| Week ending March 9, 2018 |

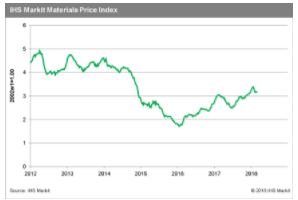

Volatility drives a narrow retreat in commodity prices

|

Three sub-indexes drive the MPI lower.

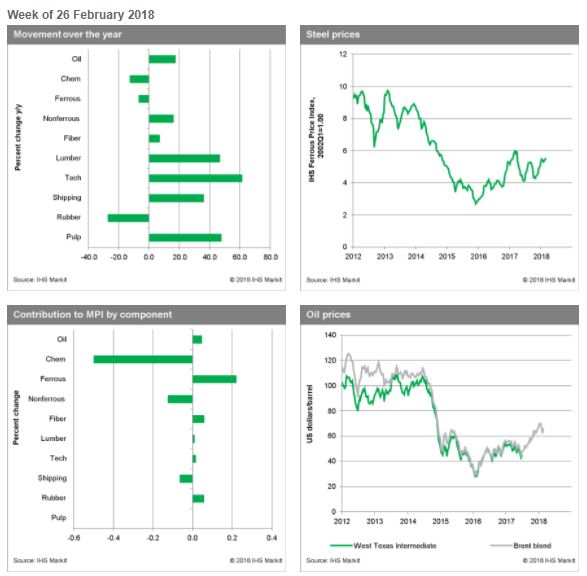

The IHS Markit Materials Price Index (MPI) fell 0.3% last week, putting the index near its starting point for 2018. Price declines were narrow, however, with only three sub-indexes retreating: chemicals, nonferrous metals, and freight rates. All fell by more than 1.5%.

Disappointing Chinese data and climbing aluminum and copper inventories pushed the nonferrous metals price index down 1.7% last week. Aluminum markets were also roiled by the Donald Trump administration’s announcement of potential tariffs on US imports. Meanwhile, chemical markets remain well supplied, pushing down prices. Ethylene prices fell 1.9% as supply conditions remained stable and two crackers came back online, while propylene prices fell 3.3% because of weak demand and ample inventories.

A wild news week contributed to market turbulence last week. Federal Reserve Chairman Jerome Powell’s comments during testimony on Capitol Hill reinforce our forecast of four interest rate hikes this year. He stressed that the Federal Open Market Committee (FOMC) will continue to try to strike a balance between avoiding overheating and encouraging a rise of inflation to 2% on a sustained basis. Attention shifted from Capitol Hill to the White House on Thursday when President Trump indicated his intention to impose steep tariffs on steel and aluminum imports. Finally, in China, there were more signs of tightening credit—reports surfaced of government assistance being given to HNA Group amid growing financial troubles, one week after the government seized Anbang Insurance Group. Expect more volatility in markets this spring as US interest rates climb and it becomes even clearer that Chinese growth is slowing. The final factor checking a continued rally in commodity prices will be energy markets, where stronger production promises to tip markets into surplus and send prices lower in the second half of the year.

|

|

|

| | IHS Materials Price Index |  |

|

| |

| Market Insight

For an overview of the IHS Materials Price Index, view this video.

Get the Materials Price Index delivered to your in-box weekly.

Subscribe here.

|

|  |

| | |

|

| Industrial Materials: Prices |  |

| Key Prices & Demand Drivers |  |

Construction Labor Costs Reach Highest Level in Almost Three Years, IHS Markit Says

|

Construction costs rose again in November, according to IHS Markit and the Procurement Executives Group (PEG). |

The current headline IHS Markit PEG Engineering and Construction Cost Index registered 60.2, supported by strong figures in both the materials/equipment and labor sub-indexes. The materials/equipment price index was 60.9 in November, moving up from the October figure of 58.9. Price increases were widespread. Current subcontractor labor prices rose at a fast pace in November: the index figure came in at 58.5, the highest reading since December 2014. “Subcontractor rates continued to accelerate over November and expectations for future increases reached a five-year high,” said Emily Crowley, principal economist - pricing and purchasing, IHS Markit. “Tightening labor market conditions combined with an uptick in activity are driving expectations of future rate increases. Currently the U.S. South and West are having the most trouble finding workers leading to stronger wage escalation, whereas the end of major projects in Eastern Canada are keeping pressure off of wages in that region.”

| | Learn More |

|

| About IHS Pricing & Purchasing | | The IHS Pricing & Purchasing Service | The IHS Pricing & Purchasing Service enables supply chain cost savings by providing timely, accurate price forecasts and cost analysis. Armed with a better understanding of suppliers' cost structures and market dynamics, organizations can effectively negotiate prices, strategically time buys, and boost the bottom line.

With a database of more than 80,000 historic prices and thousands of price, wage and input cost forecasts, IHS offers more coverage than any other provider in the market. IHS has been providing forecasts of key commodity, labor, and input costs since 1970 -- helping define the purchasing advice industry. | | Learn More |

|

| Commodity Price Forecasts & Supply Chain Cost Benchmarking. Learn More | | |

|

|

|