| Week ending March 16, 2018 |

Momentum in commodity markets ebbs

|

Signs continue to point to range-bound outlook.

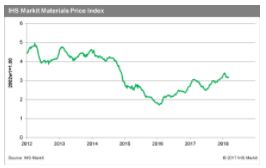

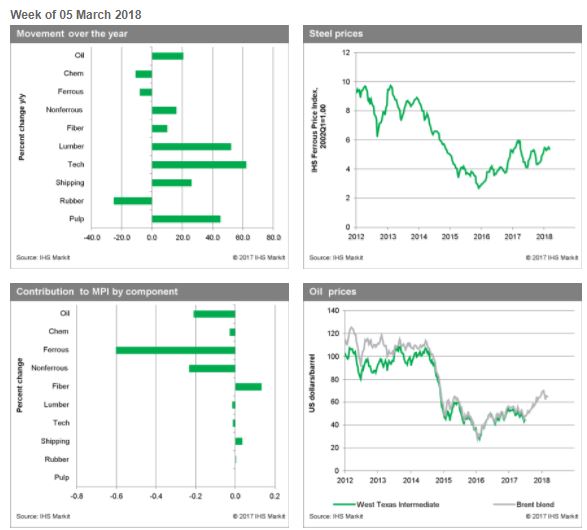

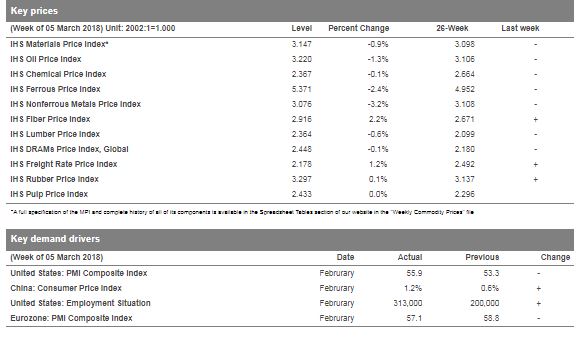

The IHS Materials Price index (MPI) fell 0.9% last week, its fifth retreat in the past six weeks, pushing the index into negative territory for 2018. The decline was broad based, with six of the ten sub-indexes falling and two showing essentially no change. Nonferrous and ferrous metals led the decline, dropping 3.2% and 2.4%, respectively. Oil also fell, dropping 1.3%.

A combination of factors has been pushing down nonferrous metals recently: higher inventories, a firming US dollar, questions about Chinese growth, and the uncertainty created by the section 232 tariffs in the United States. Questions about Chinese growth also helped push iron ore prices down more than 4.0%, causing the ferrous metals index to fall. Oil prices continued to decline despite a rally on Friday as supply remained strong—US inventories climbed by 2.4 million barrels.

Data releases last week were again mixed in terms of the implications for supply chains. The US employment report came in strong, with 313,000 jobs added in February. While the report is certainly good news, it also indicates wage pressures may be looming—even though wage growth came in below expectations. The Eurozone also remains a source of strength. February’s composite purchasing managers index (PMI) did fall to 57.1, but the retreat appears to be tied to emerging capacity bottlenecks, a sign that supply chains are strained. In China, however, producer prices are once again declining, lending support to our view that growth, especially in China’s manufacturing sector, is indeed slowing. Looking forward, the strong momentum recently seen in commodity markets seems to have dissipated. The question now is whether this change persists into the second quarter; our sense is that it will, based on a combination of slower growth in China, higher US interest rates, and a better balance developing in oil markets.

|

|

|

| | IHS Materials Price Index |  |

|

| |

| Market Insight

For an overview of the IHS Materials Price Index, view this video.

Get the Materials Price Index delivered to your in-box weekly.

Subscribe here.

|

|  |

| | |

|

| Industrial Materials: Prices |  |

| Key Prices & Demand Drivers |  |

Construction Labor Costs Reach Highest Level in Almost Three Years, IHS Markit Says

|

Construction costs rose again in November, according to IHS Markit and the Procurement Executives Group (PEG). |

The current headline IHS Markit PEG Engineering and Construction Cost Index registered 60.2, supported by strong figures in both the materials/equipment and labor sub-indexes. The materials/equipment price index was 60.9 in November, moving up from the October figure of 58.9. Price increases were widespread. Current subcontractor labor prices rose at a fast pace in November: the index figure came in at 58.5, the highest reading since December 2014. “Subcontractor rates continued to accelerate over November and expectations for future increases reached a five-year high,” said Emily Crowley, principal economist - pricing and purchasing, IHS Markit. “Tightening labor market conditions combined with an uptick in activity are driving expectations of future rate increases. Currently the U.S. South and West are having the most trouble finding workers leading to stronger wage escalation, whereas the end of major projects in Eastern Canada are keeping pressure off of wages in that region.”

| | Learn More |

|

| About IHS Pricing & Purchasing | | The IHS Pricing & Purchasing Service | The IHS Pricing & Purchasing Service enables supply chain cost savings by providing timely, accurate price forecasts and cost analysis. Armed with a better understanding of suppliers' cost structures and market dynamics, organizations can effectively negotiate prices, strategically time buys, and boost the bottom line.

With a database of more than 80,000 historic prices and thousands of price, wage and input cost forecasts, IHS offers more coverage than any other provider in the market. IHS has been providing forecasts of key commodity, labor, and input costs since 1970 -- helping define the purchasing advice industry. | | Learn More |

|

| Commodity Price Forecasts & Supply Chain Cost Benchmarking. Learn More | | |

|

|

|