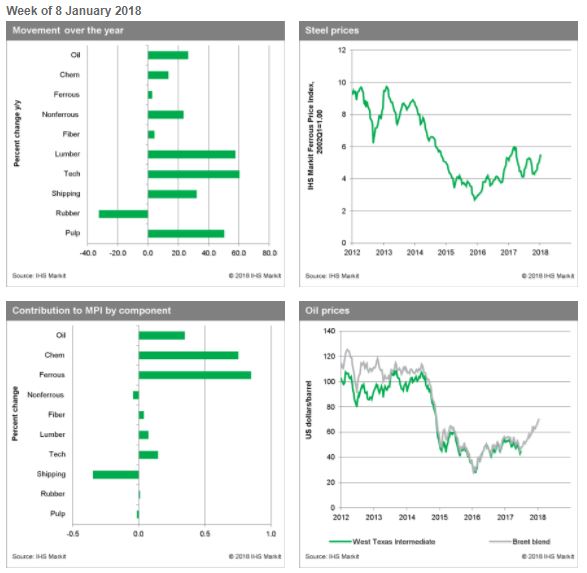

Commodity prices are having a strong start to 2018.

The IHS Materials Price Index (MPI) increased for the 10th consecutive time last week, rising 1.8%. Since early October, when the current rally began, the MPI has risen 15.1%. As has been case since mid-December, gains last week were again broadly based with 7 of the 10 subcomponents rising. Ferrous metals led the rise, climbing 3.6%, while oil prices had another strong week, moving up 2.9%.

Weather-related disruptions in Australia put pressure on iron ore prices, while continued restrictions on the Chinese industry helped lift ore, steel scrap, and finished steel prices. In crude oil markets, US inventories declined for the eighth consecutive week as imports decreased and refinery runs remained elevated, pushing up prices. Data released by the US Commodities Futures Trading Commission last week also indicated a record number of long positions in oil futures markets, highlighting strong investor play in the market that is adding upward momentum to prices.

Data releases continue to reinforce the buoyant mood in markets. In the United States, Bloomberg’s Consumer Confidence Index recorded a 17-year high. In India, industrial production rose by a sharp 8.4% year on year (y/y) in November, driven primarily by increased activity in the manufacturing sector. Industrial production in the Eurozone was also strong, growing by 3.2% y/y in a broadly based expansion. Finally, US dollar weakness is acting to raise prices for all US dollar-dominated commodities, much like a rising tide lifts all boats. While commodity markets are exhibiting real strength to start the year, our caution is that conditions now seem almost too good. We do see several potential headwinds looming in the form of slower Chinese growth, tighter financial markets, and flat or falling oil prices. For the moment, however, commodity markets are providing support for a bullish narrative to the new year.

|

|

|

| | IHS Materials Price Index |  |

|

| |

| Market Insight

For an overview of the IHS Materials Price Index, view this video.

Get the Materials Price Index delivered to your in-box weekly.

Subscribe here.

|

|  |

| | |

|

| Industrial Materials: Prices |  |

| Key Prices & Demand Drivers |  |

Construction Labor Costs Reach Highest Level in Almost Three Years, IHS Markit Says

|

Construction costs rose again in November, according to IHS Markit and the Procurement Executives Group (PEG). |

The current headline IHS Markit PEG Engineering and Construction Cost Index registered 60.2, supported by strong figures in both the materials/equipment and labor sub-indexes. The materials/equipment price index was 60.9 in November, moving up from the October figure of 58.9. Price increases were widespread. Current subcontractor labor prices rose at a fast pace in November: the index figure came in at 58.5, the highest reading since December 2014. “Subcontractor rates continued to accelerate over November and expectations for future increases reached a five-year high,” said Emily Crowley, principal economist - pricing and purchasing, IHS Markit. “Tightening labor market conditions combined with an uptick in activity are driving expectations of future rate increases. Currently the U.S. South and West are having the most trouble finding workers leading to stronger wage escalation, whereas the end of major projects in Eastern Canada are keeping pressure off of wages in that region.”

| | Learn More |

|

| About IHS Pricing & Purchasing | | The IHS Pricing & Purchasing Service | The IHS Pricing & Purchasing Service enables supply chain cost savings by providing timely, accurate price forecasts and cost analysis. Armed with a better understanding of suppliers' cost structures and market dynamics, organizations can effectively negotiate prices, strategically time buys, and boost the bottom line.

With a database of more than 80,000 historic prices and thousands of price, wage and input cost forecasts, IHS offers more coverage than any other provider in the market. IHS has been providing forecasts of key commodity, labor, and input costs since 1970 -- helping define the purchasing advice industry. | | Learn More |

|

| Commodity Price Forecasts & Supply Chain Cost Benchmarking. Learn More | | |

|

|

|