| Week ending September 22, 2017 |

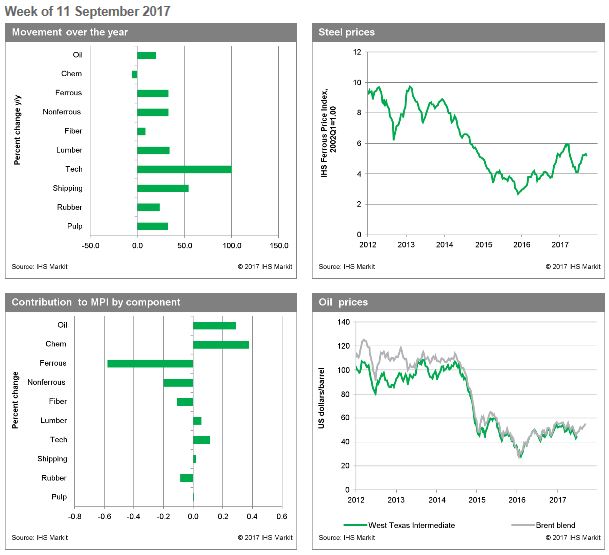

Falling metal prices weigh on index, overpowering gains in energy and chemical markets

|

Metals markets have been on a strong upward curve over the summer months, but this now appears to be in reverse as Chinese buying fails to support prices at such elevated levels.

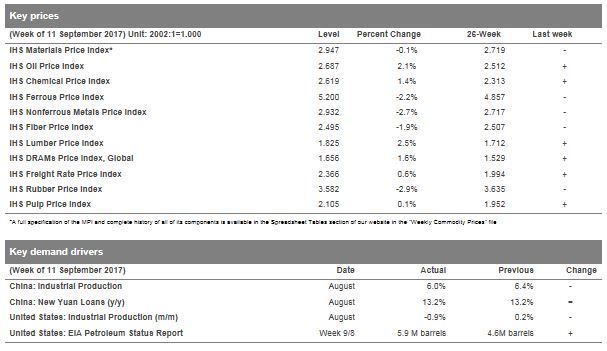

The Materials Price Index (MPI) slipped 0.1% last week, the first decline in four weeks, as metal markets finally began to slide. The strength of the last few weeks has been largely down to a surge in metal prices and the aftermath of Hurricane Harvey and its impact on chemicals and energy markets. Indeed, the latter two are still seeing price growth as the longer-run impacts of the hurricane continue to oscillate around markets.

For metals markets, a decline in interest from China has soured the mood, pushing down prices after many weeks of price growth. Ferrous markets have enjoyed strong gains in recent weeks, with iron ore prices nearly reaching $80/dry metric ton unit (dmtu) and copper prices pushing through $6,900/metric ton over the same period. For both these metals it appears the mood has changed, with prices slipping over the last week as Chinese financial interest wanes and physical buyers wait on the sidelines for more favorable pricing.

Last week there were some downbeat macroeconomic announcements, with Chinese industrial production reportedly growing 6% in August (annual basis), down 0.4 percentage point on July. In the United States, the Bloomberg consumer comfort index eased from 52.6 to 51.9 last week, following the turmoil from Hurricane Harvey. Furthermore, in the Eurozone, industrial production was up just 0.1% month on month (m/m) in July, a tepid rebound following the 0.6% m/m drop in June. It seems that some of the exuberance that has built over the last few months has begun to slip, although a decline over one week does not mean a trend reversal. Therefore, the next few weeks are key to ascertain if the current slip in metals pricing is indicative of a broader drop or this remains a false dawn.

|

|

|

| | IHS Materials Price Index |  |

|

| |

| Market Insight

For an overview of the IHS Materials Price Index, view this video.

Get the Materials Price Index delivered to your in-box weekly.

Subscribe here.

|

|  |

| | |

|

| Industrial Materials: Prices |  |

| Key Prices & Demand Drivers |  |

Construction Costs Rise for 10th Consecutive Month

|

Construction costs rose again in August, according to IHS Markit and the Procurement Executives Group (PEG).

|

The headline IHS Markit PEG Engineering and Construction Cost Index registered 54.0, up from 51.3 in July. Both material/equipment and labor sub-indexes registered rising prices.

The materials/equipment price index registered 54.2 in August, slightly higher than the July figure of 52.4. Price increases were uneven. Copper-based wire and cable increased once again, approaching the index figures last seen at the beginning of 2017.

“Commodity prices have risen strongly in the past seven weeks, with copper on the London Metal Exchange, jumping 14 percent between early June and August,” said John Mothersole, director Pricing and Purchasing, IHS Markit. “Better data from China, a softer U.S. dollar and new fears about mine supply disruptions have combined to lift prices. The market, however, looks overbought. If possible, we would avoid purchases at the moment and await what we believe will be a modest correction.”

| | Learn More |

|

| About IHS Pricing & Purchasing | | The IHS Pricing & Purchasing Service | The IHS Pricing & Purchasing Service enables supply chain cost savings by providing timely, accurate price forecasts and cost analysis. Armed with a better understanding of suppliers' cost structures and market dynamics, organizations can effectively negotiate prices, strategically time buys, and boost the bottom line.

With a database of more than 80,000 historic prices and thousands of price, wage and input cost forecasts, IHS offers more coverage than any other provider in the market. IHS has been providing forecasts of key commodity, labor, and input costs since 1970 -- helping define the purchasing advice industry. | | Learn More |

|

| Commodity Price Forecasts & Supply Chain Cost Benchmarking. Learn More | | |

|

|

|