| Record-Low Mortgage Rates Are Coming | | By Dr. Steve Sjuggerud | | Thursday, March 10, 2016 |

| Mortgage rates in the U.S. are incredibly low... and there's a great chance they'll go lower...

Last week, U.S. 30-year mortgage rates finished the week around 3.6%.

They haven't been this low – basically ever. (The exception is late 2012, when they nearly touched 3.3%.)

As an American, it sounds outrageous to even consider that they could go lower. But when you take the rest of the world into account, it's not as outrageous as it seems.

I will show you why today. But first, let's back up for a minute...

----------Recommended Link---------

---------------------------------

Where do mortgage rates come from? Who decides what they will be?

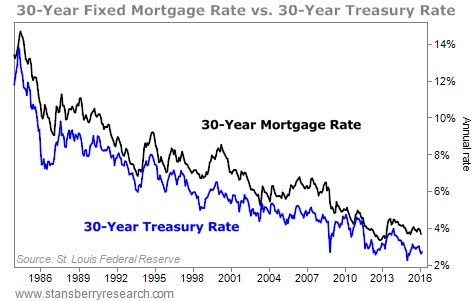

Typically, the U.S. 30-year mortgage rate is (somewhat) based off of the U.S. 30-year Treasury bond interest rate...

Take the 30-year government rate (which is thought of as the "risk-free" rate)... add a bit of interest due to the risk of the borrower... and boom, there you have it. (It's a rough approximation of reality, at least.)

You can see this idea in the chart below... The lower line is the 30-year Treasury rate. The upper line is the 30-year mortgage rate...

It has to do with what's going on in the rest of the world...

Interest rates are crashing globally. And 30-year government bond rates outside the U.S. are "crazy low." Take a look:

| Country | Rate | | United States | 2.68% | | Germany | 1.01% | | Japan | 0.71% | | Switzerland | 0.27% |

Look closely at this list... One of these four is not like the others. Which one is it?

It doesn't take long to realize that U.S. interest rates are dramatically higher than the rest of the developed world.

Keep this in mind: Money flows where it's treated best.

The difference between U.S. rates and the rest of the world is simply too great for investors to ignore... Money is about to flow into the U.S.

Investors who have their money in low-paying bonds in Germany, Japan, and Switzerland will move some of that money into higher-paying U.S. bonds.

That will put downward pressure on long-term U.S. interest rates.

And the chart above shows, if U.S. interest rates on 30-year government bonds go down, U.S. mortgage rates will likely follow them lower.

Mortgage rates are incredibly low in the U.S. based on history. And as I showed today, there's a strong chance they could go even lower...

Good investing,

Steve |

Further Reading:

With mortgage rates not far from record lows, Steve says it's time to take advantage. "If you haven't done so already, refinance your house. And if you don't currently own a house, go buy one... Seriously," he says. Read more here. "Right now, we have a long-term uptrend back in place and a major short-term breakout for the Japanese yen," Brett Eversole writes. "Both of these point to 8% gains in the yen over the next year." Learn how to take advantage here. |

|

INVESTING IN WORLD DOMINATORS WORKS

Investing in the best businesses on the planet continues to be a winning strategy... Extreme Value editor Dan Ferris calls these types of businesses "World Dominators." They have a huge, global brand and a history of steady, long-term growth. And they're often the No. 1 company in their industry. Last month, we showed you two World Dominators moving higher: retail giant Wal-Mart and food-distribution leader Sysco. Today, another world-class business is trending up: Coca-Cola (KO). The soft-drink titan sells 1.9 billion servings per day in more than 200 countries. Its portfolio features 20 billion-dollar brands, including Coca-Cola, Diet Coke, Sprite, and Coke Zero sodas, Powerade sports drink, Minute Maid juice, and Dasani water. According to Forbes, it is the world's fourth most-valuable brand. As you can see from the chart below, shares are climbing in 2016. The stock just struck a fresh 52-week high. While the market sloshes back and forth, this World Dominator continues to tick higher... |

|

| Why housing could continue soaring for years... Mortgage rates are low... and likely headed lower. This only makes housing look better on a "relative value" scale, right now. |

Are You a

New Subscriber?

If you have recently subscribed to a Stansberry Research publication and are unsure about why you are receiving the DailyWealth (or any of our other free e-letters), click here for a full explanation... |

|

Advertisement

If you were born before 1950, there's a chance you can grab a key Social Security claiming strategy before it disappears forever. There's just one catch... You must apply before April, 29 2016. Find out how you can learn more about how to get the most in retirement, by going here. |

| Here's How You Beat a Down Market | | By Dr. David Eifrig | | Wednesday, March 9, 2016 |

| | Today, David "Doc" Eifrig is going to take the time to answer how and why we can profit in a down market... |

| | Why Gold Could Climb Nearly 20% in the Next 12 Months | | By Brett Eversole | | Tuesday, March 8, 2016 |

| | Gold is up... And it could go up a lot more... |

| | This Major Currency Just Broke Out... It's Time to Take Advantage | | By Brett Eversole | | Monday, March 7, 2016 |

| | This currency has been crashing for five years. But it recently climbed 7% in just two weeks... |

| | How to Increase Both Your Wealth and the Smarts of Your Family | | By Dr. David Eifrig | | Friday, March 4, 2016 |

| | This is one of the easiest ways to shelter assets... and save a bundle on taxes while doing so. |

| | My Biggest Investing Flaw | | By Dr. Steve Sjuggerud | | Thursday, March 3, 2016 |

| | It took me a while to get this one through my thick skull. But I finally get it. |

|

|

|

|