| Week ending November 3, 2017 |

Commodity price gains continue, with technology leading the way

|

The uptick continues with robust economic announcements supporting further price gains

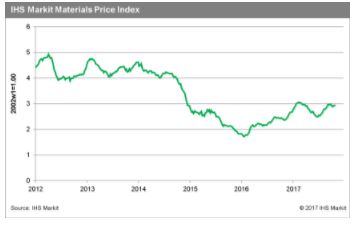

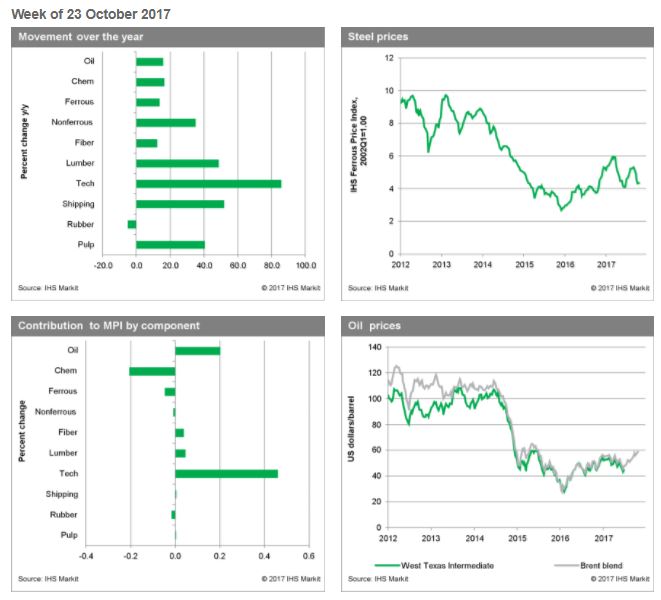

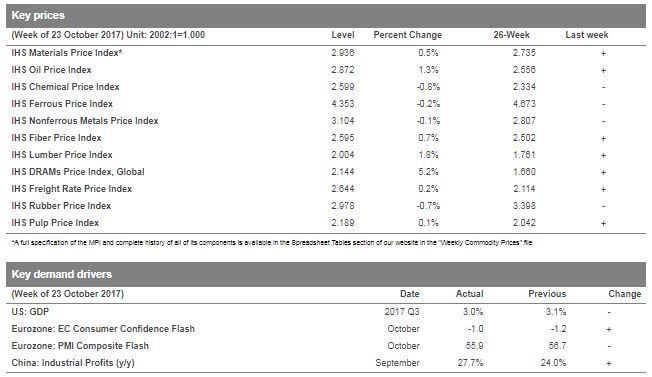

The IHS Markit Materials Price Index (MPI) rose 0.5% last week, building on the strong gains from the prior week. The main drivers last week were technology, with our DRAM sub-index up a whopping 5.2%, while oil and lumber were up 1.3% and 1.8%, respectively.

DRAM prices have seen strong gains over the last month, as supply constraints continue to push up prices. DRAM customers that didn’t secure product via contracts have been left scrambling to meet demand in the spot market and are driving up prices. Oil prices continued higher last week, holding above $60/bbl on expectations that OPEC-led production cuts would be extended beyond March 2018.

Economic data releases last week were generally supportive of higher commodity prices. In the US, third quarter GDP growth came in at 3.0%, stronger than expected. The IHS Markit composite PMI also showed strength, hitting 55.7 with growth in manufacturing centered on new orders and employment gains. In the Eurozone the new EU Commission consumer confidence survey moved higher, reaching -1.0, the highest level since the end of the Great Recession. Chinese data also continue to be good, with recent releases showing industrial profits up 27.7% on the year in September. The one negative for the week was the US dollar, which rose against a basket of currencies, including the Euro and Yuan. Watch interest rate differentials between the US and Europe through the end of the year. They may widen further, lending further support to the US dollar and thereby undercut some of the momentum in commodity markets as the year closes.

|

|

|

| | IHS Materials Price Index |  |

|

| |

| Market Insight

For an overview of the IHS Materials Price Index, view this video.

Get the Materials Price Index delivered to your in-box weekly.

Subscribe here.

|

|  |

| | |

|

| Industrial Materials: Prices |  |

| Key Prices & Demand Drivers |  |

Construction costs rose again in October

|

Construction costs rose again in October, according to IHS Markit and the Procurement Executives Group (PEG). |

The current headline IHS Markit PEG Engineering and Construction Cost Index registered 61.8, up from 58.4 in September.

All downstream materials, ranging from transformers to electrical equipment, showed a higher index figure relative to last month. This is indicative of price increases in raw materials filtering to downstream materials. "Electrical equipment prices will experience modest escalation over the next two years, driven by double-digit increases in the price of copper,” said John Bauman, principal economist - pricing and purchasing, IHS Markit. “However, prices for two other important input categories – fabricated metals and plastics – are expected to weaken and provide some relief.”

| | Learn More |

|

| About IHS Pricing & Purchasing | | The IHS Pricing & Purchasing Service | The IHS Pricing & Purchasing Service enables supply chain cost savings by providing timely, accurate price forecasts and cost analysis. Armed with a better understanding of suppliers' cost structures and market dynamics, organizations can effectively negotiate prices, strategically time buys, and boost the bottom line.

With a database of more than 80,000 historic prices and thousands of price, wage and input cost forecasts, IHS offers more coverage than any other provider in the market. IHS has been providing forecasts of key commodity, labor, and input costs since 1970 -- helping define the purchasing advice industry. | | Learn More |

|

| Commodity Price Forecasts & Supply Chain Cost Benchmarking. Learn More | | |

|

|

|