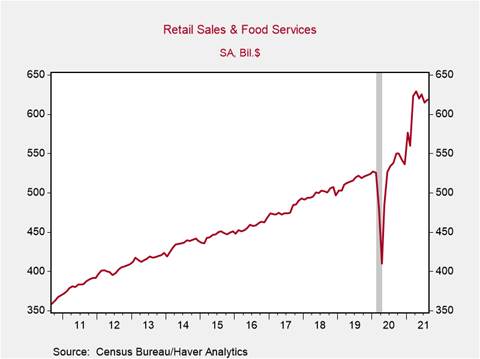

Retail sales firm in August

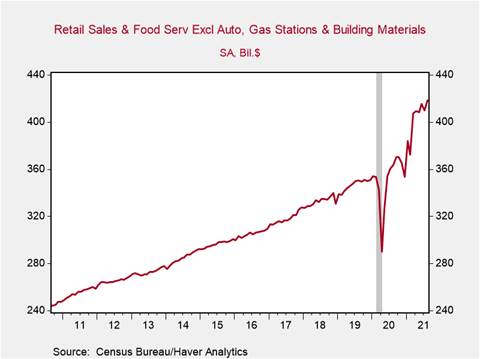

*Retail sales showed surprising strength in August rising 0.7%, reflecting underlying strength in demand and following a downwardly revised decline of 1.7% in July from -1.1% (Chart 1). Retail sales surprised to the upside despite widespread anecdotal evidence of consumer pullback from high contact activities and high frequency data suggesting a softening in retail foot traffic. The uptick in retail sales in August highlights the strength of factors supporting consumer spending during the reopening spurt– employment, disposable income, and household net worth. The sales control group – retail sales excluding autos, building materials, and gasoline stations – surged 2.5% in August lifting it 1.2% above its Q2 average (Chart 2).

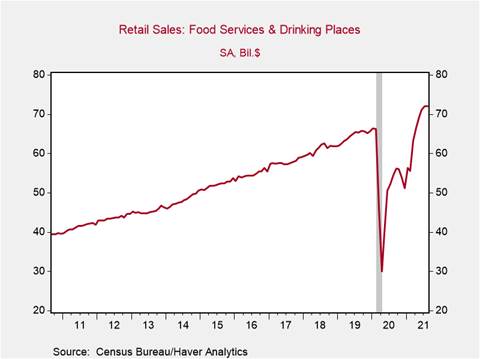

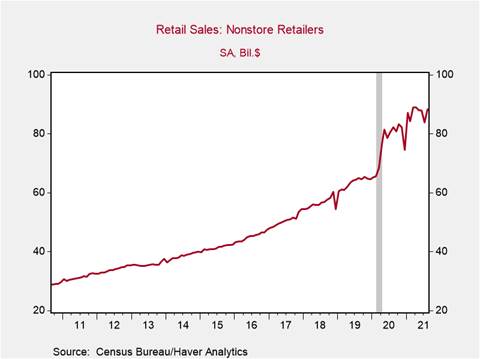

*Food services and drinking places sales flattened after five straight months of increases, but are 8.6% higher than in February 2020 (Chart 3). Pent up demand for food services dampened due to the impact of the Delta variant in August. Non-store retail sales increased 5.3% in August, after a 4.6% decrease in July, reflecting a shift in consumer spending to online shopping (Chart 4). The slowdown in food services and accelerating non-store retail sales reflect increasing Delta concerns among consumers.

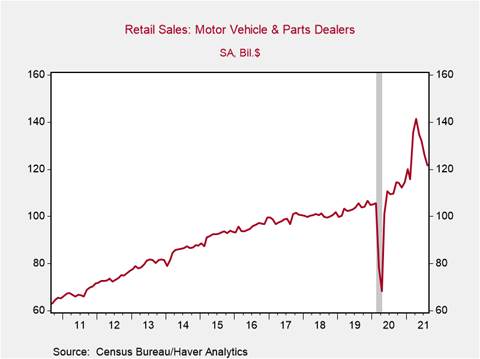

*Motor vehicle sales fell for the fourth straight month declining 3.6%. Supply chain constraints and semiconductor shortages continue to weigh on the auto industry, constraining sales. Despite the decline this month, motor vehicle sales are up 10.7% yr/yr (Chart 5). General merchandise store sales increased 3.5% in August and are up 15.5% yr/yr.

*A critical issue in the coming months is the path the Delta variant and the public health situation at large will take, particularly as flu season approaches. Early signs however are positive, daily case counts and hospitalizations appear to have reached an inflection point and begun to trend down which bodes well for future economic activity.

Chart 2: Control Group Retail Sales (ex. auto, gas stations, building materials)

Chart 3: Retail sales: food services and drinking places

Chart 4: Retail sales: nonstore retailers

Chart 5: Retail sales: motor vehicles and parts

Mickey Levy, mickey.levy@berenberg-us.com

© 2021 Berenberg Capital Markets, LLC, Member FINRA and SPIC

Remarks regarding foreign investors. The preparation of this document is subject to regulation by US law. The distribution of this document in other jurisdictions may be restricted by law, and persons, into whose possession this document comes, should inform themselves about, and observe, any such restrictions. United Kingdom This document is meant exclusively for institutional investors and market professionals, but not for private customers. It is not for distribution to or the use of private investors or private customers. Copyright BCM is a wholly owned subsidiary of Joh. Berenberg, Gossler & Co. KG (“Berenberg Bank”). BCM reserves all the rights in this document. No part of the document or its content may be rewritten, copied, photocopied or duplicated in any form by any means or redistributed without the BCM’s prior written consent. Berenberg Bank may distribute this commentary on a third party basis to its customers.