Link to full report and disclosures: Real-Time Insights, Economic and Financial Pulse

Real-Time Insights | |||||||

Highlights |

|

|

|

|

|

|

|

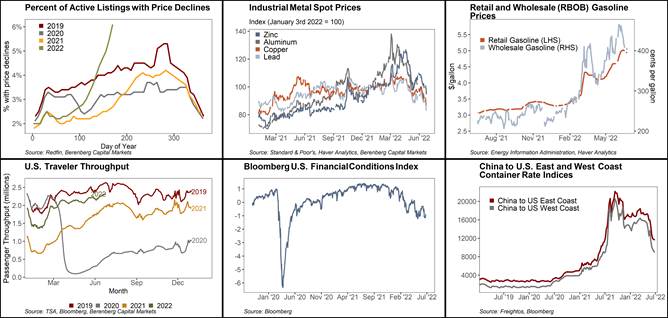

· The spike in mortgage rates and elevated home prices are cooling housing market activity, and weighing on price appreciation. The proportion of active real estate listings with price declines has jumped to 6.1%, according to data from Redfin, a substantial increase from 2.5% in January. Data suggest price declines are most prevalent in housing markets that saw heightened activity during the pandemic, such as Boise, Salt Lake City, and Sacramento. | |||||||

· Industrial metal spot prices have plummeted following an initial spike in the wake of Russia's invasion of Ukraine, with prices of zinc, aluminum, copper, and lead all falling well below their levels at the turn of the year. Prices of copper, a key input in construction and manufacturing have fallen 13% in the last two weeks reflecting ongoing concerns over slowing global economic activity. | |||||||

· Travel activity continues to gather momentum as the peak in summer holiday travel approaches, with the seven-day moving average of passenger throughput at U.S. airports increasing to 2.3 million. However, this continues to be significantly below passenger throughput at the same time in 2019 | |||||||

· While financial conditions have tightened significantly since March reflecting the Fed's hawkish pivot and forward guidance, the recent updraft in equities and lower yields have loosened financial conditions somewhat relative to early June. This is striking given how many Fed members have voiced support for another 75bp hike in July, and reflects mounting concerns over recession risks. | |||||||

· Wholesale gasoline prices have fallen 12% in the last two weeks which should translate into lower prices at the pump, albeit with a lag. Retail gasoline prices remain elevated at $4.9/gallon, but have eased modestly from their record highs. | |||||||

· Shipping costs from China to the U.S. east and west coasts have plunged since the start of May, falling 33% and 41%, respectively although they remain well above pre-pandemic levels. Data suggest shipping constraints and bottlenecks at domestic ports may be easing, with congestion at ports and the number of ships waiting to unload cargo both down sharply from their pandemic highs. | |||||||

Week ahead: Durable Goods Orders, Pending Home Sales (June 27); Wholesale and Retail Inventories, S&P CoreLogic Case-Shiller Home Price Index (June 28); MBA Mortgage Applications (June 29); Personal Income, Consumption, & PCE inflation (June 30); ISM Manufacturing, Wards Vehicle Sales (July 1) | |||||||

Link to full report and disclosures: Real-Time Insights, Economic and Financial Pulse

Mickey Levy, mickey.levy@berenberg-us.com

Mahmoud Abu Ghzalah, mahmoud.abughzalah@berenberg-us.com

© 2022 Berenberg Capital Markets, LLC, Member FINRA and SPIC

Remarks regarding foreign investors. The preparation of this document is subject to regulation by US law. The distribution of this document in other jurisdictions may be restricted by law, and persons, into whose possession this document comes, should inform themselves about, and observe, any such restrictions. United Kingdom This document is meant exclusively for institutional investors and market professionals, but not for private customers. It is not for distribution to or the use of private investors or private customers. Copyright BCM is a wholly owned subsidiary of Joh. Berenberg, Gossler & Co. KG (“Berenberg Bank”). BCM reserves all the rights in this document. No part of the document or its content may be rewritten, copied, photocopied or duplicated in any form by any means or redistributed without the BCM’s prior written consent. Berenberg Bank may distribute this commentary on a third party basis to its customers.