| Week ending September 1, 2017 |

Freight rates and chemical prices led the way as the rally in commodity markets continued.

|

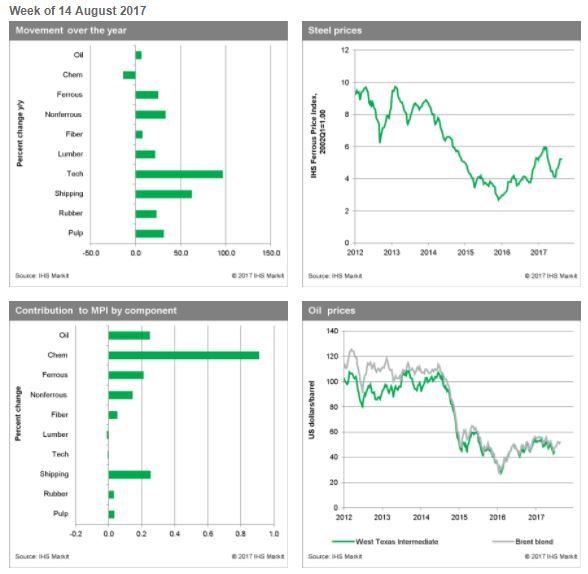

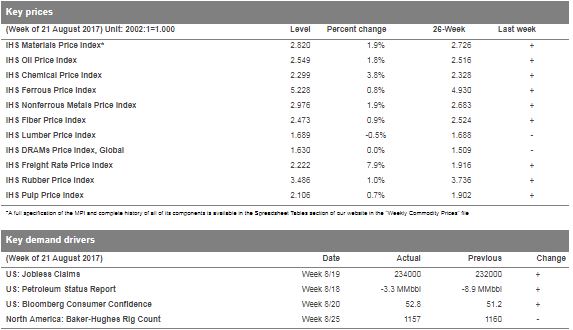

The Materials Price Index (MPI) increased 1.9% last week, resuming its rally after the previous week's pause. The MPI is now up 13.3% since late June. The rise was broadly based, as only one sub-index—lumber—fell. Freight rates and chemical prices provided the most support, rising 7.9% and 3.8%, respectively. Base metals (up 1.9%) and oil (up 1.8%) were also sources of strength.

Markets braced last week for fallout from Hurricane Harvey, sending refined product prices up and contributing to the rise in chemical prices. Oil prices initially fell as market watchers worried that inventories would build; however, sentiment shifted on Friday and prices rallied, leading oil prices to be up for the week. Metals enjoyed a good week on data showing lower inventory and a softening in the US dollar.

Economic reports last week provided evidence that economic conditions remain good, while policy developments supported commodity prices. US jobless claims remained at historic lows, beating expectations at 234,000. Meanwhile, crude oil inventories fell by 3.3 million barrels as the market continues to tighten. Comments from Federal Reserve Chairwoman Janet Yellen and her counterpart in Europe, Mario Draghi, indicated to market watchers that they would not be quickly scaling back stimulus in the near term. Political uncertainty in the United States, increasingly a source of instability in global markets and lately centered on the debt ceiling and federal budget, drove down the dollar, providing support for the commodity complex. The optimism that has carried the market in the third quarter remains; however, we maintain our view that a sustained rally in commodity prices will not carry into 2018 given our fundamental picture of the near term.

|

|

|

| | IHS Materials Price Index |  |

|

| |

| Market Insight

For an overview of the IHS Materials Price Index, view this video.

Get the Materials Price Index delivered to your in-box weekly.

Subscribe here.

|

|  |

| | |

|

| Industrial Materials: Prices |  |

| Key Prices & Demand Drivers |  |

Construction Costs Rise for 10th Consecutive Month

|

Construction costs rose again in August, according to IHS Markit and the Procurement Executives Group (PEG).

|

The headline IHS Markit PEG Engineering and Construction Cost Index registered 54.0, up from 51.3 in July. Both material/equipment and labor sub-indexes registered rising prices.

The materials/equipment price index registered 54.2 in August, slightly higher than the July figure of 52.4. Price increases were uneven. Copper-based wire and cable increased once again, approaching the index figures last seen at the beginning of 2017.

“Commodity prices have risen strongly in the past seven weeks, with copper on the London Metal Exchange, jumping 14 percent between early June and August,” said John Mothersole, director Pricing and Purchasing, IHS Markit. “Better data from China, a softer U.S. dollar and new fears about mine supply disruptions have combined to lift prices. The market, however, looks overbought. If possible, we would avoid purchases at the moment and await what we believe will be a modest correction.”

| | Learn More |

|

| About IHS Pricing & Purchasing | | The IHS Pricing & Purchasing Service | The IHS Pricing & Purchasing Service enables supply chain cost savings by providing timely, accurate price forecasts and cost analysis. Armed with a better understanding of suppliers' cost structures and market dynamics, organizations can effectively negotiate prices, strategically time buys, and boost the bottom line.

With a database of more than 80,000 historic prices and thousands of price, wage and input cost forecasts, IHS offers more coverage than any other provider in the market. IHS has been providing forecasts of key commodity, labor, and input costs since 1970 -- helping define the purchasing advice industry. | | Learn More |

|

| Commodity Price Forecasts & Supply Chain Cost Benchmarking. Learn More | | |

|

|

|