Link to full report and disclosures: Real-Time Insights, Economic and Financial Pulse

Real-Time Insights |

|

Highlights | | | | | | | |

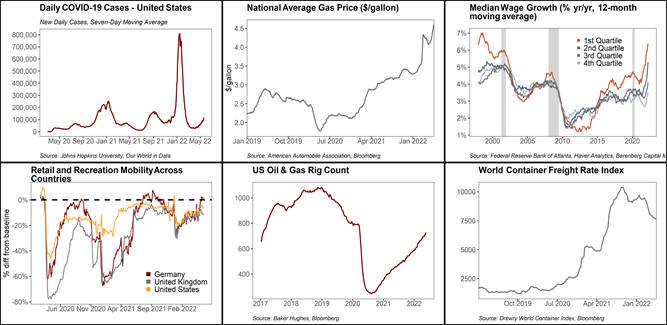

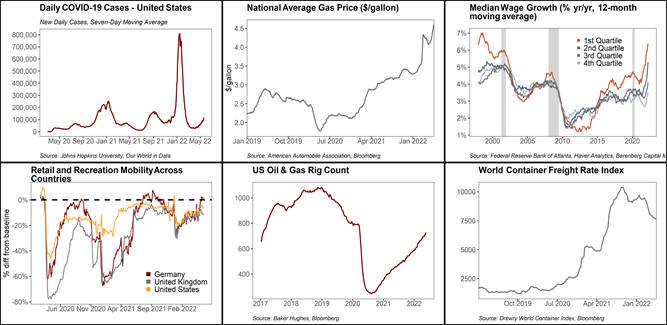

· New daily COVID-19 cases are spreading at an accelerating rate ahead of the peak U.S. holiday season. The seven-day average of daily cases has increased to 115k - comparable to the levels during the delta variant wave of infections one year ago. Current case counts are likely underreported due to the increased prevalence of home testing. Despite the increase in cases, data thus far suggest pent-up demand for services and experiences such as travel and dining out remains strong. |

· Visits to retail and recreation locations ticked down in the U.S., UK, and Germany but have returned close to pre-pandemic levels across all three countries. High frequency data do not yet reflect a decided increase in visits associated with the upcoming summer holiday season. |

· National average gas prices climbed to a record high $4.6/gallon on May 19. Prices are likely to remain elevated reflecting disruptions to production and distribution of refined petroleum products from Russia - a major exporter, domestic refining capacity constraints, and depleted inventories, particularly on the East Coast. |

· Domestic oil and gas producers are slowly but surely making needed investments in expanding production, adding a further 14 rigs in the week ending May 20. The total domestic rig count now stands at 728 and has increased 24% ytd. Further investment across the oil patch should support business fixed investment through 2022. |

· Median wage growth has broadened across the income distribution, but remains particularly elevated among lower income quartiles according to FRB Atlanta's Wage Growth Tracker. The 12-month moving average of yr/yr median wage growth among the lowest income quartile increased to 6.4% in April. |

· Drewry's world container freight rate index continues to retrace its pandemic surge although the rate of decline slowed last week, with the index falling just 0.1% compared to a 0.9% drop in the previous week. Spot shipping rates remain well above pre-pandemic levels and empirical research suggests rising shipping costs tend to impact inflation with relatively long lags. |

Week ahead: New Home Sales (May 24); Durable Goods Orders, MBA Mortgage Applications, FOMC May Meeting Minutes (May 25); Q1 GDP 2nd Estimate, Pending Home Sales (May 26); Personal Income and Consumption (May 27) |

Link to full report and disclosures: Real-Time Insights, Economic and Financial Pulse

Mickey Levy, mickey.levy@berenberg-us.com

Mahmoud Abu Ghzalah, mahmoud.abughzalah@berenberg-us.com

© 2022 Berenberg Capital Markets, LLC, Member FINRA and SPIC

Remarks regarding foreign investors. The preparation of this document is subject to regulation by US law. The distribution of this document in other jurisdictions may be restricted by law, and persons, into whose possession this document comes, should inform themselves about, and observe, any such restrictions. United Kingdom This document is meant exclusively for institutional investors and market professionals, but not for private customers. It is not for distribution to or the use of private investors or private customers. Copyright BCM is a wholly owned subsidiary of Joh. Berenberg, Gossler & Co. KG (“Berenberg Bank”). BCM reserves all the rights in this document. No part of the document or its content may be rewritten, copied, photocopied or duplicated in any form by any means or redistributed without the BCM’s prior written consent. Berenberg Bank may distribute this commentary on a third party basis to its customers.

Member FINRA & SIPC

This email and any files or attachments transmitted with it may contain confidential or privileged information and are intended solely for the use of the intended recipient. If you are not the intended recipient, please do not copy, retain, disclose or use any part of the message or its attachments. Please notify the sender immediately by return email and destroy or delete any copies. Dissemination or use of this information by anyone other than the intended recipient is unauthorized and may be illegal. Communications by email cannot be guaranteed to be secure or error-free. Emails and their attachments are subject to being intercepted, becoming corrupted, getting lost or delayed, or may contain viruses. Therefore, neither the sender nor Berenberg Capital Markets LLC (BCM) accepts any liability for any errors or omissions in the content of this message or problems in its transmission, including those arising as a result of its transmission over the internet.

BCM does not assume liability for the correctness and completeness of all information given and/or attachments contained herein. The provided information has not been checked by a third party, especially an independent auditing firm. BCM explicitly points to the stated date of preparation. The information given can become incorrect due to passage of time and/or as a result of legal, political, economic or other changes. BCM does not assume responsibility to indicate such changes and/or to publish an updated document. Any document(s) or attachment(s) is meant exclusively for institutional investors and market professionals, but not for private customers. It is not for distribution to or the use of private investors or private customers.

In light of upcoming regulatory changes, please be informed that BCM will continue to share information with you until unsubscribe@berenberg-us.com receives your termination/deletion request. For more information about the General Data Protection Regulation (GDPR) and our privacy policies please refer to https://www.berenberg-us.com/legal-notice. BCM reserves all the rights in this communication. No part of this communication or its content may be rewritten, copied, photocopied or duplicated in any form by any means or redistributed without BCMâs prior written consent.

The information contained herein and sourced may have been adopted from various news sources, for example, Bloomberg, Reuters, Street Account and various other sources. BCM does not claim accuracy, completeness, timeliness, suitability, or otherwise regarding all the information on the securities, stock markets, or developments referred to within. On no account should the Content be regarded as a substitute for the recipient procuring information for himself/herself or exercising his/her own judgments. BCM is not responsible for any recipient(s) use of this information. This Content is not a solicitation or an offer to buy or sell any of the securities contained herein. This information does not constitute a recommendation or take into account the particular investment objectives, financial situations, or needs of clients. Clients should consider whether any advice or recommendation in this Content is suitable for their particular circumstances and, if appropriate, seek professional advice, including tax advice. The price and value of securities which may be referred to in this Content and the income from them may fluctuate. Past performance is not a guide to future performance, future returns are not guaranteed, and a loss of original capital may occur. Fluctuations in exchange rates could have adverse effects on the value or price of, or income derived from, certain securities.