| Week ending November 10, 2017 |

Commodity prices record a modest retreat

|

The MPI sees modest movement for the second week in a row.

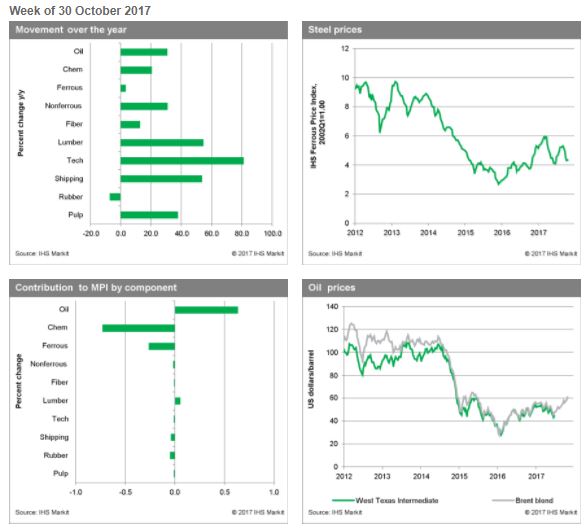

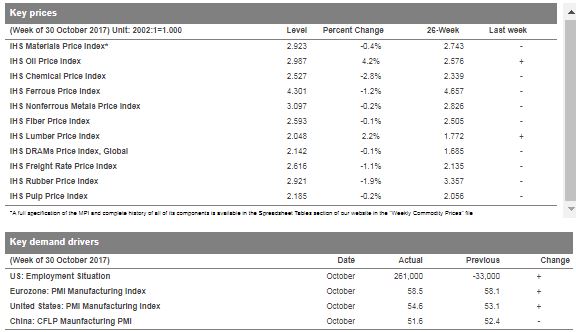

The IHS Materials Price Index (MPI) fell by 0.4% last week, its third decline in the past five weeks. While the decline was relatively modest, it was broadly based, with eight of ten subindexes falling, the first time since June that a majority of the MPI's subcomponents have been down in the same week.

Chemical prices showed the sharpest decline, falling 2.8%, although rubber, freight rates, and ferrous metal price subindexes all saw declines of more than 1.0%. Oil prices were the outlier last week, rising a relatively strong 4.2%. Declining US oil inventories and tensions in the Middle East helped drive prices higher.

There are a number of interrelated factors behind the recent change in commodities, none by themselves particularly strong, but collectively enough to undercut some of the market's recent momentum. First, October's manufacturing PMIs, while globally showing a continuing expansion, did post some lackluster readings in China and in a number of other Asian economies. Second, a subtle change in monetary policy may be starting to produce a slow drag. US interest rates have been rising for almost two years now, while in China, key long-term interest rates are up by roughly 100 basis points in the past year. Even in Europe, conditions are beginning to change, highlighted by the Bank of England lifting its Bank Rate last week for the first time in 10 years. Finally, the US dollar has rebounded since early September, a change in currency markets that corresponds almost exactly to the recent change in tone in commodity markets. The past five weeks are still too short to constitute a trend. However, we believe the combination of slower growth in China, an end to extremely loose conditions in financial markets and stable oil prices will create a change in commodity markets during 2018, with the strong price increases that have characterized the past seven quarters ending.

|

|

|

| | IHS Materials Price Index |  |

|

| |

| Market Insight

For an overview of the IHS Materials Price Index, view this video.

Get the Materials Price Index delivered to your in-box weekly.

Subscribe here.

|

|  |

| | |

|

| Industrial Materials: Prices |  |

| Key Prices & Demand Drivers |  |

Construction costs rose again in October

|

Construction costs rose again in October, according to IHS Markit and the Procurement Executives Group (PEG). |

The current headline IHS Markit PEG Engineering and Construction Cost Index registered 61.8, up from 58.4 in September.

All downstream materials, ranging from transformers to electrical equipment, showed a higher index figure relative to last month. This is indicative of price increases in raw materials filtering to downstream materials. "Electrical equipment prices will experience modest escalation over the next two years, driven by double-digit increases in the price of copper,” said John Bauman, principal economist - pricing and purchasing, IHS Markit. “However, prices for two other important input categories – fabricated metals and plastics – are expected to weaken and provide some relief.”

| | Learn More |

|

| About IHS Pricing & Purchasing | | The IHS Pricing & Purchasing Service | The IHS Pricing & Purchasing Service enables supply chain cost savings by providing timely, accurate price forecasts and cost analysis. Armed with a better understanding of suppliers' cost structures and market dynamics, organizations can effectively negotiate prices, strategically time buys, and boost the bottom line.

With a database of more than 80,000 historic prices and thousands of price, wage and input cost forecasts, IHS offers more coverage than any other provider in the market. IHS has been providing forecasts of key commodity, labor, and input costs since 1970 -- helping define the purchasing advice industry. | | Learn More |

|

| Commodity Price Forecasts & Supply Chain Cost Benchmarking. Learn More | | |

|

|

|