| Week ending February 2, 2017 |

Davos and the dollar buoy commodity markets

|

The commodity price rally marches on as exuberance remains in markets.

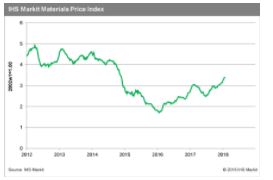

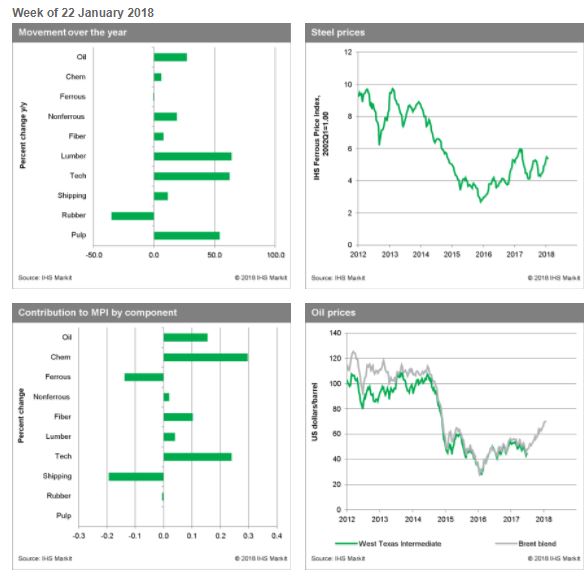

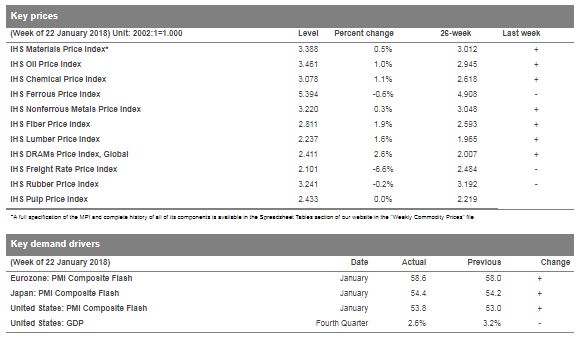

The IHS Markit Materials Price Index (MPI) increased for the 12th consecutive time last week, rising 0.5%; the cumulative gain for the index since the rally began in October is now 17.4%. Bullish sentiment coming from the World Economic Forum in Davos added to the already exuberant mood in markets, while a falling US dollar buoyed the commodity complex. Prices for fiber and DRAMs led the MPI higher, rising 1.9% and 2.6%, respectively.

Surging paraxylene prices, a primary feedstock for polyester, drove up the MPI’s fiber index last week; price increases in paraxylene markets stemmed from delayed capacity additions in Vietnam and the Middle East, along with firmer energy prices. Indeed, oil prices had another strong week, partially due to an upward revision in the demand outlook from the International Energy Agency. In DRAMs markets, a continuing spot shortage for a particular 8GB module chip—a temporary disruption that will soon dissipate—pushed up prices for the second consecutive week.

An upbeat mood at the World Economic Forum dominated headlines last week, as world leaders came together with the backdrop of a synchronized global expansion. At the event, comments seeming to favor a weaker US dollar from Treasury Secretary Steven Mnuchin roiled currency markets with the trade-weighted US dollar exchange rate dropping 1.6% by week’s end. Although eclipsed by the fanfare in Davos, the IHS Markit January flash purchasing managers’ index (PMI) reports continued to highlight strength in global manufacturing, reinforcing the bullish narrative in commodity markets. Notably, numbers for the Eurozone and Japan both beat expectations. There is no denying that conditions have improved since last year, with commodity markets showing real momentum now. Our caution is that prices in some markets appear to have run a bit ahead of fundamentals, raising the question as to whether they can be fully sustained.

|

|

|

| | IHS Materials Price Index |  |

|

| |

| Market Insight

For an overview of the IHS Materials Price Index, view this video.

Get the Materials Price Index delivered to your in-box weekly.

Subscribe here.

|

|  |

| | |

|

| Industrial Materials: Prices |  |

| Key Prices & Demand Drivers |  |

Construction Labor Costs Reach Highest Level in Almost Three Years, IHS Markit Says

|

Construction costs rose again in November, according to IHS Markit and the Procurement Executives Group (PEG). |

The current headline IHS Markit PEG Engineering and Construction Cost Index registered 60.2, supported by strong figures in both the materials/equipment and labor sub-indexes. The materials/equipment price index was 60.9 in November, moving up from the October figure of 58.9. Price increases were widespread. Current subcontractor labor prices rose at a fast pace in November: the index figure came in at 58.5, the highest reading since December 2014. “Subcontractor rates continued to accelerate over November and expectations for future increases reached a five-year high,” said Emily Crowley, principal economist - pricing and purchasing, IHS Markit. “Tightening labor market conditions combined with an uptick in activity are driving expectations of future rate increases. Currently the U.S. South and West are having the most trouble finding workers leading to stronger wage escalation, whereas the end of major projects in Eastern Canada are keeping pressure off of wages in that region.”

| | Learn More |

|

| About IHS Pricing & Purchasing | | The IHS Pricing & Purchasing Service | The IHS Pricing & Purchasing Service enables supply chain cost savings by providing timely, accurate price forecasts and cost analysis. Armed with a better understanding of suppliers' cost structures and market dynamics, organizations can effectively negotiate prices, strategically time buys, and boost the bottom line.

With a database of more than 80,000 historic prices and thousands of price, wage and input cost forecasts, IHS offers more coverage than any other provider in the market. IHS has been providing forecasts of key commodity, labor, and input costs since 1970 -- helping define the purchasing advice industry. | | Learn More |

|

| Commodity Price Forecasts & Supply Chain Cost Benchmarking. Learn More | | |

|

|

|