| Week ending October 20, 2017 |

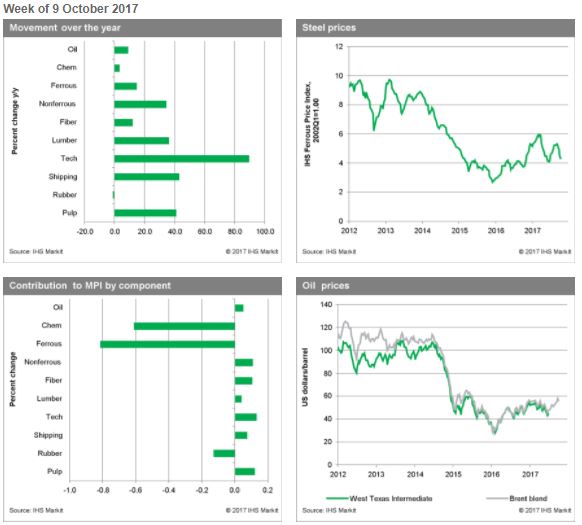

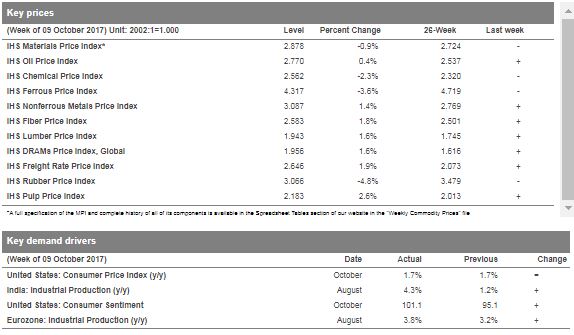

Commodity prices fall again, as ferrous metals and chemicals continue to retreat from recent highs

|

The sharp fall in iron ore prices has been driving declines in the overall index for the past two weeks.

The IHS Markit Materials Price Index (MPI) fell 0.9% last week, exacerbating a 2.3% drop from the previous week. Again, it was only a narrow subset of subindexes that contributed to the decline, with chemicals, ferrous metals, and rubber all plummeting.

Ferrous metal prices have been in a significant decline since early September, when iron ore prices began to slump when buying in China slowed. For chemical prices, the strong uptrend we saw in mid-September—the result of Hurricane Harvey-related disruption—has begun to unwind because the expected supply shortages did not materialize.

Macroeconomic data last week were sparse, but mostly positive. In Europe, industrial production growth continues to power ahead, with the Eurozone showing growth in August of 3.8% year over year (y/y). Strong growth in Germany and Italy was matched against more muted growth in France. In the United States, consumer confidence surged during October, hitting 101.1, the highest level in 13 years. Inflation also remains subdued, as highlighted in the US core consumer price index for September—it remained unchanged at just 1.7% y/y, a rate that has not changed since May. Weak inflation globally has markets expecting that central banks will continue to provide stimulus, policies that have been supportive of the entire commodity complex. However, the US Federal Reserve has already announced a gradual withdrawal of stimulus, prompting concerns regarding the level of support that central bank policy can continue to provide for commodity prices. The question arises, however, as to how commodity prices can continue to rise strongly when aggregate inflation remains persistently weak.

|

|

|

| | IHS Materials Price Index |  |

|

| |

| Market Insight

For an overview of the IHS Materials Price Index, view this video.

Get the Materials Price Index delivered to your in-box weekly.

Subscribe here.

|

|  |

| | |

|

| Industrial Materials: Prices |  |

| Key Prices & Demand Drivers |  |

Construction Costs Rise to Highest Point in Past Year, IHS Markit says

|

Construction costs rose to the highest point in the last year in September, according to IHS Markit and the Procurement Executives Group (PEG). |

The headline IHS Markit PEG Engineering and Construction Cost Index registered 58.4, up from 54.0 in August. Both material/equipment and labor sub-indexes registered rising prices. Ocean freight, both from Asia to the U.S. and Europe to the U.S. were among the largest movers compared to last month.

“Global demand for marine transportation is improving, both in the bulk segment and in the container segment,” said Paul Robinson, associate director, Pricing and Purchasing at IHS Markit. “On the bulk side, the primary driver is food products, on the container side, intraregional trade is driving some of the gain, especially in East Asia. Buyers outside of the United States should avoid locking in rates until prices pull back in 2018.”

| | Learn More |

|

| About IHS Pricing & Purchasing | | The IHS Pricing & Purchasing Service | The IHS Pricing & Purchasing Service enables supply chain cost savings by providing timely, accurate price forecasts and cost analysis. Armed with a better understanding of suppliers' cost structures and market dynamics, organizations can effectively negotiate prices, strategically time buys, and boost the bottom line.

With a database of more than 80,000 historic prices and thousands of price, wage and input cost forecasts, IHS offers more coverage than any other provider in the market. IHS has been providing forecasts of key commodity, labor, and input costs since 1970 -- helping define the purchasing advice industry. | | Learn More |

|

| Commodity Price Forecasts & Supply Chain Cost Benchmarking. Learn More | | |

|

|

|