| Week ending April 6, 2018 |

Commodity prices slip again even as global economy still expands

|

Supply remains ample in commodity markets, while policy developments are creating uncertainty

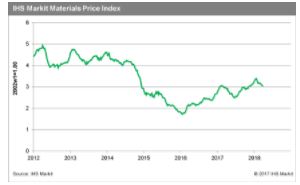

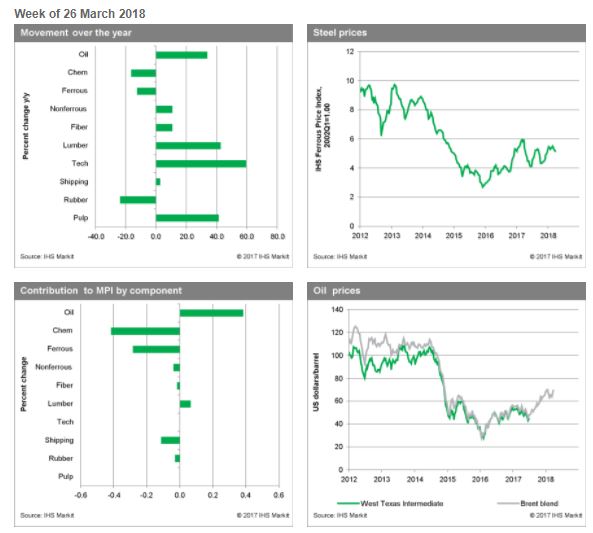

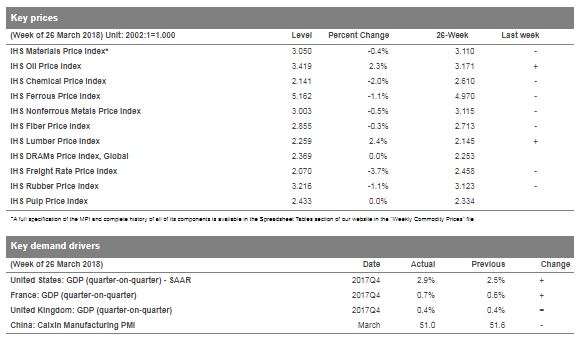

The IHS Markit Materials Price Index (MPI) fell 0.4% last week, its eighth retreat in the last nine weeks. The decline was once again broadly based, with six of the MPI’s ten subcomponents falling, while two more stayed flat. Freight rates and chemicals drove the decline in commodity prices, falling 3.7% and 2.0%, respectively.

Freight rates fell last week as iron ore prices continued to exhibit weakness, dropping for the fourth consecutive week. Softness in iron ore prices reflects fundamentals reasserting themselves; prices had reached unsustainable levels on the expectation of stronger Chinese demand, but are now retreating because fresh stimulus from the Chinese government looks less likely. Chemical prices have fallen for five consecutive weeks, with oversupply and bearish sentiment continuing to weigh on the market.

Data releases reflect a trend that we have seen emerge over the last two months: good supplies and policy uncertainty are creating volatility even though global economic growth remains healthy. US GDP growth for the fourth quarter was revised up to a 2.9% annualized rate, beating consensus expectations. GDP releases were also positive in Europe, as was the March IHS Markit Flash Eurozone PMI. In Asia, the Caixin Manufacturing PMI for China fell to a four-month low of 51, but still signaled a slow expansion. The question going forward is whether increasing policy uncertainties will begin to affect growth. We do not believe so in a meaningful way, but it has certainly undercut the optimism with which commodity markets started the year.

ANNOUNCEMENT:

Starting April 19, 2018, the weekly Pricing Pulse Newsletter will no longer be emailed but instead will be available on our ECR blog each week.

To stay on top of major developments in the market with timely price trends, news, and analysis from IHS Markit economists and commodity price forecasting experts, visit our ECR blog.

|

|

|

| | IHS Materials Price Index |  |

|

| |

| Market Insight

For an overview of the IHS Materials Price Index, view this video.

Get the Materials Price Index delivered to your in-box weekly.

Subscribe here.

|

|  |

| | |

|

| Industrial Materials: Prices |  |

| Key Prices & Demand Drivers |  |

Construction Labor Costs Reach Highest Level in Almost Three Years, IHS Markit Says

|

Construction costs rose again in November, according to IHS Markit and the Procurement Executives Group (PEG). |

The current headline IHS Markit PEG Engineering and Construction Cost Index registered 60.2, supported by strong figures in both the materials/equipment and labor sub-indexes. The materials/equipment price index was 60.9 in November, moving up from the October figure of 58.9. Price increases were widespread. Current subcontractor labor prices rose at a fast pace in November: the index figure came in at 58.5, the highest reading since December 2014. “Subcontractor rates continued to accelerate over November and expectations for future increases reached a five-year high,” said Emily Crowley, principal economist - pricing and purchasing, IHS Markit. “Tightening labor market conditions combined with an uptick in activity are driving expectations of future rate increases. Currently the U.S. South and West are having the most trouble finding workers leading to stronger wage escalation, whereas the end of major projects in Eastern Canada are keeping pressure off of wages in that region.”

| | Learn More |

|

| About IHS Pricing & Purchasing | | The IHS Pricing & Purchasing Service | The IHS Pricing & Purchasing Service enables supply chain cost savings by providing timely, accurate price forecasts and cost analysis. Armed with a better understanding of suppliers' cost structures and market dynamics, organizations can effectively negotiate prices, strategically time buys, and boost the bottom line.

With a database of more than 80,000 historic prices and thousands of price, wage and input cost forecasts, IHS offers more coverage than any other provider in the market. IHS has been providing forecasts of key commodity, labor, and input costs since 1970 -- helping define the purchasing advice industry. | | Learn More |

|

| Commodity Price Forecasts & Supply Chain Cost Benchmarking. Learn More | | |

|

|

|