Link to full report and disclosures: Real-Time Insights, Economic and Financial Pulse

Real-Time Insights |

|

Highlights | | | | | | | |

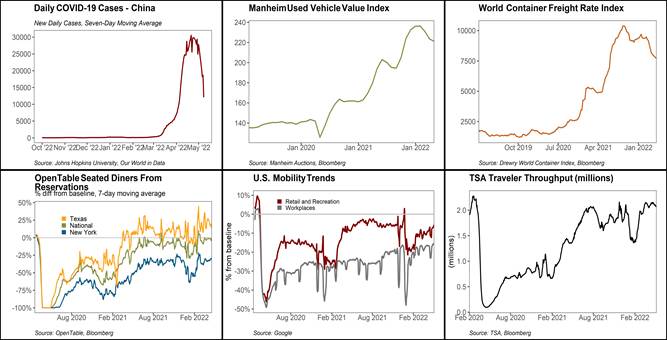

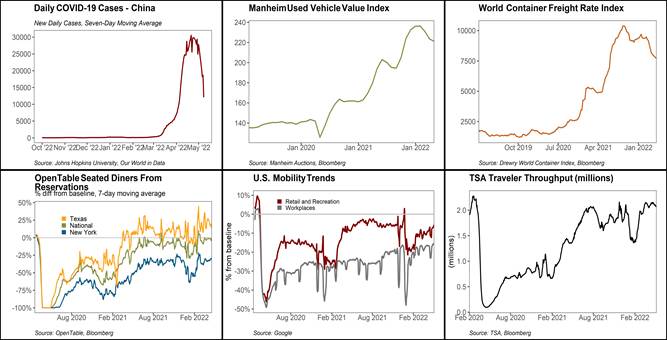

· Although the seven-day moving average of COVID-19 cases in China continues to recede (falling to 12,000 on May 8), strict lockdown measures remain in place in Shanghai, portions of Beijing, and other cities, disrupting production and trade. Chinese export growth softened markedly on a yr/yr basis in April. |

· Used vehicle prices extended their decline into April, according to data from Manheim, falling 1% m/m on a seasonally-adjusted basis (although unadjusted prices rose 2.9% relative to March). Notably, Manheim also estimates a 13% m/m and 20% yr/yr decline in used vehicle retail sales in April. Declining used vehicle prices are likely to weigh on sequential core inflation prints in coming months. |

· Container spot shipping rates extended their decline in April, falling ~4%, according to Drewry's World Container Composite Index, but remain well above their pre-pandemic levels while new container prices have declined to below $3,000 from $3,400 in Q4. A protracted slowdown in Chinese and European manufacturing output could contribute to further declines in shipping costs. |

· In-person dining in the U.S. has largely recovered to its pre-pandemic trends, according to data from OpenTable, on numbers of seated diners from reservations, although the seven-day moving average of seated diners ticked down over the last week. While continued economic reopening is likely to continue to support spending on dining and food services, the recent pickup in domestic COVID-19 cases could prompt a modest pullback from at-risk diners (seven-day moving average of new cases has doubled to 70k from April - May). |

· Measures of retail & recreation and workplace visits from Google continue to improve but remain well below pre-pandemic levels. Notably, retail and recreation visits remain below levels set during mid-late 2021, even as nominal spending has soared. |

· Traveler throughput at U.S. airports has rebounded close to pre-pandemic levels ahead of the summer holiday season but has edged down in recent weeks, with the seven-day moving average falling to 2.1 million. Sharp increases in jet fuel and other costs have pushed airfares up 20% in the last three months, although they remain 6% below pre-pandemic levels. |

Week ahead: NFIB Small Business Optimism (May 10); CPI (May 11); PPI (May 12); U. of Mich. Sentiment & Inflation Expectations (May 13) |

Link to full report and disclosures: Real-Time Insights, Economic and Financial Pulse

Mickey Levy, mickey.levy@berenberg-us.com

Mahmoud Abu Ghzalah, mahmoud.abughzalah@berenberg-us.com

© 2022 Berenberg Capital Markets, LLC, Member FINRA and SPIC

Remarks regarding foreign investors. The preparation of this document is subject to regulation by US law. The distribution of this document in other jurisdictions may be restricted by law, and persons, into whose possession this document comes, should inform themselves about, and observe, any such restrictions. United Kingdom This document is meant exclusively for institutional investors and market professionals, but not for private customers. It is not for distribution to or the use of private investors or private customers. Copyright BCM is a wholly owned subsidiary of Joh. Berenberg, Gossler & Co. KG (“Berenberg Bank”). BCM reserves all the rights in this document. No part of the document or its content may be rewritten, copied, photocopied or duplicated in any form by any means or redistributed without the BCM’s prior written consent. Berenberg Bank may distribute this commentary on a third party basis to its customers.

Member FINRA & SIPC

This email and any files or attachments transmitted with it may contain confidential or privileged information and are intended solely for the use of the intended recipient. If you are not the intended recipient, please do not copy, retain, disclose or use any part of the message or its attachments. Please notify the sender immediately by return email and destroy or delete any copies. Dissemination or use of this information by anyone other than the intended recipient is unauthorized and may be illegal. Communications by email cannot be guaranteed to be secure or error-free. Emails and their attachments are subject to being intercepted, becoming corrupted, getting lost or delayed, or may contain viruses. Therefore, neither the sender nor Berenberg Capital Markets LLC (BCM) accepts any liability for any errors or omissions in the content of this message or problems in its transmission, including those arising as a result of its transmission over the internet.

BCM does not assume liability for the correctness and completeness of all information given and/or attachments contained herein. The provided information has not been checked by a third party, especially an independent auditing firm. BCM explicitly points to the stated date of preparation. The information given can become incorrect due to passage of time and/or as a result of legal, political, economic or other changes. BCM does not assume responsibility to indicate such changes and/or to publish an updated document. Any document(s) or attachment(s) is meant exclusively for institutional investors and market professionals, but not for private customers. It is not for distribution to or the use of private investors or private customers.

In light of upcoming regulatory changes, please be informed that BCM will continue to share information with you until unsubscribe@berenberg-us.com receives your termination/deletion request. For more information about the General Data Protection Regulation (GDPR) and our privacy policies please refer to https://www.berenberg-us.com/legal-notice. BCM reserves all the rights in this communication. No part of this communication or its content may be rewritten, copied, photocopied or duplicated in any form by any means or redistributed without BCMâs prior written consent.

The information contained herein and sourced may have been adopted from various news sources, for example, Bloomberg, Reuters, Street Account and various other sources. BCM does not claim accuracy, completeness, timeliness, suitability, or otherwise regarding all the information on the securities, stock markets, or developments referred to within. On no account should the Content be regarded as a substitute for the recipient procuring information for himself/herself or exercising his/her own judgments. BCM is not responsible for any recipient(s) use of this information. This Content is not a solicitation or an offer to buy or sell any of the securities contained herein. This information does not constitute a recommendation or take into account the particular investment objectives, financial situations, or needs of clients. Clients should consider whether any advice or recommendation in this Content is suitable for their particular circumstances and, if appropriate, seek professional advice, including tax advice. The price and value of securities which may be referred to in this Content and the income from them may fluctuate. Past performance is not a guide to future performance, future returns are not guaranteed, and a loss of original capital may occur. Fluctuations in exchange rates could have adverse effects on the value or price of, or income derived from, certain securities.