The US market has seen some outrageous daily share price moves in global giants. When the likes of Walmart can shed 20% of their value in a matter of hours, nothing is safe.

This is a direct result of the asset price bubble that was created by an environment of non-existent interest rates and unprecedented stimulus. When the money is cheap, the assets are expensive. The reverse also applies, as many are now learning.

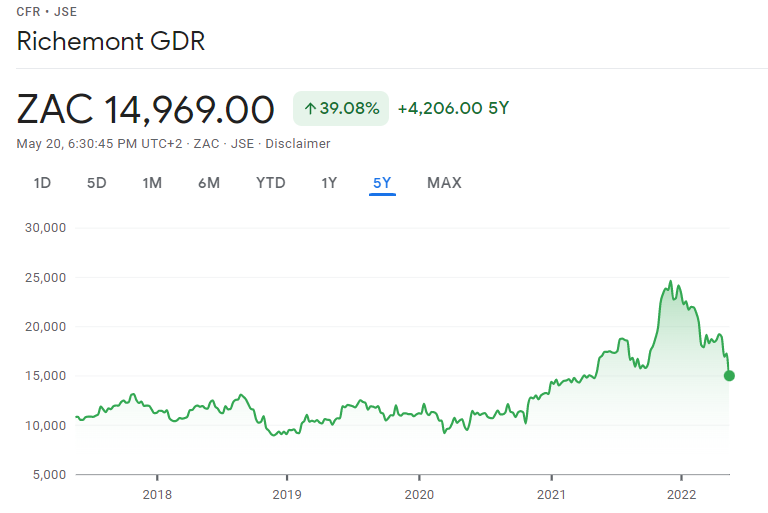

The Richemont chart offers an excellent visual representation of what we've seen over the past couple of years:

You can clearly see how the share price shot off into the stratosphere during the pandemic. Like a space shuttle, it is now returning to earth, partially on fire. This is despite releasing excellent results, which I wrote about in this feature article.

In contrast to Richemont, The Foschini Group (TFG) makes a living by selling goods to us normal folk rather than helping the rich and famous wear Cartier jewellery and Panerai watches. I mean, timepieces. When it costs more than a car, it's definitely a timepiece.

TFG is navigating this environment with great skill. A localised supply chain has really paid off during a time of global turmoil. After everyone spent years outsourcing to China to cut costs, companies are scrambling to bring supply chains back home. In today's second featur e article, I cover TFG's latest quarterly result and earnings update for the full year.

For a quick update on the rand, we have this comment from Wichard Cilliers, Head of Market Risk at TreasuryONE:

"We ended off last week on a quiet note, with the Rand very well behaved on Friday. We saw a bit of a wobble at the close of the SA session, but in a surprise announcement S&P Global revised South Africa's outlook from neutral to positive, leaving the ratings unchanged. This helped the rand reverse the wobble and we start the new week off on firmer levels for the first time in more than a month. We will await the Fed minutes on Wednesday as this could give us more insights into their thinking and could possibly move markets."

The financial ecosystem is interconnected, which is what makes it both challenging and incredibly fun. To explain in more detail how rates, inflation and currencies interact with one another, Chris Gilmour has written on how real interest rates are still in negative territory for many countries around the world. South Africa is one of the few countries offering positive real rates. I found this article particularly interesting and I suggest that you read it.

To end off a wonderful basket of insights today, the latest Magic Markets podcast features Rob Grieve from Westbrooke Alternative Asset Management. He joined us to discuss some technical concepts related to private equity and the differences between the UK and South African markets. If you have any interest whatsoever in the exciting world of private equity, this podcast cannot be missed.

Of course, you should never forget your daily dose of Ghost Bites to get you up to speed with all the stories on the JSE!

Remember that on Thursday at 12pm, I'm co-hosting the Calgro M3 management team on Unlock the Stock. This is your chance to be an equity analyst for 40 minutes or so, listening to a management presentation and then asking questions. Attendance is free and you need to sign up at this link to attend.

There's just so much to learn. Get stuck in and enjoy it.