Note: Use ‘Link to PDF’ to view the full array of high-frequency, economic, and financial charts covered in this report

Link to PDF: Real-Time Insights, Economic and Financial Pulse

Real-Time Insights | |||||||

Highlights |

|

|

|

|

|

|

|

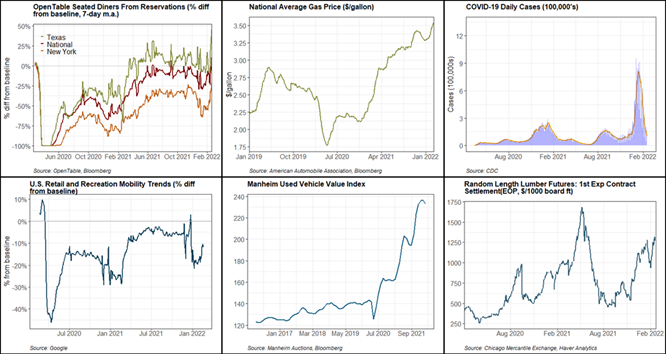

· The number of seated diners from reservations has soared through February, according to OpenTable, reflecting declining COVID-19 incidence and pent-up demand for leisure and hospitality. | |||||||

· Russian aggression on Ukraine and strong global demand for oil have boosted prices of Brent and WTI to fresh highs and will feed through into already elevated prices at the pump; a renewed surge in energy costs would accentuate inflationary pressures and, depending on the magnitude, could impinge on economic activity | |||||||

· Daily COVID-19 cases have declined precipitously from their January peak; the seven-day moving average of new cases ticked down to 100k, just 12% of their peak. Despite the recent decline, daily COVID-19 cases remain elevated - for comparison, the peak of the delta wave of infections saw daily cases rise to ~150k. | |||||||

· Retail and recreation mobility trends have retraced a significant portion of their January decline, climbing to just 11% below the pre-pandemic baseline; measures of in-person economic activity, including mobility, should improve with the onset of spring/summer weather and fading public health concerns. | |||||||

· The used vehicle market has likely reached an inflection point: the Manheim Used Vehicle Value Index ticked down 1.5% over the first two weeks of February and declined at an accelerating rate while used retail days' supply is 12 days higher than this time one year ago, pointing to a moderation of used vehicle prices. | |||||||

· Random length lumber futures surged ~$350 over the month, reflecting ongoing supply constraints including floods and transportation bottlenecks that have curtailed logging and shipping; elevated lumber prices have contributed substantially to the increased cost of new home construction. | |||||||

Week ahead: S&P CoreLogic Case-Shiller Home Price Index (Feb 22); New Home Sales (Feb 24); Personal Income, PCE Price Index, Durable Goods Orders (Feb 25) | |||||||

Link to PDF: Real-Time Insights, Economic and Financial Pulse

Mickey Levy, mickey.levy@berenberg-us.com

Mahmoud Abu Ghzalah, mahmoud.abughzalah@berenberg-us.com

© 2022 Berenberg Capital Markets, LLC, Member FINRA and SPIC

Remarks regarding foreign investors. The preparation of this document is subject to regulation by US law. The distribution of this document in other jurisdictions may be restricted by law, and persons, into whose possession this document comes, should inform themselves about, and observe, any such restrictions. United Kingdom This document is meant exclusively for institutional investors and market professionals, but not for private customers. It is not for distribution to or the use of private investors or private customers. Copyright BCM is a wholly owned subsidiary of Joh. Berenberg, Gossler & Co. KG (“Berenberg Bank”). BCM reserves all the rights in this document. No part of the document or its content may be rewritten, copied, photocopied or duplicated in any form by any means or redistributed without the BCM’s prior written consent. Berenberg Bank may distribute this commentary on a third party basis to its customers.