| Week ending November 17, 2017 |

Commodity prices record strongest week in two months

|

The MPI surges after seeing two weeks of modest movement.

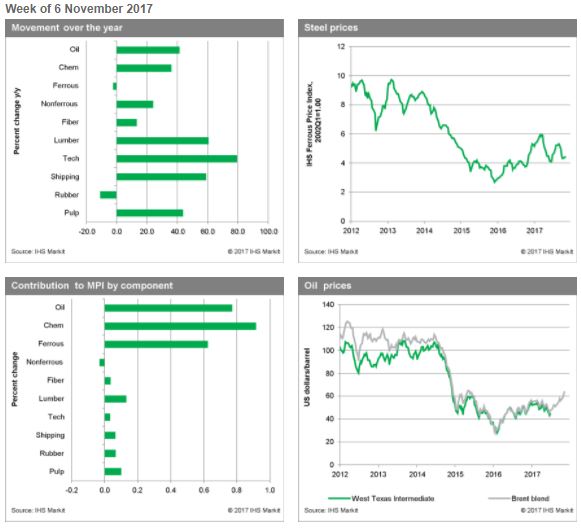

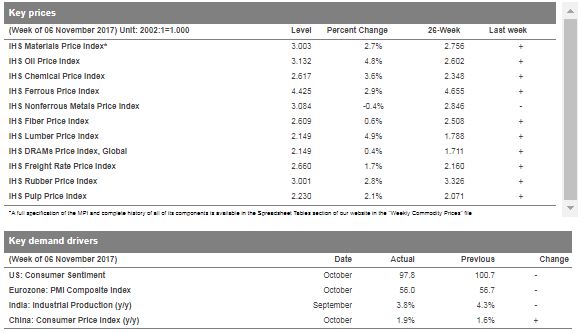

The IHS Markit Materials Price Index (MPI) gained 2.7% last week, its largest jump since the first week of September. The rise in prices was broadly based, with nine of ten subcomponents increasing. Oil and lumber were the biggest movers, increasing by 4.8% and 4.9%, respectively.

Oil prices rose again last week as geopolitical tensions roiled markets, particularly in Saudi Arabia. Despite the recent strength in oil markets, our view of fundamentals is that the upside is limited. This said, downstream industries are beginning to feel the impact of surging oil prices, most notably chemicals, where prices rose 3.6% last week. Lumber prices climbed in response to a decision from the Department of Commerce in favor of countervailing and antidumping duties on Canadian softwood lumber imports. In the near term, lumber prices face additional upside risk.

Fresh data help explain the upbeat mood in commodity markets last week. In the Eurozone, the IHS Markit Composite PMI recorded another strong month at 56.0, slightly above expectations. In China, increases in both the producer and consumer price indexes came in a bit stronger than expected, a sign that aggregate demand remains healthy. Furthermore, industrial production in India showed robust growth in September, increasing 3.8% y/y. Notwithstanding their strength last week, or indeed, the general strength in commodity markets since late June, we see a change ahead. Slowing growth in China, tighter monetary policies, and flat oil prices signals a more benign commodity market environment in 2018.

|

|

|

| | IHS Materials Price Index |  |

|

| |

| Market Insight

For an overview of the IHS Materials Price Index, view this video.

Get the Materials Price Index delivered to your in-box weekly.

Subscribe here.

|

|  |

| | |

|

| Industrial Materials: Prices |  |

| Key Prices & Demand Drivers |  |

Construction costs rose again in October

|

Construction costs rose again in October, according to IHS Markit and the Procurement Executives Group (PEG). |

The current headline IHS Markit PEG Engineering and Construction Cost Index registered 61.8, up from 58.4 in September.

All downstream materials, ranging from transformers to electrical equipment, showed a higher index figure relative to last month. This is indicative of price increases in raw materials filtering to downstream materials. "Electrical equipment prices will experience modest escalation over the next two years, driven by double-digit increases in the price of copper,” said John Bauman, principal economist - pricing and purchasing, IHS Markit. “However, prices for two other important input categories – fabricated metals and plastics – are expected to weaken and provide some relief.”

| | Learn More |

|

| About IHS Pricing & Purchasing | | The IHS Pricing & Purchasing Service | The IHS Pricing & Purchasing Service enables supply chain cost savings by providing timely, accurate price forecasts and cost analysis. Armed with a better understanding of suppliers' cost structures and market dynamics, organizations can effectively negotiate prices, strategically time buys, and boost the bottom line.

With a database of more than 80,000 historic prices and thousands of price, wage and input cost forecasts, IHS offers more coverage than any other provider in the market. IHS has been providing forecasts of key commodity, labor, and input costs since 1970 -- helping define the purchasing advice industry. | | Learn More |

|

| Commodity Price Forecasts & Supply Chain Cost Benchmarking. Learn More | | |

|

|

|