| Week ending February 9, 2017 |

The bond market checks commodity prices

|

A potential fourth interest rate hike from the Federal Reserve over 2018 roiled commodity markets last week.

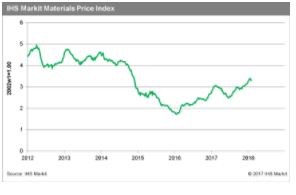

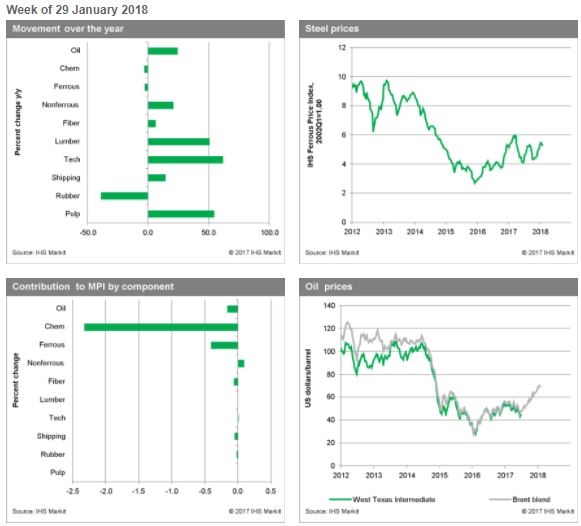

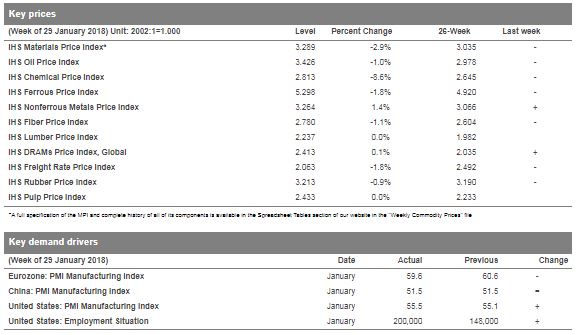

In the sharpest drop since last May, the IHS Markit Materials Price Index (MPI) tumbled 2.9% last week, putting an end to a 12-week rally. Price declines were widespread, with six of ten subindexes dropping. Chemical prices saw the largest decline, falling 8.6%, while both ferrous metals and shipping rates decreased 1.8%.

The retreat in chemicals was led by a pullback in propylene prices; recovering production in US dehydrogenation units has been pushing up inventory, which finally caused propylene prices to crack with a dramatic 14% correction last week. Ethylene prices also fell last week, as supply remains ample. Upstream, in crude oil markets, US inventories jumped 6.8 MMbbl, a sign perhaps that supply is beginning to build in response to the recent surge in crude prices. Meanwhile, iron ore prices fell more than 2% last week, pushing down both ferrous metals and freight rates.

Fresh data last week were fairly good: the January purchasing managers' indexes recorded another solid month of growth globally, while January’s US employment report beat expectations. The bond market, however, grew nervous that the stronger wage growth hinted at in the January US employment report might prompt the Federal Reserve to become more aggressive in lifting interest rates, triggering the selling on Friday that left the MPI down for the week. Equity and commodity markets have enjoyed a nice run since October; some sort of pullback on profit-taking, if nothing else, was overdue. The question now is whether rising bond rates increase volatility in a more systematic repricing of risk. Fundamentals look good for 2018; however, the bond market could undercut the investor buying that has provided markets with upward momentum during the past six months.

|

|

|

| | IHS Materials Price Index |  |

|

| |

| Market Insight

For an overview of the IHS Materials Price Index, view this video.

Get the Materials Price Index delivered to your in-box weekly.

Subscribe here.

|

|  |

| | |

|

| Industrial Materials: Prices |  |

| Key Prices & Demand Drivers |  |

Construction Labor Costs Reach Highest Level in Almost Three Years, IHS Markit Says

|

Construction costs rose again in November, according to IHS Markit and the Procurement Executives Group (PEG). |

The current headline IHS Markit PEG Engineering and Construction Cost Index registered 60.2, supported by strong figures in both the materials/equipment and labor sub-indexes. The materials/equipment price index was 60.9 in November, moving up from the October figure of 58.9. Price increases were widespread. Current subcontractor labor prices rose at a fast pace in November: the index figure came in at 58.5, the highest reading since December 2014. “Subcontractor rates continued to accelerate over November and expectations for future increases reached a five-year high,” said Emily Crowley, principal economist - pricing and purchasing, IHS Markit. “Tightening labor market conditions combined with an uptick in activity are driving expectations of future rate increases. Currently the U.S. South and West are having the most trouble finding workers leading to stronger wage escalation, whereas the end of major projects in Eastern Canada are keeping pressure off of wages in that region.”

| | Learn More |

|

| About IHS Pricing & Purchasing | | The IHS Pricing & Purchasing Service | The IHS Pricing & Purchasing Service enables supply chain cost savings by providing timely, accurate price forecasts and cost analysis. Armed with a better understanding of suppliers' cost structures and market dynamics, organizations can effectively negotiate prices, strategically time buys, and boost the bottom line.

With a database of more than 80,000 historic prices and thousands of price, wage and input cost forecasts, IHS offers more coverage than any other provider in the market. IHS has been providing forecasts of key commodity, labor, and input costs since 1970 -- helping define the purchasing advice industry. | | Learn More |

|

| Commodity Price Forecasts & Supply Chain Cost Benchmarking. Learn More | | |

|

|

|