| Week ending October 27, 2017 |

Commodity prices jump, led by increases in oil and chemicals

|

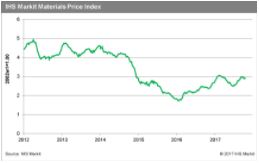

The MPI rebounds after falling the previous two weeks

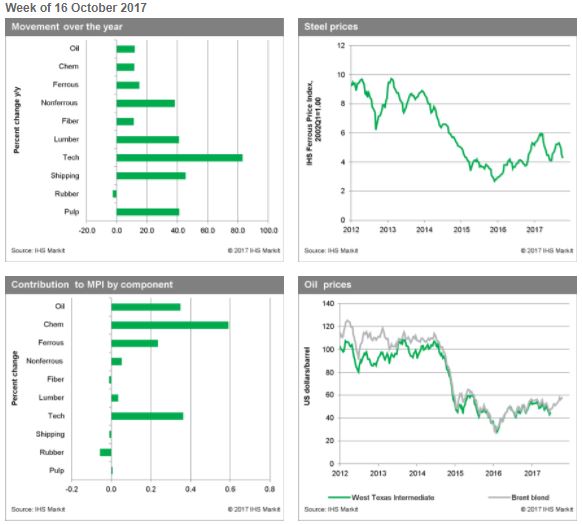

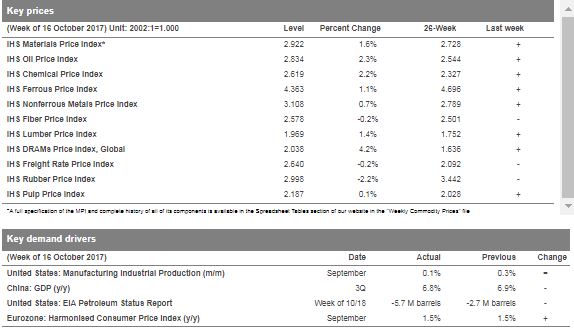

The IHS Markit Materials Price Index (MPI) rose 1.6% last week, its strongest increase since late August, breaking a two-week streak of losses. The expansion was broadly based, with seven of ten sub-indices increasing. Oil and chemical prices posted strong gains, increasing by 2.3% and 2.2%, respectively, while DRAM prices rose 4.2%.

Data releases were supportive of oil prices last week; the Baker-Hughes rig count fell for the third consecutive time with crude oil inventories also falling. Additionally, tensions in northern Iraq between government and Kurdish forces created unease in markets, putting upward pressure on prices. Higher oil prices moved to downstream products, particularly chemicals. The recent strength in oil prices will not persist—markets are overheated and prices will retreat as production increases. As for DRAM markets, supply constraints are continuing to push up prices, a trend we have seen persist over the past three weeks.

With the exception of China, data releases last week did not reflect the strength in the MPI. In the United States, the manufacturing component of the Industrial Production report was disappointing, increasing only 0.1% (m/m). In the Eurozone, the Harmonized Index of Consumer Prices (HICP) increased 0.4% (m/m), coming in as expected. Alternatively, in China, the surprising strength seen this year persisted; GDP for the third quarter increased by 6.8% (y/y), only 0.1% lower than in the second quarter. Chinese industrial value added output grew 6.6% (y/y) in September, faster than in August, but still below the rates of growth recorded in the first and second quarters. Although the latest data from China look promising, and have excited commodity markets, we do not expect this strength to continue. Slower growth in China, combined with our outlook for oil prices and tighter financial markets, is expected to produce a change in commodity markets; upside risk will be limited for prices in the near term.

|

|

|

| | IHS Materials Price Index |  |

|

| |

| Market Insight

For an overview of the IHS Materials Price Index, view this video.

Get the Materials Price Index delivered to your in-box weekly.

Subscribe here.

|

|  |

| | |

|

| Industrial Materials: Prices |  |

| Key Prices & Demand Drivers |  |

Construction Costs Rise to Highest Point in Past Year, IHS Markit says

|

Construction costs rose to the highest point in the last year in September, according to IHS Markit and the Procurement Executives Group (PEG). |

The headline IHS Markit PEG Engineering and Construction Cost Index registered 58.4, up from 54.0 in August. Both material/equipment and labor sub-indexes registered rising prices. Ocean freight, both from Asia to the U.S. and Europe to the U.S. were among the largest movers compared to last month.

“Global demand for marine transportation is improving, both in the bulk segment and in the container segment,” said Paul Robinson, associate director, Pricing and Purchasing at IHS Markit. “On the bulk side, the primary driver is food products, on the container side, intraregional trade is driving some of the gain, especially in East Asia. Buyers outside of the United States should avoid locking in rates until prices pull back in 2018.”

| | Learn More |

|

| About IHS Pricing & Purchasing | | The IHS Pricing & Purchasing Service | The IHS Pricing & Purchasing Service enables supply chain cost savings by providing timely, accurate price forecasts and cost analysis. Armed with a better understanding of suppliers' cost structures and market dynamics, organizations can effectively negotiate prices, strategically time buys, and boost the bottom line.

With a database of more than 80,000 historic prices and thousands of price, wage and input cost forecasts, IHS offers more coverage than any other provider in the market. IHS has been providing forecasts of key commodity, labor, and input costs since 1970 -- helping define the purchasing advice industry. | | Learn More |

|

| Commodity Price Forecasts & Supply Chain Cost Benchmarking. Learn More | | |

|

|

|