| Week ending September 8, 2017 |

The strength in underlying industrial activity continues across the global economy.

|

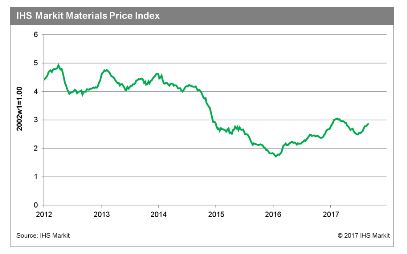

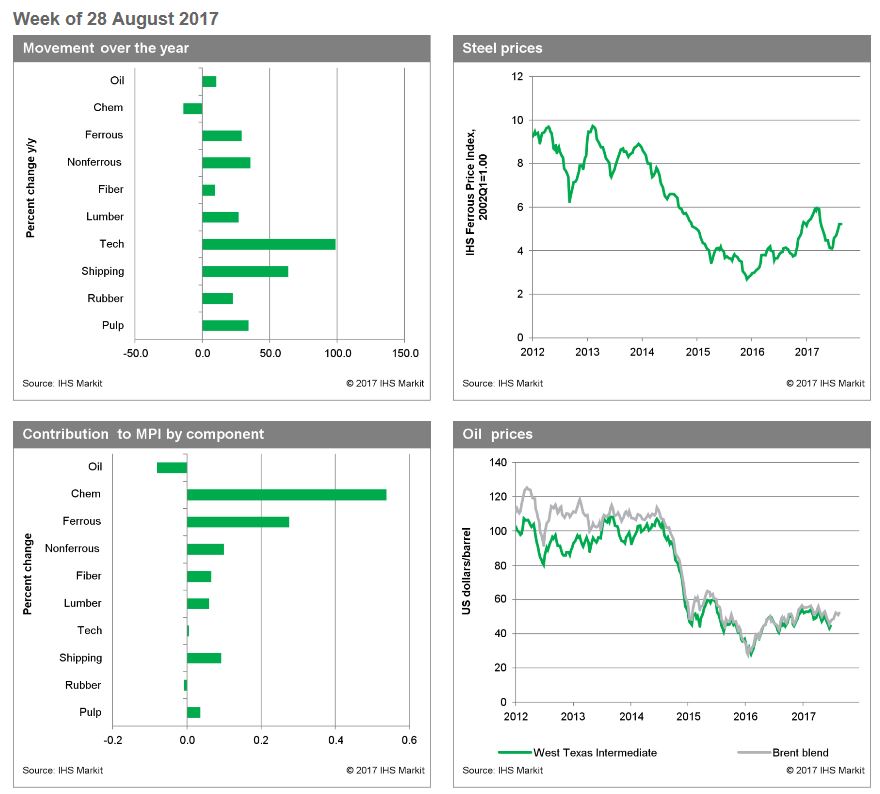

The IHS Markit Materials Price Index (MPI) advanced again last week, rising 1.1%. Once more, the rise in prices was fairly broad based, with only the oil and rubber subindexes slipping. In particular chemicals, freight, and lumber rose most strongly, up 2.2%, 2.7%, and 2.6%, respectively.

North American chemical prices rose as the fallout from Hurricane Harvey continued. Freight rates into Asia climbed on higher oil prices the previous week and the still-strong demand for capacity from the iron ore sector. Lumber prices gained last week as wildfires spread in British Colombia and the prospect of a jump in demand following the destruction caused by Hurricane Harvey.

Data releases last week continued to provide support to the current rally. In the Eurozone, economic sentiment reached a post-financial crisis high, hitting 111.9, with only Germany experiencing a slight decline. In China, the Caixin Manufacturing PMI rose to 51.6 in August, the third consecutive increase and the highest level since February, continuing a rebound from a minor contraction in May. Weakness in the US dollar, as markets remain focused on the US federal debt ceiling, also continued to boost commodity prices. Global optimism remains strong and while we do see headwinds ahead, markets are carrying real momentum. Our caution is that price increases have been almost too strong in some cases, pushing ahead of fundamentals and exposing some markets to a profit-taking correction in the fourth quarter. Watch Chinese money supply growth. It has been slowing since late 2016 as authorities have cautiously worked to tighten financial markets. Given normal lags, this tightening should become evident in the real economy and, in particular, in the industrial sector shortly.

|

|

|

| | IHS Materials Price Index |  |

|

| |

| Market Insight

For an overview of the IHS Materials Price Index, view this video.

Get the Materials Price Index delivered to your in-box weekly.

Subscribe here.

|

|  |

| | |

|

| Industrial Materials: Prices |  |

| Key Prices & Demand Drivers |  |

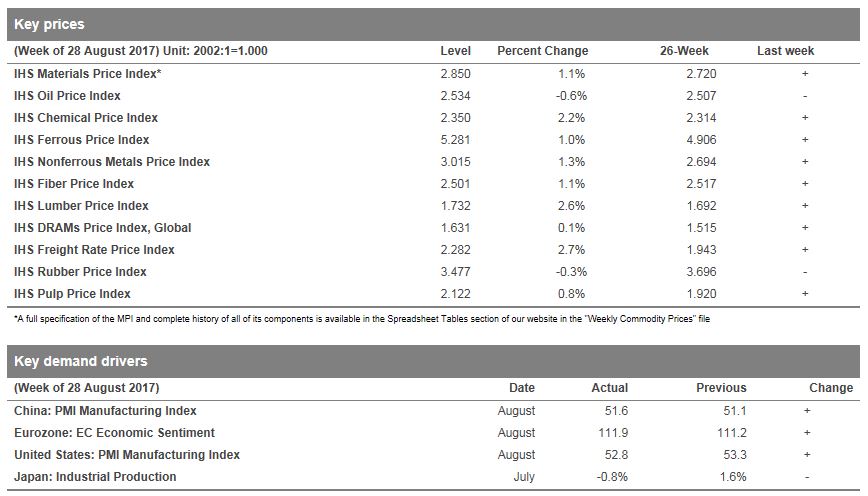

Construction Costs Rise for 10th Consecutive Month

|

Construction costs rose again in August, according to IHS Markit and the Procurement Executives Group (PEG).

|

The headline IHS Markit PEG Engineering and Construction Cost Index registered 54.0, up from 51.3 in July. Both material/equipment and labor sub-indexes registered rising prices.

The materials/equipment price index registered 54.2 in August, slightly higher than the July figure of 52.4. Price increases were uneven. Copper-based wire and cable increased once again, approaching the index figures last seen at the beginning of 2017.

“Commodity prices have risen strongly in the past seven weeks, with copper on the London Metal Exchange, jumping 14 percent between early June and August,” said John Mothersole, director Pricing and Purchasing, IHS Markit. “Better data from China, a softer U.S. dollar and new fears about mine supply disruptions have combined to lift prices. The market, however, looks overbought. If possible, we would avoid purchases at the moment and await what we believe will be a modest correction.”

| | Learn More |

|

| About IHS Pricing & Purchasing | | The IHS Pricing & Purchasing Service | The IHS Pricing & Purchasing Service enables supply chain cost savings by providing timely, accurate price forecasts and cost analysis. Armed with a better understanding of suppliers' cost structures and market dynamics, organizations can effectively negotiate prices, strategically time buys, and boost the bottom line.

With a database of more than 80,000 historic prices and thousands of price, wage and input cost forecasts, IHS offers more coverage than any other provider in the market. IHS has been providing forecasts of key commodity, labor, and input costs since 1970 -- helping define the purchasing advice industry. | | Learn More |

|

| Commodity Price Forecasts & Supply Chain Cost Benchmarking. Learn More | | |

|

|

|